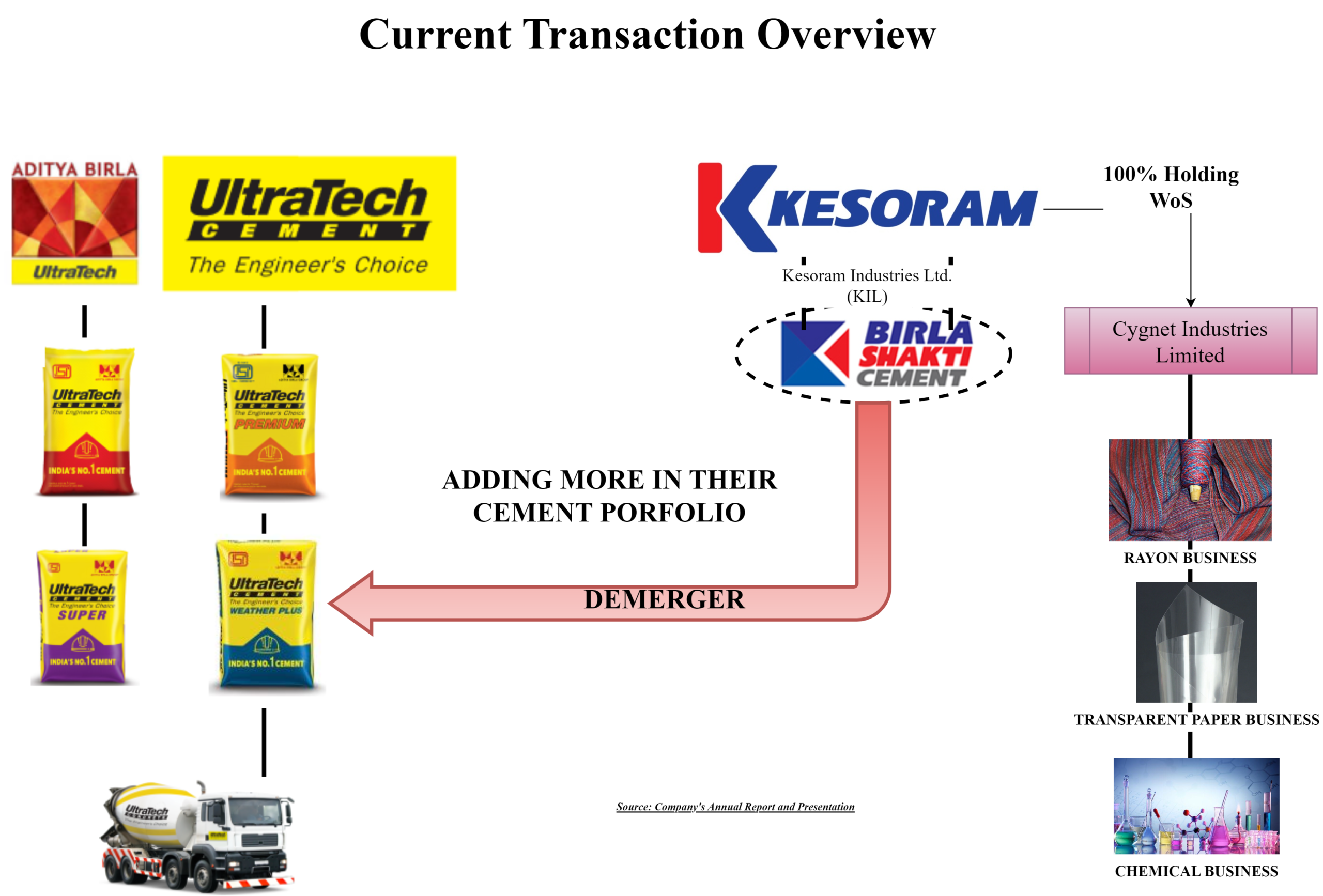

The Board of Directors of Ultratech Cements Limited & Kesoram Industries Limited at their respective board meeting have approved a composite scheme of arrangement (scheme) which envisages the demerger of the cement business of Kesoram Industries Limited into Ultratech Cements Limited. In addition, Kesoram Industries Limited also approved the withdrawal of the earlier announced scheme of demerger with its wholly owned subsidiary i.e., Cygnet Industries Limited and their respective shareholders.

UltraTech Cement Limited (“Ultratech” or “Resulting Company”) is the cement flagship company of the Aditya Birla Group. UltraTech is India’s largest & third largest Cement producer in the world, outside of China, with a total Grey Cement capacity of 137.85 MTPA. The equity shares of Ultratech are listed on nationwide bourses.

Kesoram Industries Limited (“Kesoram” or Demerged Company”) is incorporated under the provisions of the India Companies Act, 1913 engaged in the business of grey cement, rayon, transparent paper, and chemicals. The equity shares of the company are listed on nationwide bourses. Over the last few years, the company is continuously incurring losses and pursuant to revival plans, executed couple of restructuring including debt restructuring.

Currently, its cement business is carried through Kesoram while Rayon, transparent paper & chemical business is being carried by its wholly owned subsidiary i.e., Cygnet Industries Limited.

The proposed transaction:

The Scheme, inter alia, provides for:

- Demerger of the Cement Business of the Demerged Company into the Resulting Company; and

- The reduction and cancellation of the preference share capital of the Demerged Company.

The Cement Business of Kesoram consists of 2 integrated cement units at Sedam (Karnataka) and Basantnagar (Telangana) with a total capacity of 10.75 mtpa. Out of this total capacity, 8.50 mtpa is clinker backed and 2.25 mtpa is surplus grinding capacity. The cement business also has a 0.66mtpa packing plant in Solapur, Maharashtra. Upon consummation of this Scheme of Arrangement, UltraTech’s cement capacity will stand augmented to 149.14 mtpa including its overseas operations. Kesoram will remain with its investment in Cygnet & Gondkhari Coal Mining Limited, Injepalli Mine 2, etc.

The Appointed Date for the demerger is opening hours of 1st April 2024 or such other date as may be mutually agreed by the board of directors.

Further, the Board of Companies have also approved the execution of an implementation agreement between the Resulting Company and the Demerged Company (“Implementation Agreement”), which inter alia sets out manner of implementation of the Proposed Transaction contemplated under the Scheme, the representations and warranties given by each party and the rights and obligations of the respective parties in relation to the Proposed Transaction.

Further, as per clause 14 of the scheme, the existing debentures of Kesoram will be transferred to Ultratech with same terms.

Rationale for the transaction

(A) In case of the Demerged Company:

- Unlocking the value of the Cement Business for the shareholders of the Demerged Company;

- Assisting in the de-leveraging of its balance sheet including reduction of debt and outflow of interest as well as creation of value for its shareholders; and

- Focusing on core business areas such as rayon, transparent paper, and chemicals.

Post demerger, Kesoram’s only significant asset will be the investment in Cygnet which inter-alia is engaged in rayon, transparent paper, and chemicals.

(B) In case of the Resulting Company:

- Expansion in markets where the Resulting Company has no physical presence;

- Creating value for shareholders by acquiring ready-to-use assets which shall create operational efficiencies and reduce time to markets vis-à-vis greenfield projects which are time-consuming on account of acquisition of land and limestone mining leases;

- Good fit for serving existing markets and catering to additional cement volume requirements in new markets;

- The transaction will provide UltraTech the opportunity to extend its footprint in the highly fragmented, competitive, and fast growing Western and Southern markets in the country;

For Ultratech, this is yet another acquisition of cement business from the group’s entity. Previously Ultratech has also consolidated Binani Cement, Century Textiles Industries Limited (“Century Textile) cement business and JP Cement etc.

Consideration

Upon the Scheme coming into effect and in consideration, the Resulting Company shall issue and allot, to each shareholder of the Demerged Company:

- 1 (one) fully paid-up equity share of Rs. 10 each of the Resulting Company for every 52 (fifty-two) fully paid-up equity shares of Rs. 10 each of the Demerged Company held by equity shareholder.

The demerged company has issued non-convertible preference shares & optionally convertible shares. As per the valuation report & clause 12 of the scheme, these preference shares shall form part of the demerged undertaking and thus the resulting company shall issue consideration:

- 54,86,608 fully paid-up 7.3% non-convertible redeemable preference shares of Rs. 100 each of the Resulting Company for 90,00,000 5% cumulative non-convertible redeemable preference shares of Rs. 100 each of the Demerged Company held by the preference shareholder in the Demerged Company as on the Effective Date; and

- 8,64,275 fully paid-up 7.3% non-convertible redeemable preference shares of Rs. 100 each of the Resulting Company for 19,19,277 zero% optionally convertible redeemable preference shares of Rs. 100 each of the Demerged Company held by the preference shareholder in the Demerged Company as on the Effective Date.

Pursuant to the debt restructuring plan executed in 2021, Kesoram had issued 4,48,97,195 OCRPS to various lenders of which in 2022 has been converted into equity shares of the Kesoram except for OCRPS held by West Bengal Infrastructure Development Finance Corporation Limited.

For the purpose of this transaction, 59,74,301 new equity shares of Ultratech will be issued to the shareholders of Kesoram as on the record date as defined in the Scheme. This will increase UltraTech’s equity capital to Rs. 294.66 crores consisting of 29.47 crore equity shares of Rs. 10/- each. The transaction will dilute the promoters holding from 59.96% to 59.18%.

Kesoram will remain only with a few assets significant being investment in Cygnet. With this the capital size of Kesoram will be far excess than its requirement. In coming period Kesoram shall likely to evaluate a way to reduce its paid-up capital significantly.

Reduction of the Existing Preference Share Capital of the Demerged Company:

- As the resulting company will issue preference shares in consideration of the existing preference shares of the demerged company, the existing preference share capital shall be reduced and cancelled. In short, the liability towards making the payment/redeeming the preference shares will be transferred to Ultratech.

- The existing preference shares will not be transferred to Ultratech but will be cancelled by the demerged company only as a result, Ultratech will issue new preference shares.

- As envisaged under clause 12.2 of the scheme, the preference shares will be considered as debt in the books of Kesoram and accounting treatment for reduction will be in accordance with Ind-AS 109 the same as with other liabilities of the undertaking getting transferred. The key question will be whether there will be any tax implications on the reduction of preference shares.

- The paid-up value of the newly issued preference shares will be less than the paid-up value of the existing preference shares.

- The existing preference shareholders will be incentivised from the increase in dividend.

- The redeemable preference shares issued by the resulting company to the preference shareholders of the demerged company shall have tenure of 3 months and shall be redeemed at premium of 1.825% (INR 101.825 per share) thus, preference shareholders are incentivised by immediate payment with premium.

- Clause 11 of the scheme provides for increase in authorised preference share capital Ultratech will increase its authorised preference share capital through the scheme.

- As far as the new shares being issued as consideration to preference shares, there should not be any tax implication in the hands of preference shareholders as the same will be exempted transfer in accordance with the provision of section 47(vid) of the Income Tax Act, 1961. However, one needs to understand any tax implication on reduction of the shares held in demerged entity.

Financials & Accounting Aspects

Ultratech being the leader in cement sector is efficiently managed and enjoys economies of scale vis-à-vis Kesoram which has tiny capacity & managed with lot of financial turbulences.

The turnover of the Cement Business of the standalone Demerged Company as on 31st March 2023 forms 99.54% of the total turnover of the Demerged Company. Though the margins of Kesoram are lower, Ultratech is likely to improve the margins of Kesoram’s unit post-transaction. For Kesoram, the company will likely to be debt free having only significant asset being investment in Cygnet.

Accounting Treatment:

Both Ultratech & Kesoram will account the transaction in accordance with the provisions of Ind-AS. Kesoram will pass necessary entries as envisage under Ind-AS 10 and Ultratech will record the assets & liabilities of the demerged undertaking at fair values in accordance with Ind-AS 103.

As provided, based on financial position as on 30th September 2023, the net worth of Ultratech will increase by circa INR 5380 crore (on account of recording of assets & liabilities on fair value) while Kesoram’s NetWorth will also increase by circa INR 171 crore.

Assigned Valuation

The Cement Business of Kesoram consists of 2 integrated cement units at Sedam (Karnataka) and Basantnagar (Telangana) with a total capacity of 10.75 mtpa. Along with all assets, Ultratech will also takeover entire debt pertaining to the Cement business along with preference shares & debentures issued by Kesoram.

Please note that:

- The market value has been arrived as per the value provided in the valuation report to determine the swap ratio.

- Cash & Cash equivalent is not considered while deriving the enterprise value.

- It is assumed that the total standalone debt of Kesoram will get transferred pursuant to the demerger.

- For Kesoram, the above numbers are the standalone numbers as on 30.09.2023. For Ultratech numbers are derived as per the company’s presentation for Q2 FY 2024.

There is a stark difference in enterprise value per ton for Ultratech & Kesoram cement business. Some of the probable reason for lower valuation of Kesoram could be old plant, lessor efficiencies, overall past etc. As on the date, entire market capitalisation of Kesoram is equivalent to circa INR 5200 crore. Thus, it derives almost entire value through its cement business.

In 2018, when Ultratech acquired Century Textile’s cement business in similar fashion, the Enterprise value per ton assigned to the deal was also circa INR 6073 while Ultratech was assigned valuation at circa INR 12,396 per ton.

Conclusion

Like previous transaction, Ultratech is acquiring one more cement undertaking from its group entities. For Ultratech, this acquisition not only strengthens its numero uno positions but also provides an opportunity for shareholders of group entity to become part of its flagship company (of course at arm’s length)

Kesoram is one of the companies who have done ample of restructurings for its survival. With exit from the Cement business, decade old company will now be left with hefty capital with only asset being investment in its subsidiary engaged in rayon business which cannot generate enough profits to compensate its shareholders. So, it will not be worthwhile to run the company as is where is basis. So, options for Kesoram are I) to sell the subsidiary or to consolidate its remaining business with the group entities engaged in similar business-like Century Textile. It will be sooner the better for all stakeholders.