Triveni Engineering & Industries Ltd. (TEIL) is a focused, growing corporation having core competencies in the areas of sugar and engineering. The Company is one amongst the largest sugar manufacturers in India. Its engineering businesses comprise high-speed gears, gearboxes, and water treatment solutions.

A few years back, the company demerged its turbine business, located at Bengaluru through a scheme of arrangement into Triveni Turbine Limited from the appointed date on 1st October 2010. Currently, TEIL holds 21.8% equity capital of Triveni Turbine Limited.

Demerged Businesses

Sugar Production:-

Triveni is one of the largest integrated sugar players in India with its 7 sugar mills with a total capacity of 61,000 TCD (Tonnes Crushing in a Day). Its operations are spread across the western, central and eastern part of the cane rich areas of Uttar Pradesh (U.P.)

Co-Generation:-

Triveni presently operates four co-generation power plants, one at Deoband, two at Khatauli and one at Sabitgarh unit with combined capacity of 80 MW. Apart from the co-generation facilities, the company also has two incidental co-generation plants at Chandanpur & Milak Narayanpur with a total capacity of ~ 23 MW. Triveni export surplus power generated to Uttar Pradesh Power Corporation Limited.

Distillery:-

Triveni entered the distillery business in 2007 with an aim to integrate its sugar operations and to reduce the impact of its cyclicality, with the commissioning of one of the largest single stream molasses based distilleries in India in Muzaffarnagar district in U.P.

Remaining Businesses

Triveni Gears, Gear Business of the group is the largest manufacturer of high-speed gears and gearboxes in India for steam turbines, gas turbines, compressors, pumps, blowers as well as special purpose industry applications designed as per API, AGMA. DIN, ISO and other international standards. Triveni Gears also manufactures niche low-speed gearboxes for mini Hydel turbines, Steel mills, sugar mills, rubber mixers and extruders, cement mills. Thermal plants, plastics etc.

TEIL also offers efficient total water management and sustainable solution for treatment across the water cycle.

Triveni Industries Limited (Resulting Company)

Triveni Industries Limited incorporated on 22nd July 2015 is a wholly owned subsidiary of TEIL. Currently, the company is not having any significant operations.

About The Transaction

Upon the Scheme becoming effective and in consideration of the transfer of Sugar Business through demerger, TIL will issue and allot to the shareholders of the Company one equity shares of Re 1/- each credited as fully paid up in TIL for every one equity shares of TEIL held by them in the equity shares of the Company. The equity shares of TIL will be listed on both BSE and NSE. The appointed date of the Scheme is 01 April 2016

Earlier Transaction:-

Last year the company had proposed a Composite Scheme of Arrangement to segregate the Sugar business and Engineering business.

Step I

Transfer and vesting of five sugar plants of TEIL into wholly owned subsidiary Triveni Sugar Limited (TSL) with effect from the appointed date as on 1st July 2015.

Step II

Transfer and vesting of two sugar plants along with their cogeneration facility and Distillery further including TEIL investment in TSL to TIL with effect from the appointed date 1st November 2015. After proposed restructuring, it was proposed to list TIL on national bourses.

Approvals for the Scheme from Stock Exchange/SEBI, shareholders and creditors were also obtained. However, with the improvement in sugar scenario, the Board of Directors felt that the earlier Scheme may not realize the perceived benefits and more efficient structures may be possible to fulfill the objectives of the Company.

Rationale for Demerger

- The transferor company is engaged in the businesses of manufacturing and refining of sugar, a distillation of alcohol, generation of power, manufacturing of gears & gearboxes and providing water and water waste treatment management. As part of the overall reorganization plan and to achieve greater efficiencies in operations.

- Demerger will create opportunities for creating a strategic partnership and flexibility of fundraising capability for future growth and expansion and to create a business structure which is geared to take an advantage of possible growth opportunities.

- The separation of Sugar Business and Engineering Business would also result in unlocking and maximize shareholders value.

Facts and Figure

Performance of various divisions of TEIL

(In INR Crore)

| Consolidated financials as on 31.3.16 | |||||

| Particulars | Revenue | EBIT | Gross Profit Margin | Capital Employed | ROCE |

| Sugar & Allied | |||||

| Sugar | 1551 | -31 | -2% | 1650 | -2% |

| CoGeneration | 171 | 77 | 45% | 193 | 40% |

| Distillery | 166 | 43 | 26% | 153 | 28% |

| Engineering | |||||

| Gears | 108 | 29 | 27% | 113 | 26% |

| Water Management | 131 | -22 | -17% | 120 | -18% |

Past Performance

(In INR Crore)

| Particulars | For the period ending on | |||

| 30.09.11 | 31.03.14 | 31.03.15 | 31.03.16 | |

| Revenue | ||||

| Sugar | 1800 | 3095 | 2008 | 1887 |

| Engineering | 286 | 410 | 311 | 239 |

| EBIT | ||||

| Sugar | 1 | -19 | -71 | 89 |

| Engineering | 42 | 26 | 26 | 7 |

| Total Net Assets | ||||

| Sugar | 1584 | 1604 | 1710 | 1997 |

| Engineering | 256 | 263 | 217 | 232 |

| Note:-Financials for the period ending on 31.03.14 consist of 18 months. | ||||

Comparison with peer: – Balrampur Chini Mills Limited (Balrampur)

Segment Wise INR in crore

| Particulars | Triveni | Balrampur |

| Revenue | ||

| Sugar | 1551 | 2478 |

| CoGeneration | 171 | 412 |

| Distillery | 166 | 270 |

| EBIT % | ||

| Sugar | -2% | 2% |

| CoGeneration | 45% | 43% |

| Distillery | 26% | 50% |

| ROIC | ||

| Sugar | -2% | 3% |

| CoGeneration | 40% | 26% |

| Distillery | 28% | 70% |

Conclusion

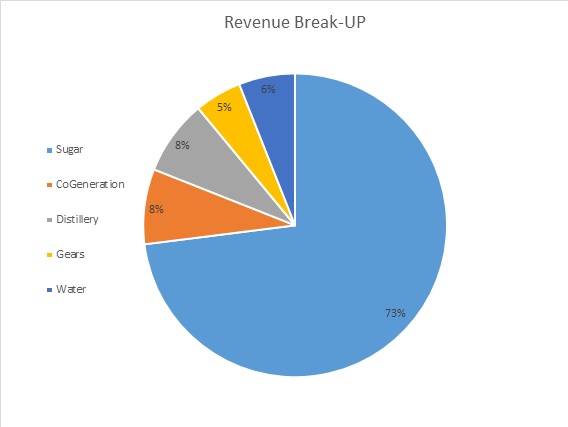

Triveni’s sugar segment is poorly performing since last few years. On the revenue front, Sugar business over the last few years grew by only 2% CAGR against a negative growth rate of its other segment. Today, TEIL is demerging its sugar business which contributes ~89% to total top line.

Due to relentless initiatives by the new government to improve/ to bring sugar business into profit, demerger can create a value for its sugar business. However, due to a poor performance of engineering division, Slump sale of engineering division to a third party would have created more value for all the stakeholders.