The Board of Directors of Sterlite Technologies Limited (“STL”) at its meeting held on May 17, 2023 has considered and approved a Scheme of Arrangement (“Scheme”) between Sterlite Technologies Limited (the “Demerged Company”) & STL Networks Limited (the “Resulting Company”) and their respective shareholders and creditors, under Sections 230 to 232 and other applicable provisions of the Companies Act, 2013 and the rules made thereunder.

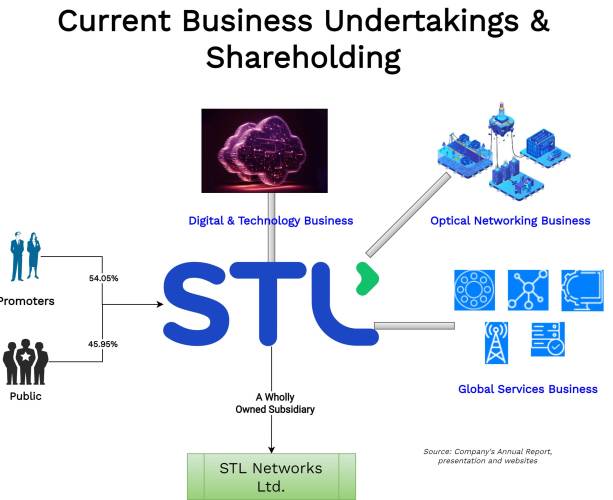

Sterlite Technologies Limited is a global integrator of digital network and is primarily engaged in designing, manufacturing and marketing of wide array of optical products and providing information technology-enabled services and network services. The key business verticals include:

- Optical Networking

- Global Services

- Digital & Technology Solutions

The equity shares of STL are listed on nationwide bourses while its non-convertible debentures are listed on BSE Limited.

In FY 2022, To unlock next phase of technology leadership, STL onboarded industry stalwarts as CEOs for all its key businesses of Optical Networking, Global Services, and Software and Wireless. These leaders-initiated steps to accelerate STL’s growth trajectory in the global markets.

STL Networks Limited is a wholly owned subsidiary of STL and currently not having any operating business.

The Transaction:

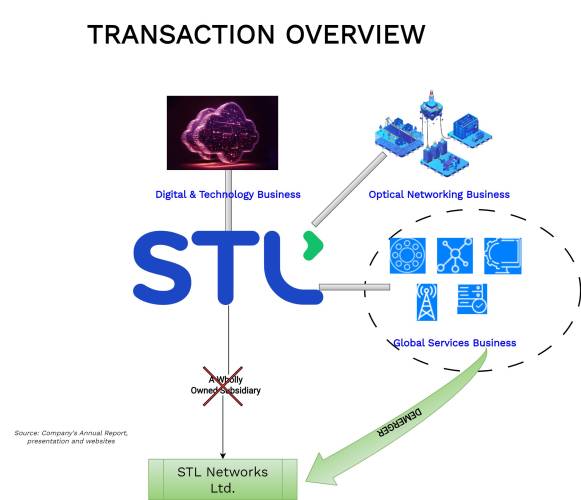

The proposed Scheme of Arrangement, inter alia, provides for the following:

(a) Transfer by way of demerger of the Demerged Undertaking consisting of Global Services Business of the Demerged Company to the Resulting Company and consequent issuance of equity shares by the Resulting Company to the shareholders of the Demerged Company; and

(b) Various other matters consequential or otherwise integrally connected therewith including the reorganisation of the share capital of the Resulting Company.

The demerger is of the Global Services Business, i.e. the division of STL engaged, both directly and through its subsidiaries, in system integration telecom network solutions and laying/developing private network infrastructure on turn-key project contract basis and provision of related services both in India and overseas, such as, fiber deployment services, managed services, system integrations services, FTTH deployment services, operations and maintenance of fiber and other MPLS based networks.

Some of the Rationale as proposed in the Scheme:

- The Global Services Business and other business verticals of the Demerged Company have been commenced and nurtured over different periods of time. They are currently at different stages of growth and maturity with each having distinct market dynamics, geographic focus, strategy, capital requirements and investor interest. Hence, segregation of the Demerged Undertaking into a separate entity would enable focused management to explore potential business opportunities.

- Further growth and expansion of the Global Services Business would require a differentiated strategy aligned to its industry specific risks, market dynamics and growth trajectory.

The Appointed Date for the transaction is opening hours of 1st April 2023 or such other date as NCLT may direct.

Consideration for Demerger:

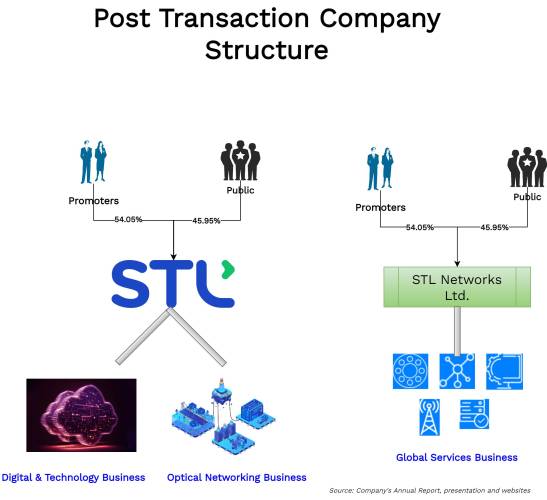

For every 1 equity share of INR 2 each of STL, the Resulting Company shall issue 1 equity share of INR 2 each. Thus, the shareholders of the Company will be issued shares in the Resulting Company in the same proportion as their holding in the Company. The equity shares of the Resulting Company are to be listed on BSE Limited and National Stock Exchange of India Limited post the effectiveness of the Scheme.

Paid-up Capital of the Companies:

| Particulars | STL | Resulting Company (post-demerger) |

| No. of Paid-up Equity Shares | 39,85,80,433 | 39,85,80,433 |

| Face Value | 2 | 2 |

| Public Stake | 45.95% | 45.95% |

Financials

INR in Crore

*: Segment Assets & liabilities having (net liabilities of Rs 3123 crores) are excluding unallocable.From FY 2023 only, STL also started to report Global Service Business as different segment. Interesting the revenues of Optical networking business increased from INR 3713 crore in FY 2022 to INR 5439 crore in FY 2023 vis-à-vis INR 1511 crore in FY 2023 compared to INR 1844 crore in FY 2022 for Global Services Business. The key reason as stated by STL for decrease in revenue was change in STL strategy to focus only on profitable projects in Global Services Business. The EBITDA for the same segment was decreased to INR 47 crore (3.11%) from INR 156 crore (8.45%) for FY 2022. Considering the depreciation & interest cost of STL, even after allocating minimum 10% to Global Service Business, the result for Global Service Business will be negative. With separate company going forward, it will be interesting how Global Service Business performs and how STL allocates its huge net unallocable liabilities of INR 3123 crore across demerged & remaining businesses.

The consolidated net worth of STL as on 31st March 2023 was INR 2095 crore. Allocation of net unallocable liabilities across demerged & remaining business will have significant impact on the respective net worth after the demerger.

Right Issue

STL has also announced raising of INR 1000 crore through equity issuance. The proceeds of the same will be used for both businesses to bring down the overall debt. As the right issue is after the appointed date, it will be used to reduce unallocated debt as on the Appointed Date. How fund allocation to the demerged undertaking will be archived need to be seen.

Conclusion:

The demerged undertaking consisting of Global Service Business is shown as different segment in accounts from FY23 only. Though the name suggests it has operations all over the global including in India. It is low EBITDA business. It is to be seen when it will become profitable after considering interest and depreciation. It is difficult to understand why management decided to have such huge capital in resulting company considering present business scenario.