The Union Cabinet has approved the sale of its 53.29% stake in Bharat Petroleum Corp Ltd (BPCL) to a private entity. The state-owned company is one of the most profitable oil refiners and operates fuel stations. At the prevailing market cap, the government expects to garner about Rs 56,000 crore from the stake sale.

The government’s idea of privatising BPCL was to usher in greater competition in sectors that can sustain on their own. The government is keen to get international energy majors such as Saudi Aramco, Total SA of France and ExxonMobile to operate in the downstream fuel marketing business so as to bring in greater competition. In fact, BPCL will offer attractive buy for global oil majors such as Saudi Aramco of Saudi Arabia. However, with global oil prices in a slowdown mode, the appetite for large acquisition becomes difficult.

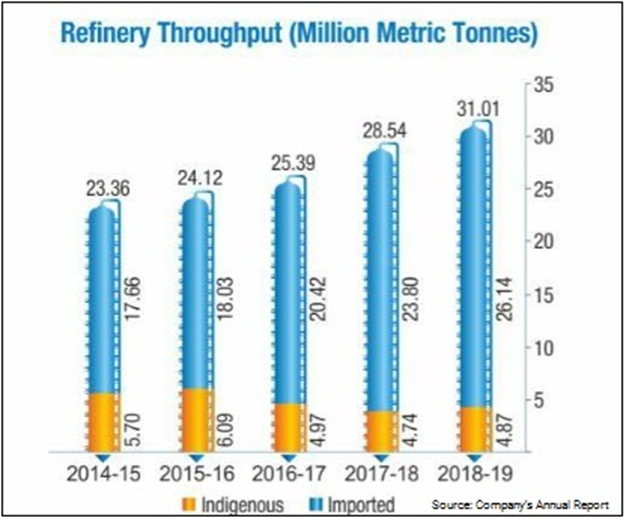

Privatisation of BPCL would help realise a higher price and may take out politics out of auto fuel pricing. At present, BPCL operates four refineries at Mumbai, Kochi, Bina in Madhya Pradesh and Numaligarh in Assam with a combined capacity of 38 million tonnes of crude oil. The proposed stake sale will, however, exclude the strategic Numaligarh Refinery Ltd, which will be sold to another public sector company because it supplies fuel to the security forces in the North East. As a retailer of petroleum products, the company has over 15,000 petrol pumps and 6,000 LPG distributors. It accounts for a quarter of the fuel retail outlets in the country. Moreover, BPCL has stakes in gas companies such as Petronet and Indraprastha Gas and a presence in gas fields in Brazil and Mozambique.

What BPCL means to a strategic investor?

The strategic investor will get access to BPCL’s refining capacity and retail fuel outlets. As most metros are well proliferated in terms of retail outlets, it will be difficult for a new player to open up new retail outlets and land price is very expensive. In India, constructing depots and terminal is a major challenge because of myriad state and Central laws. In fact, BPCL alone accounts for 20% of petroleum product pipelines, 25% of marketing depots and 23% of retail outlets. So, it provides a lucrative entry point for the prospective strategic buyer. Also, with 26% and 24% share of petrol and diesel sales, respectively in the country, the company will be a strategic fit for any investor.

India is the third largest and one of the fastest growing petroleum markets in the world after the US and China with consumption of 5.2 thousand barrels of oil per day (kbopd). During 2013-18, the consumption of petroleum products in India came in at 6.4% CAGR as against 1.6% for the US. In 2019, India witnessed a growth of 3% in consumption of petroleum products. Rise in urbanization combined with better road connectivity is expected to result in sustained high growth of auto fuel consumption.

The decision on BPCL comes in the backdrop of the government opening up the fuel retail market by lowering the entry barrier and allowing all companies with a net worth of Rs 250 crore to set up outlets. The earlier rules required prior investments of Rs 2,000 crore for companies to enter the fuel retail segment, which favoured state-owned companies. In the private sector, Reliance Industries, Essar Oil and Shell India have presence in fuel retail.

Challenges in BPCL’s disinvestment

Challenges remain on BPCL’s disinvestment to a private party due to lack of clarity on the continuation of subsidies on LPG and kerosene. There is no guarantee that there will be no interference in pricing of auto fuels even if oil price surges. There are complexities involved in dealing with subsidies and joint ventures and the company has high employee costs. The stake sale of BPCL may also lead to reassessment of linkages between the government and oil marketing companies.

The entire process of disinvestment has to be done in a transparent manner so that it does not come back to haunt in the future to those involved with the process. The government too, should not give the idea that it is desperate to sell the company to meet its disinvestment target. The company is not a distress sale and the government needs to fix the criterion for the sale which will be value-getter. The government will also have to see after the stake sale, will it get assured supply of refined oil products. The Competition Commission of India may have certain reservations about the stake sale as the market will get more concentrated.

The foreign direct investment (FDI) norms may also need tweaking as the current norms for petroleum and natural gas sector allow 100% automatic route for exploration and production and refining by private companies. But for public sector companies in refining, the norm is 49% on automatic route without any disinvestment/dilution of domestic equity in the existing public sector units. Even a larger question will emerge if the buyer decides to buy one business of BPCL as the company has business presence abroad in refining and retail. So, the Centre needs to decide if it wants to split the deal in three types: overseas, refining and retailing.

About BPCL

BPCL was previously Burmah Shell and in 1976 the government nationalized the company by an Act of Parliament. In fact, Burmah Shell was set up in 1920 as an alliance between Royal Dutch Shell and Burmah Oil and Asiatic Petroleum (India). In FY19, BPCL’s gross revenue from operations was Rs 3,40,879 crore as compared with Rs 2,79,438 crore in FY18. The group reported a profit of Rs 7,802 crore in FY19 as compared with Rs 9,008 crore in FY18. As on March 31, BPCL reported cash and cash equivalents of around Rs 5,300 crore against Rs 10,900 crore of debt maturing over the next 15 months.

Table 1: Financials* BPCL (All Figs in INR Crores)

| Year | Gross sales | Profit after tax |

| 2014-15 | 253073 | 5085 |

| 2015-16 | 217682 | 7056 |

| 2016-17 | 241859 | 8039 |

| 2017-18 | 276401 | 7976 |

| 2018-19 | 336384 | 7132 |

Table 2: Profit after tax as % of Capital Employed.

| Year | % |

| 2014-15 | 17.47 |

| 2015-16 | 21.43 |

| 2016-17 | 18.03 |

| 2017-18 | 13.76 |

| 2018-19 | 11 |

*The above tables and charts excludes the financials of Numaligarh Refinery

BPCL’s contribution to the exchequer by way of taxes, duties and dividend during FY19 amounted to Rs 95,035 crore as against Rs 89,725 crore in the previous year. As on March 31, BPCL’s total equity stands at Rs 36,738 crore, as against the previous year’s figure of Rs 34,131 crore.

Oil sector: Past mergers and stake sales

The Indian energy sector is witnessing a spate of deals in the past. Couple of months ago, French energy giant Total SA had decided to buy a 37.4% stake in Ahmedabad-based Adani Gas Ltd for Rs 6,200 crore. The French energy giant has made an open offer to public shareholders of Adani Gas to acquire up to 25% stake and the rest will be the family shares of Gautam Adani, the owner of the company. The partnership will help develop regasification terminals including Dharma Ltd on the east coast of India and Mundra in the west. The partnership comes after a year when the two companies had agreed to set up an equal joint venture to import and retail natural gas. Under the deal, Total will bring its LNG as well as retail expertise and will also supply LNG to Adani Gas. The acquisition of stake by Total SA will be the largest foreign direct investment in India’s city gas distribution industry.

Similarly, state-owned Oil and Natural Gas Corporation, which accounts for 73% of India’s oil and gas output, acquired the entire government’s 51.11% stake in HPCL for Rs 36,915 crore in 2018. The acquisition was done in an off-market deal. Through this acquisition, ONGC became India’s first vertically integrated ‘oil major’ company, having presence across the entire value chain.

In 2019, in one of the largest foreign investments ever to be made in India, Reliance Industries Ltd (RIL) had decided to sell 20% stake in its oil business to Saudi Aramco at around $15 billion — at an enterprise value of $75 billion. RIL expects that the transaction will close before March 2020. From the Saudi Aramco deal, RIL will receive the proceeds in three stages. Around 50% will come on closing of the deal, 25% after one year of the closing of the deal and 25% in the following year. Also, RIL had signed a pact with BP Plc to form a joint venture in the petroleum retailing business, in which RIL will hold 51% stake and the company and will get Rs 7,000 crore from BP Plc.

In 2016, the Ministry of Petroleum and Natural Gas had proposed merger of all 13 public sector oil companies into one behemoth, an idea which was first mooted by former minister Mani Shankar Aiyar as per the recommendations of V Krishnamurthy’s Synergy in Energy panel in 2005. The idea was to create a giant with global scale and financial strength to stand among the largest in the hydrocarbon sector globally. Even years before, the country’s largest oil and gas exploration firm – ONGC — wanted a merger to bring upstream, downstream, transmission and engineering business under one umbrella. The proposal, however, did not find wide acceptance. Post BPCL stake sale, other PSUs in the oil sector should be merged at the earliest.

Conclusion

The government has a huge divestment program and tries to achieve the target by selling minority stake directly or through ETF. Such divestment becomes mere fund-raising exercise to finance deficit and not real divestment where the government exit the business and not participate in management. So strategic sale like the one proposed by way of sale of BPCL will not only raise funds but also attract private investment and participation in the growth of the economy. If the government wants to maximize its revenue from the stake sale, privatizing will be a better choice. Making another state-owned company to buy the stake will be money moving from one hand to the other hand of the government. For a private sector domestic or international oil company, BPCL will be an attractive buy seeking a major presence in the attractive Indian oil market. The government needs to do a fine balance to sell BPCL, which is one of its prized jewels.

Add comment