Indian Pharmaceutical Industry is witnessing sea changes. With China + 1 strategy, India Pharma Companies are at inflection points. Amidst this, Indian Pharma companies are trying to expand its wings to strengthening their operations to make most of the current scenario.

In a similar move, Solara Active Pharma Science Limited announced amalgamation of Aurore Life Sciences Private Limited along with the other two companies.

Solara Active Pharma Sciences Limited (“Solara”) is an API manufacturer. It has a legacy of over three decades and traces its origins to the API expertise of Strides Shasun Ltd. and the technical know-how of human API business from Sequent Scientific Ltd. It has 140+ scientists working at two R&D centres and 6 API manufacturing facilities armed with global approvals and 2 dedicated R&D facilities.

Solara has formed in 2018 under the demerger scheme of the select API business of Strides Shasun Limited (Strides) and the human API business of Sequent Scientific Limited (Sequent).

Aurore Life Science Private Limited (” Aurore”) company incorporated on 26th September 2016. Aurore Life Science is engaged in the business of developing a wide range of generic pharmaceutical products. It has one R&D centre and 2 API manufacturing facilities. Aurore Life Science Pvt Ltd holds 100% of the share capital of Empyrean Life Sciences Pvt Ltd and also holds 67% stake in Aurore Pharmaceuticals Private Limited which also develops and manufactures a wide range of generic pharmaceutical products.

Empyrean Lifesciences Private Limited (“Empyrean”), a private limited company and a wholly-owned subsidiary of Aurore Life Science is engaged in the pharmaceutical business. Empyrean is also engaged in the research and development of pharmaceutical products.

Hydra Active Pharma Sciences Private Limited (“Hydra”) is engaged in the pharmaceutical business through its subsidiary company Aurore Life Science Pvt Ltd wherein it holds 61.65% stake.

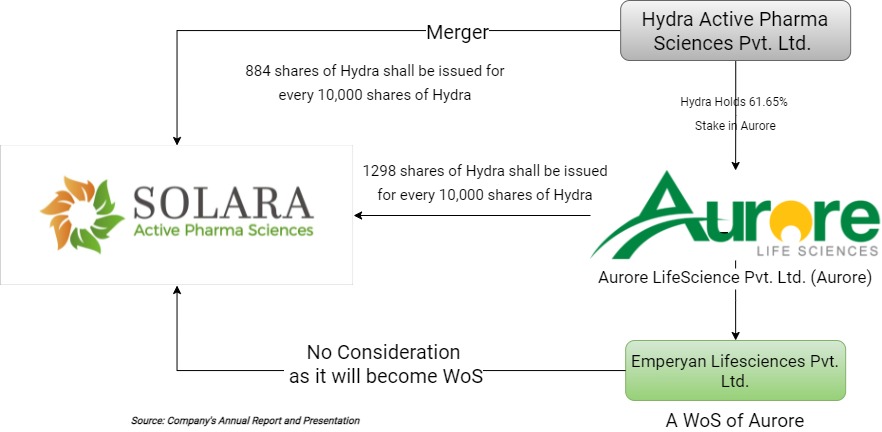

Transaction Structure:

With an Appointed Date as 1st April 2021, Aurore will get merged with Solara followed by the merger of Empyrean & Hydra into Solara.

Post-merger, Solara will hold 67% stake in Aurore Pharmaceuticals Private Limited, that is an existing subsidiary of Aurore Life Science.

Swap Ratio

- As a result of a merger of Aurore into Solara, Solara will issue (including to Hydra) 1,298 number of equity shares for every 10,000 number of shares held in Aurore.

- No shares will be issued as Empyrean will become wholly-owned subsidiary of Solara as a result of Step 1.

- As a result of merger of Hydra into Solara, Solara will issue 884 number of equity shares for every 10,000 number of shares held in Hydra.

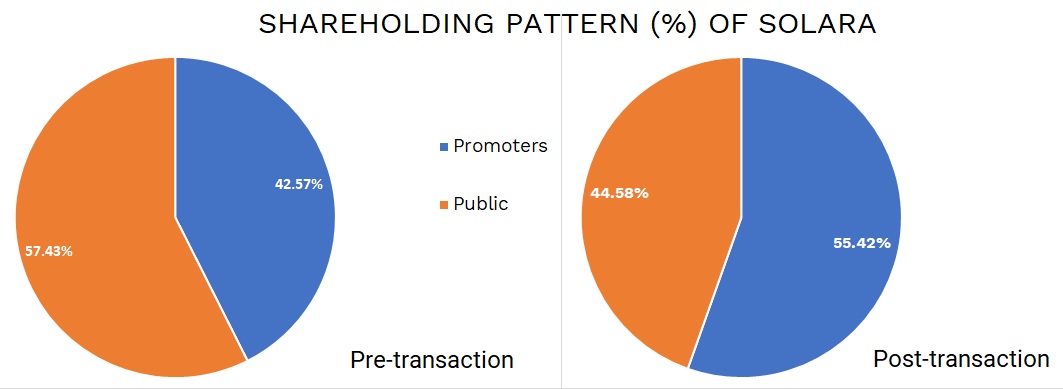

Post-Merger, certain shareholders of Aurore will be classified as Promoters of Solara and thus, the promoter holding in Solara will increase.

Table 1: Share Issuance by Solara

| Category | Pre-transaction | New Issue | Solara (Post) |

| Equity Shares | 3,59,29,767 | 1,32,94,800 | 4,92,24,567 |

| Equity Value (₹ Crores) | 5055 | 1870 | 6926 |

| Relative value per share | 1406 | 1406 | – |

The companies involved in the Scheme have following relationship with each other–

- Karuna Business Solutions LLP is a common promoter in Solara and Hydra holding 7.83% and 27.40% stake in respective companies.

- Hydra holds 61.65% stake in Aurore Life Science

Thus, Post-Merger, existing promoter’s stake in Solara will increase along with the promoters of Aurore getting classified as a promoter. Currently, Mr. Bharat Sesha is Managing Director & CEO of Solara and Aurore is headed by founder Rajender Rao Juvvadi as MD and Amit Kaptin as COO. Rajender & Amit will continue post-merger, however, their roles in merged entity has not yet clarified by Solara.

Rationale for the Merger

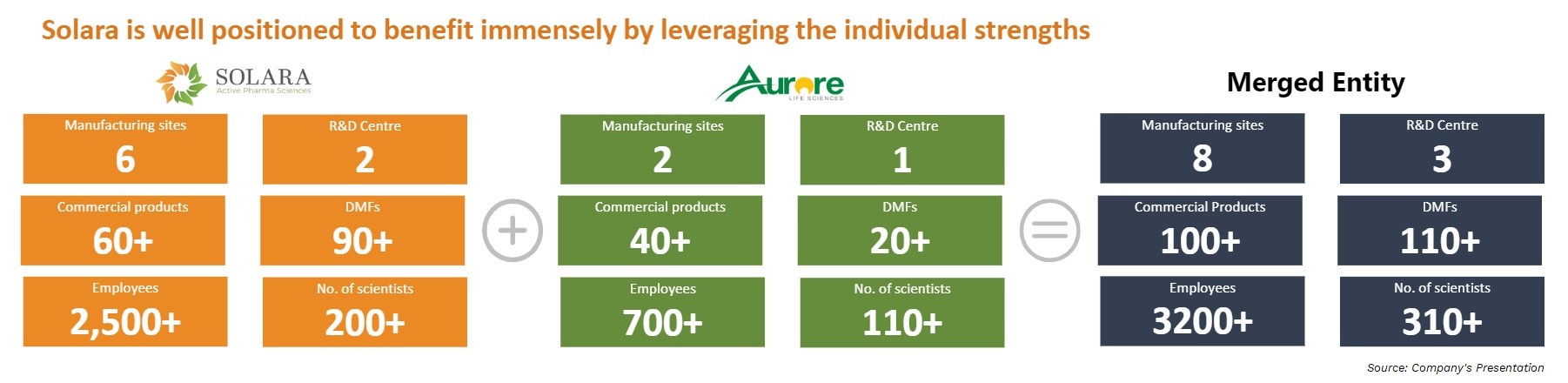

Strengthening API Business

The amalgamation will enable the consolidation of the API business of the Transferor Companies with the Transferee Company and would create one of the largest API players in the industry and will facilitate focused growth, operational efficiency, integration synergies and better supervision of the business. As per the management, Aurore’s product portfolio is completely complementary to that of Solara and thus, Aurore will bring additional products to the Solara’s basket.

Efficient Use of Marketing Resources & Capacity

In last few years, Solara has made significant investment to enhance the capacity including the multipurpose plant in Vizag while Aurore has expanded its reach in multiple geographies. This will enable combined company to use the facilities and marketing capabilities efficiently.

Additional Sites

With an addition of two sites to existing six sites of Solara, one out of two is FDA approved from the Aurore family means that Solara can now have multiple site-based supply security for many of its key products. The amalgamation will significantly de-risk operations with the combined entity having eight manufacturing facilities, three Research & Development Centres and footprint in 75 + countries enabling a wider market reach and customer offerings.

CRAMS Business

Aurore brings significant CRAMS business to the combined entity. Solara’s CRAMS footprint will now triple in size, and this provides Solara with a scale to grow at a much faster trajectory than planned in the CRAMS vertical. In short, this merger addresses key priority areas for Solara and is fully in line with its stated strategy of accelerating growth via an inorganic play.

Financials & Valuation

Table 2: Financials of Solara and Aurore FY 19-20 (All figs in ₹ Crores)

| Particulars | Solara | Aurore |

| Revenue | 1616 | 545 |

| EBITDA | 413 | 175 |

| EBITDA % | 25.5% | 32.11% |

| PAT | 221 | 95 |

| Circa Capital Employed | 2100 | 500 |

As per management, Aurore has valued at INR 1870 crores. After considering the debt of around INR 270 crores, the enterprise value assigned to Aurore comes to around INR 2140.

Solara has been valued at around INR 5055 crore.

Table 3: Valuation metrics

| Particulars | Solara | Aurore |

| Enterprise Value (₹ Crores) | 6000 | 2140 |

| EV/EBITDA | 14.52 | 12 |

| EV/Revenue | 3.7 | 3.9 |

Conclusion

Solara has formed inorganically under the demerger scheme by demerging the select API business of Strides Shasun Limited and the human API business of Sequent Scientific Limited. The demerger changed the fortune as revenue’s increased from INR 562 crores in 2018 to 1616 in 2021.

With changing global dynamics, Indian Pharma entities has potential to grow multifold in next few years. To reap maximum benefits, companies will look to consolidate the operations which can give numerous benefits to them. Solara-Aurore merger is a classic example of this. The proposed merger will not only give multiple benefits to both companies, it can likely start next wave of consolidation in the pharma sector.

Promoters having different expertise will come together and manage the operations of merged Solara which may open new avenues for Solara. Along with part of a bigger entity, merger will offer liquidity to the existing promoters of Aurore as well as will not trigger “Open Offer” requirement under SEBI Takeover Code. Going forward, merged entity can leverage upon the strengths of each of the standalone entities and offer better value proposition. In future, if required, promoters may invite strategic partner at much better valuation than standalone valuation or even can raised funds for expansion at a lower cost.

Add comment