Sheela Foams Limited (“SFL”) incorporated in 1971 is the market leader and the largest manufacturer of Polyurethane Foam in India. The flagship household brands include: ‘Sleepwell’ for mattresses and home comfort, ‘Feather Foam’ a pure PU Foam and ‘Lamiflex’ a polyester foam for lamination. The equity shares of SFL are listed on nationwide bourses.

Kurlon Enterprise Limited (“KEL” or “Kurlon”) is founded in 1962 by the Pai family business group from South India. Its flagship household brands include Kurlon, Home Komforts (Furniture), Komfort Universe and premium brands such as Spring Air and Englande.

In March 2014, Kurlon Limited, holding company of KEL signed a business transfer agreement with KEL, effective from April 01, 2014, to transfer the business division of mattress, foam, furniture and other of Kurlon Limited, as a going concern, on a slump-sale basis to KEL. Under the agreement, all land and buildings were retained by Kurlon Limited and all plant and machinery (except the Gwalior plant) were transferred to KEL. The core operations of the mattress, foam and furniture business are now carried out by KEL, and all the products manufactured by Kurlon Limited are sold to KEL.

House of Kieraya Private Limited (“Furlenco”) is a Bengaluru-based startup founded by Mr. Ajith Mohan. The company offers easy and flexible access to designer furniture with options to change at periodic intervals. The company’s product portfolio includes brand-new as well as refurbished furniture. Furlenco is currently owned by Promoter, Venture Fund & several angel investors.

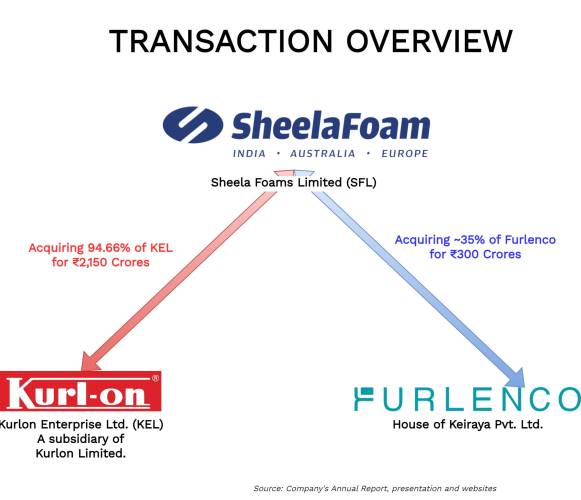

The Transaction:

SFL announced two significant acquisitions:

- SFL will be acquiring 94.66% of KEL’s share capital at an equity valuation of INR 2150 crores

- SFL will acquire ~35% of the share capital of Furlenco through share subscription for a consideration of INR 300 crore

Both acquisitions will be funded through part of internal accruals & remaining amount through mix of debt & equity. Further, as informed by the management, remaining stake 5.34% stake in Kurlon is held by various family members of existing promoters of Kurlon which will be transferred to SFL by the promoters in due course at same valuation.

The INR 300 crores investment in Furlenco is totally primary infusion and broadly 55% would go for the retirement of debt. The remaining would be with the company for growth capital. Initially, SFL have equity stake of 35% and have an option of purchasing additional 9% stake at the same valuation to be exercised within 1 year.

Transaction Rationale – Kurlon

Technology

Sheela Foam is a pioneer and leader in foam mattresses while Kurlon’s strength lies in its rubberized coir mattresses. rubberized coir mattresses contribute to the total of 30% of the revenues of Kurlon while 34% is through Foam & Spring based.

Incremental Market Share

SFL has ~13% market share of modern mattress segment while Kurlon is the second largest mattress player with ~8% market share in modern mattress segment. Together the company will have 21% market share of modern mattress segment. With lot of new startup coming into a category, with consolidation, SFL will be better poised to capture more market share.

Capacity & Distribution

SFL has an integrated manufacturing facility 123,000 MTPA with a robust distribution network of 100+ exclusive distributors, 5,400+ exclusive retail dealers, and 7,850+ multi-brand outlets

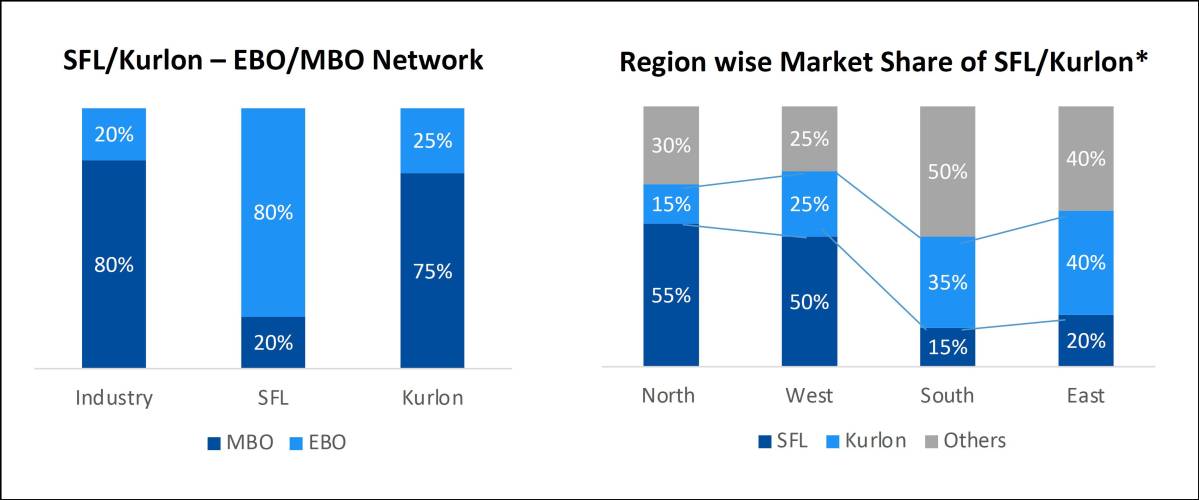

Kurlon has one of the largest direct dealership networks in the sector spanning more than 10,000 touch points and a distribution network of 450+ Exclusive Brand Outlets (EBOs) and 4500+ Multi Brand Outlet (MBOs). Kurlon’s stronghold in MBO dealer network to provide additional sales while Sleepwell’s extensive EBO presence can bolster reach of Kurlon’s product. Much diversified presence of both SLF & Kurlon might help SFL to not immediately look for expansion of EBO/MBO’s.

Geographical Presence:

While SFL is strong in North and West, Kurlon has a stronger presence in the East and South. With the acquisition the combined entity will have a strong market presence in all the markets for all the products.

Brand Positioning:

Sheela Foam being a stronger “Prestige” brand has lower market share compared to Kurlon in “Mass” price point market. This acquisition will give boost to Sheela Foam’s presence in the “Mass” price point acting as starting point of migration from Unorganized to Organized market.

Manufacturing:

SFL has a global manufacturing footprint with 11 nationwide manufacturing plants in India, 5 in Australia, and 1 in Spain. While Kurlon with 10 manufacturing plants located strategically across 5 states in India offering unparalleled distribution and logistics advantages. The manufacturing facilities of SFL & Kurlon do not have a single town where there is an overlap.

Currently, some of the manufacturing plants are with the holding company of KEL which in due course will be transferred to KEL. It is not clear whether any additional consideration will be payable to the holding company by KEL on account of transfer or will be discharged before SFL acquisition.

Cost saving initiatives

There is a significant scope of improvement in operational efficiencies at Kurlon amid declining revenues and margins. Improvement in Plant efficiencies, RM landed costs, reduction in Operational spends with tighter business controls has the potential to improve the EBIDTA margins significantly.

Revenue Distribution

| Particulars | SFL | Kurlon |

| Mattress | 41% | 64% |

| Comfort Foam | 21% | 24% |

| Sofa & Furniture | 12% | 4% |

| Technical Foam | 26% | – |

| Others | – | 8% |

The combined entity will be more diversified with more products to offer across the value chain, from foam manufacturing to mattresses to furniture products. Currently Kurlon also sell Furniture (like Sofa) through its Home Komforts and Regins brands. Going ahead, SFL will evaluate option of cross-selling products through combined channels of acquired companies.

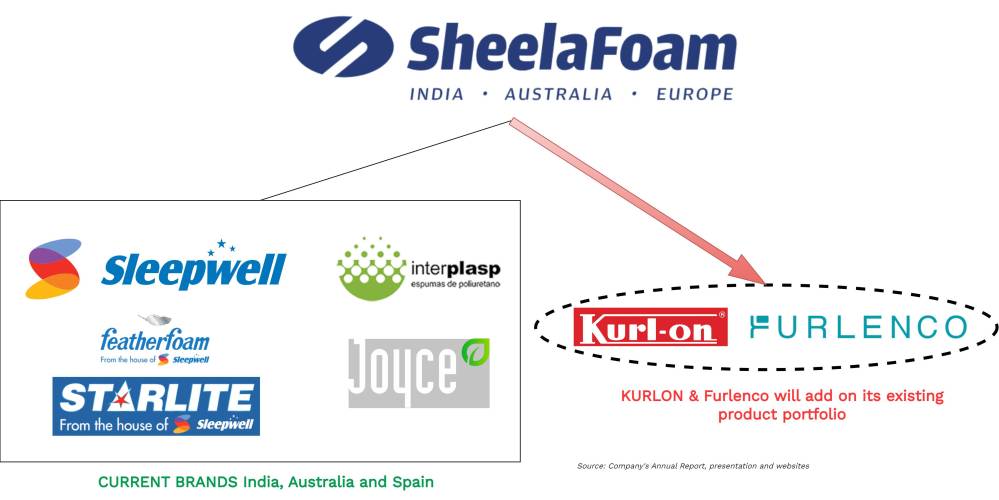

Transaction Rationale – Furlenco

The Furlenco deal will help Sheela Foam to enter the fast-growing branded furniture and furniture rental market and an opportunity to further diversify its product presence. Another advantage of Sheela Foam and Furlenco coming together is the possibility of offering its products or offering Furlenco’s products on the EBOs and MBOs that have and vice versa of Sheela Foam’s products which is the Sleepwell and the Kurlon mattresses on Furlenco’s platform for their online strength.

Furlenco is one of the largest and fastest-growing furniture rental companies in India. Furniture is an extremely fragmented category as far as India is concerned and there are multiple ways where one can interact with the consumer, be it selling new furniture, be it renting, be it buying back, be it refurbishing, etc., and all this is in the portfolio of Furlenco this might provide opportunity for SFL & Kurlon to interact more with customers & to improve brand presence.

Major Brands under SHEELA FOAM

Financials

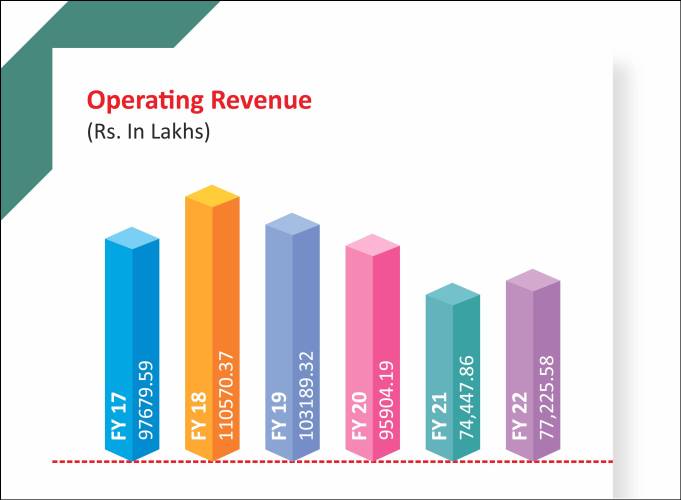

SFL will acquire stake in Kurlon for debt & cash free basis. Over the last couple of years, Kurlon has witnessed continuous de-growth. Operating margins of Kurlon has also been fluctuating and have fallen from mid-teens to lower single digit number. In 2020, Kurlon bought professional CEO to improvise its numbers.

SFL has stated immediate target of taking Kurlon’s revenue above INR 1000cr with 10%+ operating margins.

Revenue of Kurlon

On other hand, Furlenco is relatively start-up company trying to establish its foot in fragmented furniture market. The revenue of Furlenco for FY 2023 was circa 150 crore. Furlenco is expected to be EBITDA positive by H2-FY24 led by reduction in logistical and warehousing costs. It is expected to be PAT positive by FY25.

As stated by the company, out of total requirement of around Rs. 2,350 crores for both acquisitions, Rs. 800 crores will be funded through available cash with SFL and the rest would be funded through a combination of debt and equity. SFL will raise debt of circa INR 600 crore and remaining amount coming as equity portion.

SFL’s Tentative Debt: Equity Ratio

| Particulars | Amount in crore (As on 31st March 2023) |

| Networth | 1608 |

| Borrowings | 466 |

| Current Debt: Equity Ratio | 0.29 |

| Additional Debt & Equity each | 600 & 950 each |

| Revised Debt: Equity Ratio | 0.41 |

It looks, even after raising the remaining amount in the combination of debt & equity, revised debt: equity ratio will be pretty comfortable for SFL. At SFL’s current valuation of circa INR 12,000 crore, equity dilution for raising INR 950 crore will be circa 7.33% stake (post-money)

Valuation:

Tentative valuation assigned to each of the Companies

| Particulars | SFL | Kurlon | Furlenco |

| Assigned Valuation | 12,000 | 2150 | 557* |

| Revenue Multiple | 4 | 2.66 | 3.54 |

*: Pre-Money ValuationInterestingly, assigned valuation to Furlenco during last round was circa INR 1400 crore. In FY2023, KEL has provided exit to private equity investor, Motilal Oswal Private Equity Investment Advisors through a group company, Kurlon Trading & Invest Management Private Limited (wholly owned subsidiary of Kurlon Limited). The group paid circa INR 325 crore for acquiring a 6.19% stake in KE which translated assigned valuation of INR 5250 crore.

In January 2023, Wake Fit Innovations Private Limited (Online Mattresses Company) raised circa INR 370 crore at post-money valuation of INR 2500 crore. In FY 2022, Wakefit was having revenue of INR 636 crore with negative EBITDA (INR -91 crore). However, the revenues of Wakefit are growing decently well clocking more than 50% year-on-year growth.

Conclusion

The Organised Mattress sector is witnessing sea-changes. The online players are increasing their share while existing brands are struggling for growth. SFl, which has largest market share in organised Mattress sector, Kurlon acquisition will not only strengthen its numero uno position but also acquired brand which will deepen its presence in South & East India.

For Kurlon, deal remains attractive as anyways Kurlon was going through professional management transition and complete exit makes win-win deal for them. Going ahead strategy will be to have complementary products than competition among products. Using Kurlon, SFL will look to strengthen mass market---tier II & tier III cities. SFL may also evaluate to merge Kurlon with SFL & giving exit to remaining 5% equity shareholders of Kurlon.

On other hand, Furlenco will widen its addressable market but at same time may require lot of money to expand. It will be interesting to see whether SFL acquires controlling interest in Furlenco going ahead. Finally, Growth in revenue remains the key challenge for SFL & minority shareholders.