Today the cement industry is going through a consolidation phase with large Indian cement players vying for smaller ones and foreign cement majors acquiring controlling stake in Indian majors. In a move to strengthen its position, Birla Corporation announced an acquisition of the entire cement business of Reliance Infrastructure Limited for an Enterprise Value (EV) of INR 4800 crore.

The said divestiture will help Reliance Infrastructure to deleverage its debt-laden balance sheet and exit a non-core business.

About Birla Corporation Limited:

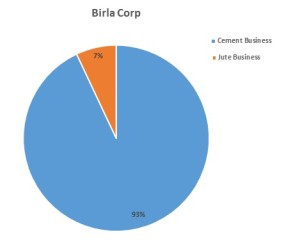

Established in 1919, Birla Corporation Limited (Birla Corp) is the flagship Company of the M.P. Birla Group. Birla Corporation Limited has been mainly in cement business (>90%) but also having a presence in jute goods, PVC floor covering, as well as auto trims all taken together amounting to less than 10% of the turnover.

Birla Corp’s Cement Business:

The cement is marketed under the brand names of Birla Cement SAMRAT, Birla Cement KHAJURAHO, Birla Cement CHETAK and Birla Premium Cement, bringing the product under the common brand of Birla Cement while retaining the niche identity of SAMRAT for blended cement, i.e. PPC & PSC, for all the units, KHAJURAHO (for the OPC product of Satna) and CHETAK (for the OPC product of Chanderia).

The Cement Division of Birla Corporation Limited has seven plants, two each at Satna (M.P.), Chanderia (Rajasthan) and Durgapur (W.B.) & one at Raebareli (U.P.) with total installed capacity of approximately 10 MTPA.

Interestingly, this deal comes just six months after Birla Corp had agreed to buy two assets totaling 5.15 MTPA from French cement maker Lafarge for INR 5,000 crore in August 2015. The company is now in the process of taking legal action against Lafarge India after the latter conveyed its inability to proceed with the agreement to sell the plants.

About Reliance Infrastructure Limited:

Reliance Infrastructure Limited, incorporated in 1929, is amongst the largest and fastest growing companies in the infrastructure sector. The company also has a presence across various spectrums.

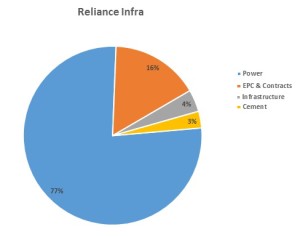

Snapshot of various businesses of Reliance Infra:-

Reliance Infra’s Cement Business:

Reliance Infrastructure does its cement manufacturing through its subsidiary, Reliance Cement Company Private Limited (RCCPL). It started actual production in FY 2014 however in a current financial year it became completely operational. Today, Reliance Cement has 3 plants (Maihar, Kundanganj, and Butibori) with total installed capacity of 5.5 Million Tonne Per Annum (MTPA) (This includes grinding unit of 0.5 MTPA at Butibori). Another 5 Million Tonnes equivalent cement manufacturing facility is being developed at Mukutban in Maharashtra.

Consolidation of cement industry in last decade:

| Year | Particulars | Consideration |

| 2004 | Aditya Birla group acquired Ultratech Cemco- from Larsen & Toubro. | |

| 2005 | Holcim acquires a stake in ACC and later in Ambuja Cements | $111 per tonne & $193 per tonne respectively. |

| 2006 | Heidelberg Cement Group enters India via a 50:50 joint venture in Indorama Cement and acquires a majority stake in Mysore Cement. | Not Available |

| 2008 | Heidelberg Cement Group acquires balance stake in Indorama Cement and merges operations of the same with Mysore Cement forming Heidelberg Cement India | Not Available |

| 2011 | Jaypee Group purchases a controlling stake in Andhra Cements | INR 280 crore. |

| 2013 | Ultratech bought Gujarat unit of Jaiprakash Associates | INR 3800 crore. |

| 2014 | Ambuja Cement first acquires 24 percent stake in Holcim India, followed by a merger of Holcim India into Ambuja Cements. | INR 3500 crore. |

| 2014 | Ultratech acquires two plants from Jaiprakash Associates | $140 per tonne. |

The Transaction:

Birla Corp will acquire all the shares of Reliance Cements Company Pvt. Limited (Cement Business of Reliance Infra) from Reliance infra at an enterprise value of INR 4800 crores.

The acquisition will provide Birla Corp ownership of high-quality assets taking its total capacity from 10 MTPA to 15.5 MTPA strengthening its presence in the high-growth central region. The transaction will enhance Birla Corp’s potential with mineral concessions in Madhya Pradesh, Maharashtra, Rajasthan and other regions.

With the acquisition of three plants, Birla Corp will also get benefits from Reliance cement’s strategically located raw material sources, captive coal mines, optimum manpower, efficient operating parameter and technical capability of producing a top end quality product.

The transaction aligned with the Reliance Infra’s strategy to reduce its existing debt. For the financial year ended on 30th September 2015, its consolidated total debt was approximately INR 24,600 crores.

For Birla Corp, The acquisition will be funded through existing cash reserve & incremental debt.

Valuation:

| Particulars | Amount (INR in Crores) |

| Assigned Enterprise Value of Reliance’s cement business | 4,800 |

| Total Debts (As on 31st March 2015) | 2,150 |

| Equity Component in assign EV (EV-Total Debt) | 2,650 |

| Investment made by Reliance infra in Reliance Cement Private Limited | 978 |

| Gain to Reliance Infra | 1,672 |

On the valuation front, at an EV of INR 4,800 crore, Reliance will get a 2.7X return on the equity it invested in the cement business. With a sale of cement business, Reliance Infra will able to reduce its consolidated debt by almost INR 4800 crores.

As on 19th February 2016, enterprise value of Birla Corp was approximately INR 3600 crore which is almost 0.75 times the enterprise value assigned to the deal. With a total capacity of 5.5 MTPA (Including 0.5 MTPA grinding unit capacity), consideration per tonne comes out to be around $140. While considering the enterprise value of Birla Corp as on 19th February 2016, EV per tonne of Birla Corp comes out to be around $53. The reason behind this could be Reliance Cement plants are newly established, a captive coal mine near Maihar project and its strategic locations of its plants. However, compared to Birla Corp’s previous proposed deal with Holcim, they are getting Reliance Infra’s cement business at a cheaper rate.

STRATEGY:

Revenue breakup:

During FY 2014, Reliance Infra started its cement production from its two plants at Maihar and Kundanganj. As cement revenue contributes only 3% in total revenue of Reliance Infra, the company decided to divest its cement business and to utilise the funds in strengthening its other core business. For this, during last & current year Reliance Infra developed its cement business and once it started yielding positive EBIT, it sold cement business to Birla Corp for a better valuation.

Reliance Cement Private Limited:

| Particulars | Amount |

| For FY2015 | |

| Revenue | 518 |

| EBIT | -38 |

| Net Profit | -114 |

| Net Worth | 821 |

| Total Debt | 2,150 |

| Enterprise Value | 2,939 |

| Total Asets | 3,529 |

| Net Current Assets | -483 |

| Finance Cost | 100 |

| Debt Equity Ratio | 2.62 |

| Total Capacity | 5.3 MTPA |

| For H1FY16 | |

| Revenue | 736 |

| EBIT | 36 |

| Capital Employed | 3,197 |

| RoCE | 1.13% |

| Effective Revenue per tonne (In INR) | 2,676 |

All figures in INR Crore otherwise mentioned

As compared to Birla Corp, Reliance Infra’s cement business is very new. Further, its largest capacity plant i.e Maihar plant started its operations during last year only. Further, Birla Corp’s debt equity ratio & Interest coverage ratio is pretty handsome as compared to Reliance Infra. As on 30th September 2015, a Total consolidated debt of Birla Corp was approximately INR 1241 crore. While cash and cash equivalent stood at INR 468 crore. As transaction will be funded through existing cash and incremental debt, post-transaction Birla Corp’s total debt will increase significantly. Initially, the transaction is going to hit all its profitability ratios adversely, however, going forward Birla Corp can turn the deal EPS accretive.

Peer comparison:-

| Particulars | Birla Corp | Ramco Cement | JK Cement |

| Consolidated as on 31.03.2015 | |||

| Capacity (MTPA) (Including grinding unit) | 10 | 16.45 | 10.5 |

| Revenue | 3,209 | 3,732 | 3,398 |

| EBIT (Including other income) | 304 | 554 | 365 |

| EBIT % | 9.5% | 14.8% | 10.7% |

| Finance Cost | 78 | 195 | 229 |

| Interest Coverage Ratio | 3.9 | 2.8 | 1.6 |

| Net Profit (Including other income) | 175 | 244 | 142 |

| Net Margin | 5.5% | 6.5% | 4.2% |

| Net Worth | 2,627 | 2,625 | 1,616 |

| Return on Net Worth | 6.7% | 9.3% | 8.8% |

| Total Debt | 1,241 | 2,280 | 3,030 |

| Capital Employed | 3,868 | 4,905 | 4,646 |

| RoCE | 7.9% | 11.3% | 7.9% |

| Enterprise Value* (As on 19.02.16) |

3,596 | 10,750 | 5,795 |

| EV/EBIT | 12 | 19 | 15.88 |

| Debt Equity Ratio | 0.47 | 0.87 | 1.88 |

| Total Assets | 4,995 | 7,074 | 6,050 |

| Net Current Assets | 1,694 | -246 | 203 |

| Revenue per tonne | 2,929 | 2,230 | 3,236 |

| *Debt is as on 30.09.15 while for JK Cement it is as on 31.03.15. | |||

All figures in INR Crore otherwise mentioned

CONCLUSION:

Reliance Infra had been targeting to emerge as one of the biggest cement players in the country with the largest single-location cement facility since 2008. However, the company’s capital-intensive plans were shelved as the Reliance Group got saddled with debt and recently shifted the focus to the manufacturing of defense equipment.

On the sluggish demand, competition across cement sector is heating up. Last year Birla Corp had agreed to buy two assets totaling 5.15 MTPA from French cement maker Lafarge however the deal didn’t go through. But with strong desire to expand its cement business, Birla Corp announced an acquisition of Reliance Infra’s cement business. With this acquisition, Birla Corp, will not only strengthen its presence in central India but also increase its total operational capacity to 15.5 MTPA with further 5 MTPA by developing a Mukutban project. Though the acquisition is likely to increase its capacity by two folds, Birla Corp will still be far behind industry leaders like Ultratech, LafargeHolcim which has a capacity of approximately 67 MTPA.