Over the last decade, Reliance Industries Limited (RIL) has diversified its operations from Oil-to-Chemical to Telecommunications, Retail, and Financial Services. During COVID-19 when most businesses were evaluating strategy for survival, RIL raised billion dollars in its Telecommunication & Retail arms from various global funds and strategic partners like Google, Facebook etc. This fundraising was followed by multiple bolt-on acquisitions by RIL/ & its subsidiaries to enable it to offer a complete product basket to its customers.

As RIL turned into a behemoth, people were expecting the announcement of demerger of its Telecommunication & Retail arm. However, to the surprise of many, RIL announced the demerger followed by a separate listing of its Financial Services arm.

Reliance Industries Limited (“RIL” or “Demerged Company”) is India’s biggest conglomerate which through itself and its subsidiaries engaged in activities span hydrocarbon exploration and production, petroleum refining and marketing, petrochemicals, advanced materials and composites, renewables (solar and hydrogen), financial services, retail, and digital services. The equity shares of RIL are listed on nationwide bourses.

Reliance Strategic Investment Limited (“RSIL” or “Resulting Company”) is currently a wholly owned subsidiary of RIL and is an RBI-registered non-deposit-taking Systemically Important (ND-SI) Non-Banking Financial Company. It holds certain investment in group companies and outside.

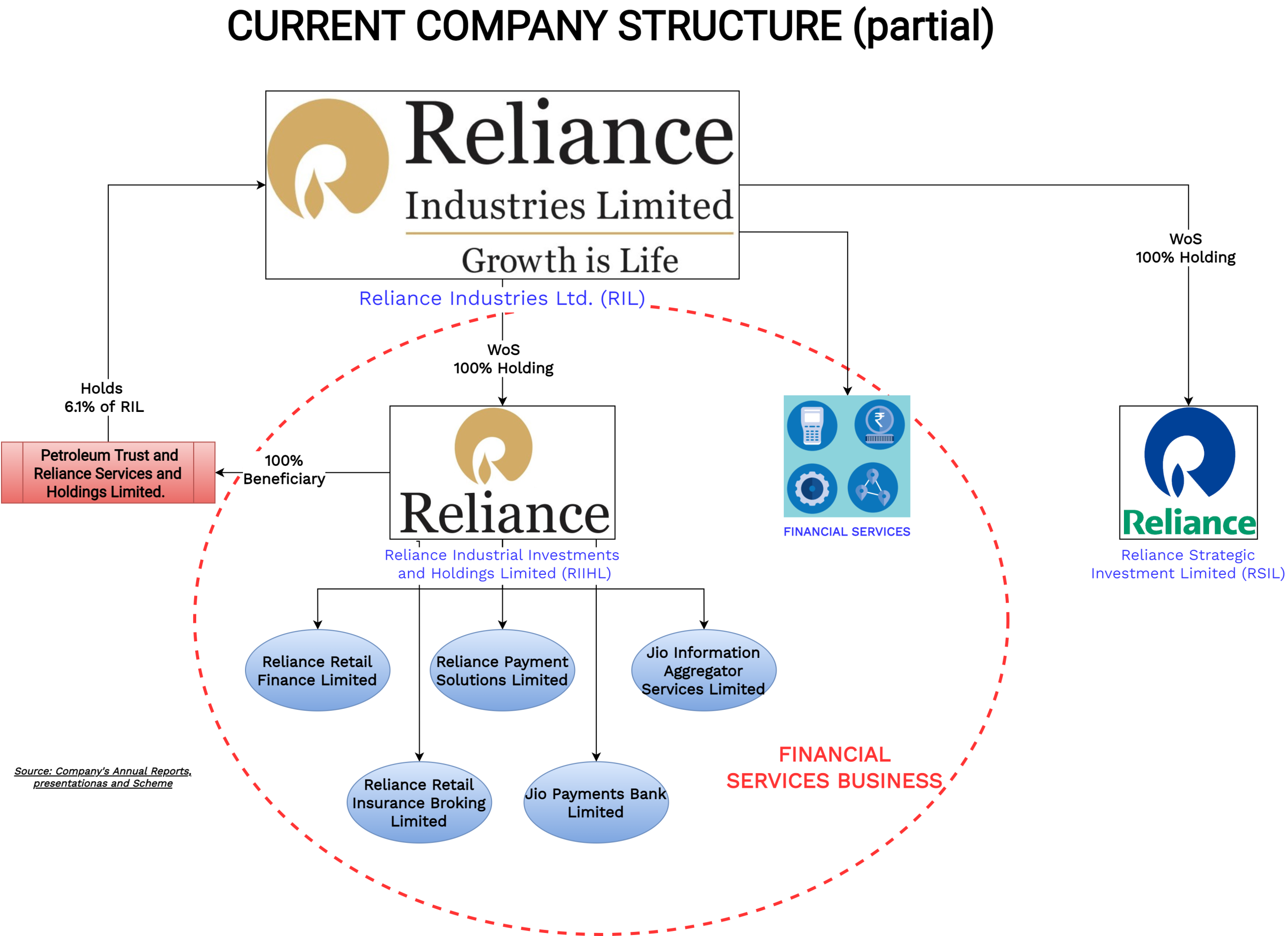

Current Structure of the business to be emerged

The Transaction:

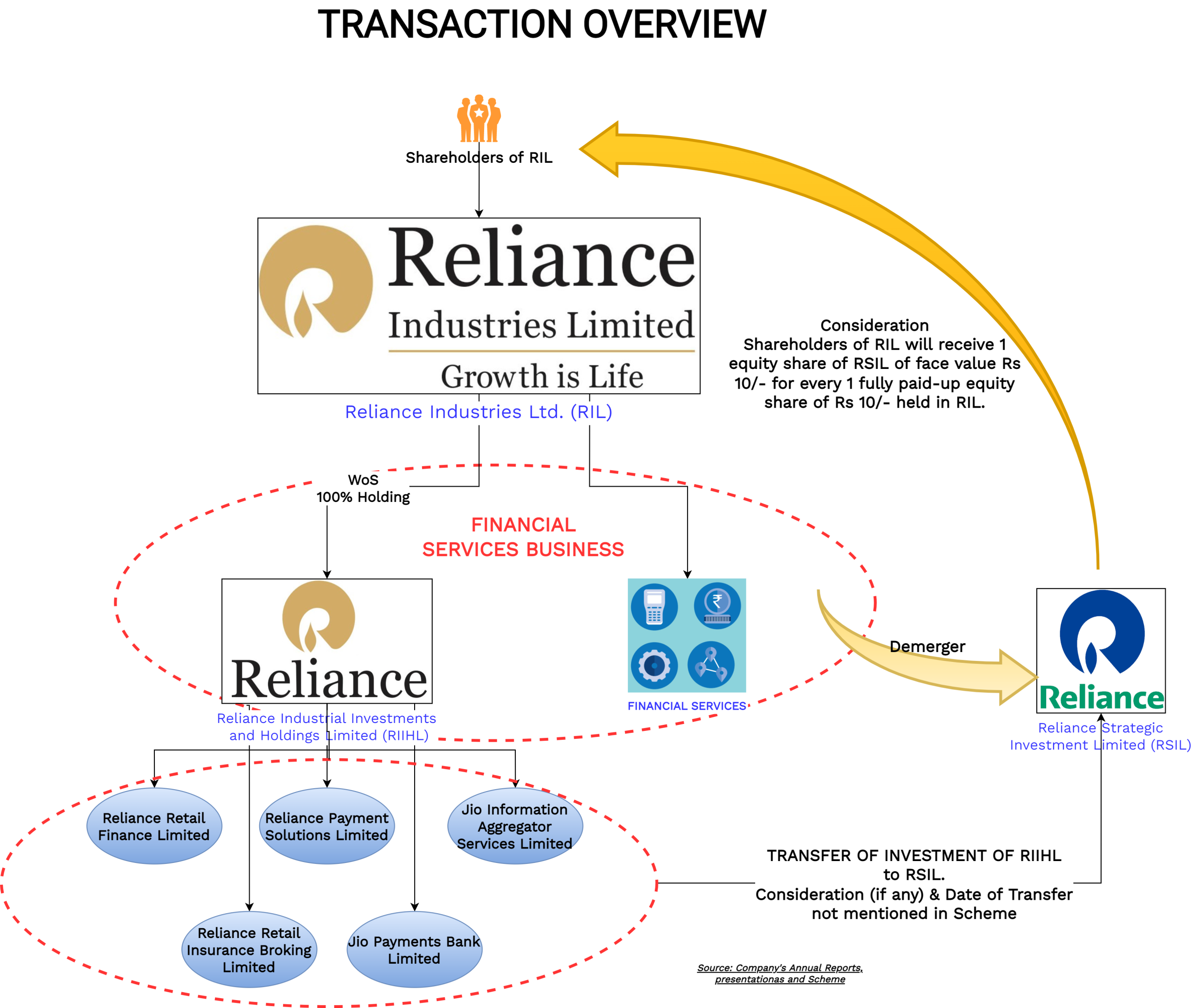

The Board of Directors of Reliance Industries Limited approved a Scheme of Arrangement (“Scheme”) which inter-alia provides for the demerger of the Financial Services Business of RIL into Reliance Strategic Investments Limited (“RSIL”).

“Financial Services Business” means the division of the Demerged Company engaged in investment and other financial services business including non-banking financial services, insurance broking, payments bank, payment aggregation, directly and through its subsidiaries and joint ventures other than the investments of the Demerged Company in Reliance Ventures Limited and Reliance Strategic Business Ventures Limited.

Some of the Rationale as mentioned in the Scheme:

- Growth & Expansion of the Financial Business

- Attracting strategic partners/investors

- Higher leverage for growth

The Appointed Date for the demerger will be closing business hours of March 31st, 2023. Thus, effectively, for FY 2023, a separate balance sheet as on 31st March 2023 will be prepared for the Financials Services Business while the entire profitability/loss pertaining to the same will be in RIL.

Consideration:

Pursuant to the Scheme, shareholders of RIL will receive 1 equity share of RSIL of face value Rs 10/- for every 1 fully paid-up equity share of Rs 10/- held in RIL.

The equity shares issued by the Resulting Company will be listed on nationwide bourses.

Paid-Up Capital of the Companies:

| Particulars | RIL | RSIL* |

| 676,53,73,111 equity shares of Rs 10 each fully paid-up | 6765.37 | – |

| 615,81,42,874 equity shares of Rs.10 each fully paid-up | – | 6150.81 |

| 3,41,236 equity shares of Rs 10 each (Rs 2.5 paid-up) | 0.8 | NA |

| 2,79,667 equity shares of Rs 10 each (Rs 5 paid-up) | 0.13 | NA |

The existing share capital of the Resulting Company (entirely held by Demerged Company) shall be cancelled pursuant to this scheme.

*: In case of partly paid-up shares, the Resulting Company shall allot the shares to a Trust set up by the Demerged Company in consideration as to the fully paid-up equity shareholder. As and when the shareholder pays the balance amount to the demerged company, the trustees shall transfer such number of equity shares of the resulting company to that shareholder.

The Scheme also provided that equity shares of the Resulting Company aggregating to 41,28,24,826 shall not be issued and allotted to Petroleum Trust and Reliance Services and Holdings Limited) in respect of the shares of the Demerged Company held by them (explained hereunder) in view of the proviso to Section 232(3)(b) of the Companies Act, 2013.

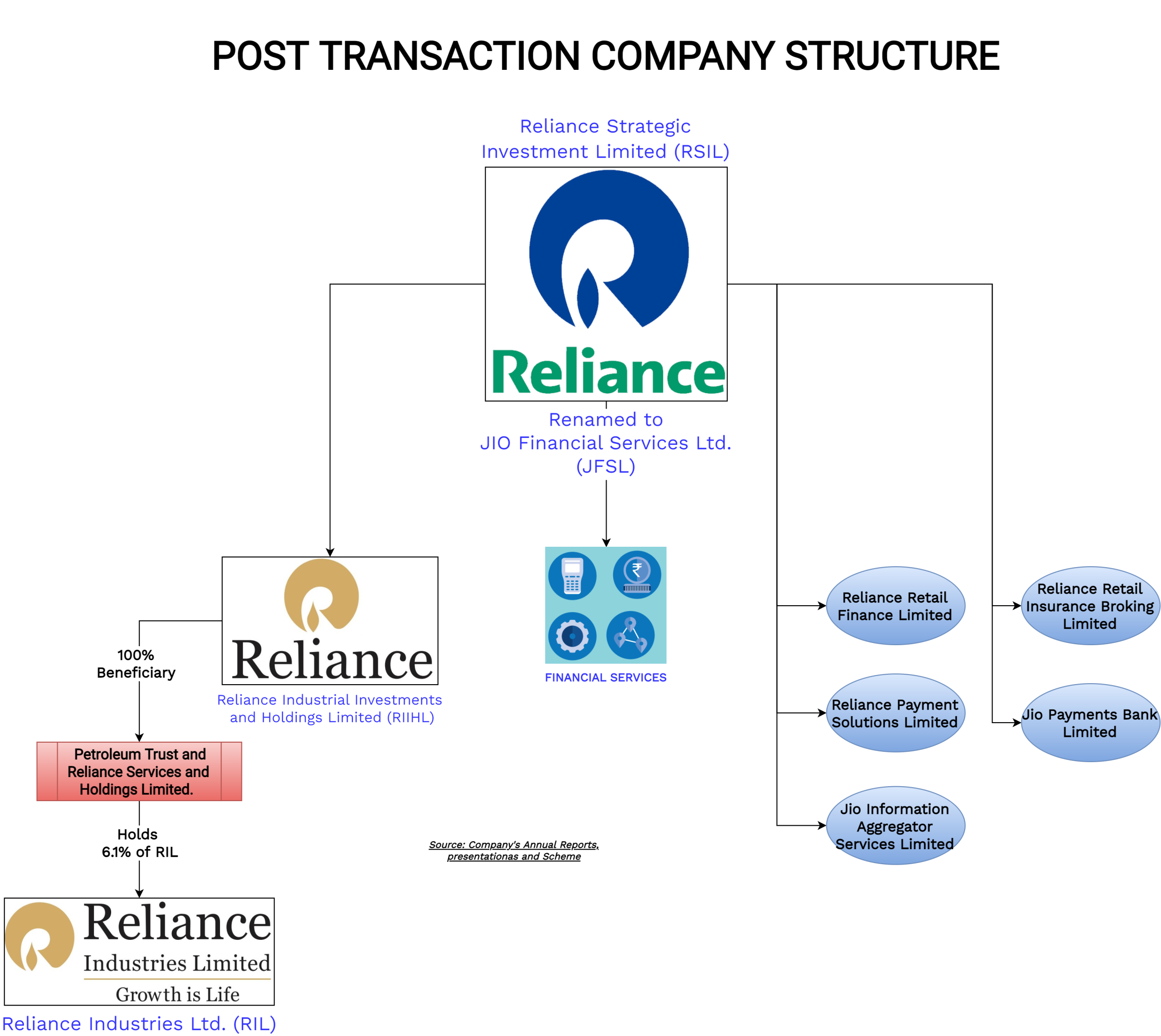

The Scheme explicitly provides for demerger of investments in Reliance Industrial Investments and Holdings Limited to be a part of the demerged undertaking. Reliance Industrial Investments and Holdings Limited is the ultimate beneficiary of 6.1% RIL shares through its interest in Petroleum Trust and Reliance Services and Holdings Limited. Thus, post-demerger, the said interest will indirectly be held by RSIL which is valued more than INR 1 lac crore.

As RIL directly or indirectly hold its own shares and hence shares are not being issued as part of the scheme. It may be noted that to that extent promotor’s holding in RSIL (post-demerger) will be lower as compared to their shareholding in RIL. In RIL promoters holding is 50.57% & in RSIL it will be 47.25%.

Clause 14 of the Scheme provides for transfer of investments in certain companies namely Reliance Retail Finance Limited, Reliance Payment Solutions Limited, Jio Information Aggregator Services Limited, Reliance Retail Insurance Broking Limited and Jio Payments Bank Limited held by Reliance Industrial and Investment Holdings Limited to the Resulting Company (RSIL) through a separate agreement. The consideration if any for the transfer through agreement and date of transfer i.e., before or after the Appointed Date is not mentioned. One of the reasons for mentioning the same in the scheme could be to make operating companies direct subsidiaries and as a result, RIIHL will left with only beneficial interest in RIL.

Post-demerger, RSIL will be renamed as Jio Financial Services Limited.

The entire cost for the demerger including stamp duty will be borne by the demerged company. Generally, the Resulting Company being the Acquirer of the business pays the stamp duty cost for any transaction.

Additionally, through the Scheme, RSIL will acquire liquid assets to – a) provide adequate regulatory capital for lending to consumers, merchants, etc., and b) incubate other financial services verticals such as insurance, payments, digital broking, asset management for at least the next 3 years of business operations. The regulatory licenses for the key businesses are in place. Effectively, it is likely that RIL will transfer some extra cash & cash equivalent as part of the undertaking for future expansion of the financial business, though exact amount is not specified. It may be presumed that it will be additional to the net worth of the financial service division of Rs 95,416 shown as on 30the September 2022.

Securities Premium Account

Clause 8 of the Scheme provides that, the issue price of each Resulting Company Equity Share shall be (‘A’ – ‘B’) / ‘C’,

where ‘A’ is the book value of the assets minus liabilities of the Demerged Undertaking as of the Appointed Date;

‘B’ is the reserves/retained earnings of the Demerged Undertaking, if any, to the extent identified and transferred to the Resulting Company under this Scheme; and

‘C’ is the total number of equity shares issued and allotted by the Resulting Company pursuant to this Clause 8.

The difference between the issue price and the face value of equity shares to be issued and allotted by the Resulting Company will be recorded as a securities premium.

For illustrative purpose:

| Particulars | Amount |

| book value of the assets minus liabilities of the Demerged Undertaking (A) | 100 |

| reserves/retained earnings of the Demerged Undertaking, if any (B) | 40 |

| total number of equity shares issued and allotted by the Resulting Company | 10 |

| Issue price will be x times face value | 6 |

Thus, effectively the difference will be recorded as part of the “Securities Premium Account” and no capital reserve will be likely to be created on account of demerger in the books of the Resulting Company as it is normally required to be done. This, in our view, facilitate the company to show higher regulatory net worth and higher borrowing capacity.

Interestingly, this clause doesn’t form part of “Accounting Treatment” which states that the difference between (A) the book value of assets minus liabilities and reserves/retained earnings, if any, recorded in the books of the Resulting Company, and (B) the value of the Resulting Company New Equity Shares issued and allotted to the shareholders of the Demerged Company (number of Resulting Company New Equity Shares issued multiplied by issue price per Resulting Company New Equity Shares) as consideration, if any, shall be debited/ credited to the capital reserve account of the Resulting Company;

Financials

Significant part of the revenues of Financial Services Segment comes from inter-segments. It is not clear whether the segment assets include a fair value of 6.1% equity shares held by Reliance Industrial and Investment Holdings Limited or some of the assets which are now being not getting included in Demerged Undertaking in segmental accounting. Considering the behemoth size of RIL, the demerger of its Financials Services Business will not have any impact on the financials and Earning Per Share of the RIL. However, considering the opportunities from group business vertices such as retail and telecommunication, it has tremendous scope to become one of the top financial services provider companies in India.

Valuation

Below is the some of the data points of Piramal Enterprises Limited (PEL) & Bajaj Finance Limited (BFL):

Though PEL & BFL are not apple-to-apple comparable to the financial service business of RIL, assuming it gets decent MCAP/BV multiple, it will fetch a significant valuation. Further, each of the shareholder of RSIL will own part RIL share worth INR circa 180 being 6.1% of RIL share price.

Conclusion:

Though the size of the financial services business in overall RIL is not significant, it will become one of the largest financial services company (in terms of Net Worth) in India. With a large customer base available through its group business like telecommunication (JIO) & Reliance Retail arm, RSIL is well poised to grow immensely. The proposed swap ratio & certain provisions provided in the scheme envisage that sufficient regulatory capital will be available with financial services business to scale its activities very quickly without any dilution post listing.

Going ahead, RSIL plans to launch consumer and merchant lending business based on proprietary data analytics to complement and supplement the traditional credit bureau-based underwriting. This will possess a significant challenge to some of the companies in the space who are currently enjoying virtual monopoly.

Descriptors like biggest, largest come along with RIL. With the demerger of the financial services business, it will be having ambition to make RSIL a true fintech which will house financial business, insurance business, AMC, Broking and modern fintech businesses. For this, they have appointed Industry veteran Mr. KV Kamath as a chairperson.

The demerger will also open an opportunity for the group to acquire/partner with some of the prominent financial institutions in India. We may see some good acquisitions/mergers in near future including acquisition/merger with other NBFC’s and/or one of the public sector bank.