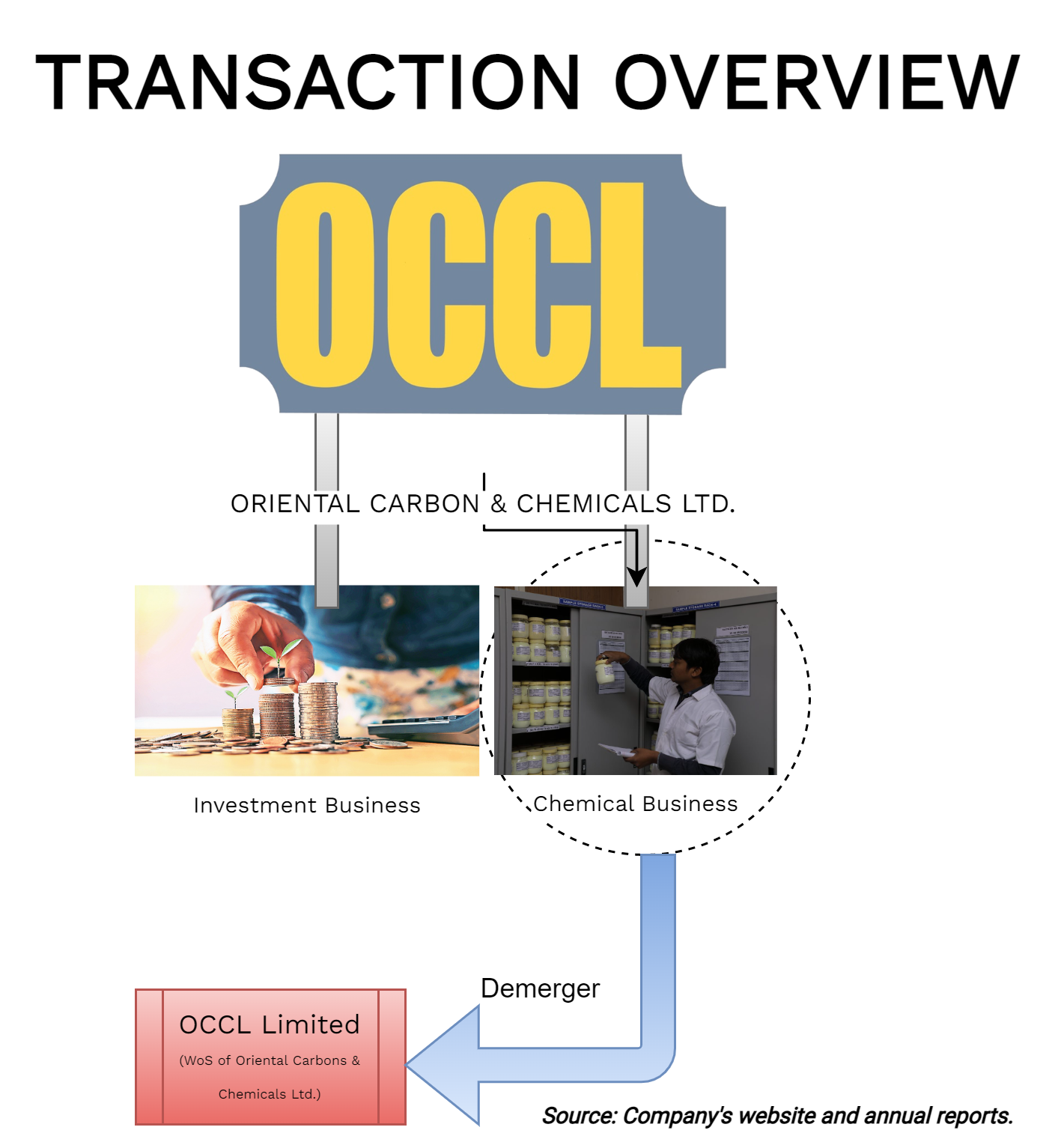

Oriental Carbon & Chemicals Limited (“Oriental Carbon/Demerged Company”), belonging to JP Goenka Group of Companies, Listed Company on BSE and NSE has announced scheme of arrangement for Demerging its “Chemical Business” in relation to insoluble Sulphur, acid, and oleum into its newly incorporated Wholly Owned Subsidiary Company i.e., OCCL Limited (“OCCL/Resulting Company”) to carry on the demerged business.

The Demerged Company is engaged in the business of manufacturing and sales of chemicals (insoluble sulphur, sulphuric acid, and oleum) and investments. The Demerged Company is a global supplier of insoluble sulphur of which about two-thirds of the turnover is from exports. Demerged Company is into the process of shifting of Registered office from Kolkata to Gujrat.

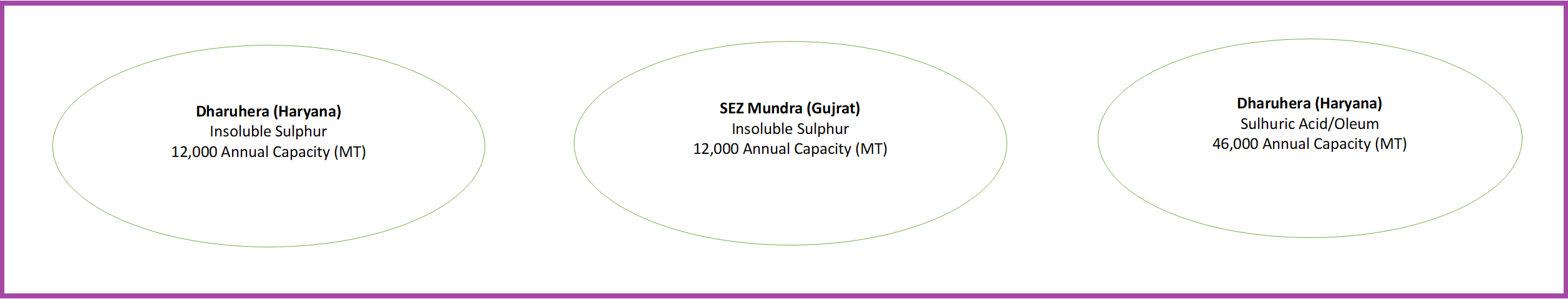

Demerged company is having manufacturing facilities located at –

The Transaction:

The Board of Directors of Oriental Cabon approved demerger of “Chemical Business” which constitutes the revenue for FY 2021 to its wholly-owned subsidiary OCCL. Post scheme of arrangement, Demerged Company will carry on the activities of investments and intends to initiate trading business such as commodity Trading.

The Appointed Date for the demerger will be the Effective Date or such other date as may be agreed by the Boards of the companies. “Effective Date” means the date on which last of the conditions specified in Clause 19 (Conditions Precedent) of this Scheme are complied with or waived, as applicable.

To carry on the activities of investments, Demerged Company will have to get itself registered with Reserve Bank of India as a Non-Banking Financial Company.

Rationale of the Scheme:

As envisaged under the Scheme, separation of Chemical and Investment has been proposed to focus on growth of each businesses, provide flexibility in accessing capital and attract investors and to unblock the values based on respective risk return profiles and cash flows.

Swap Ratio:

Upon scheme becoming effective, 5 (Five) fully paid-up equity share of INR 2/- each of the Resulting Company will be issued as fully paid up, for every 1 (One) fully paid-up equity share of INR 10/- each of the Demerged Company.

Resulting Company is incorporated with authorised and paid-up capital of INR 1 Lakh. The Scheme does not contain any clause for increase in authorised capital of the Resulting Company. Resulting Company will have to increase the same separately before allotting the shares.

The Number of shares of the Chemical business will be five times than existing shares however, the paid-up capital will remain the same as the equity shares issued will have 5 times lesser face value.

Listing of Resulting Company:

Post effective of the scheme of arrangement, equity shares issued by the Resulting Company shall be listed on the BSE and NSE claiming relaxation under sub-rule (7) of rule 19 of the Securities Contracts (Regulation) Rules, 1957

Shareholding pattern of “Demerged Company” and Resultant company pre and post scheme of arrangement:

| Category | % of shareholding |

| Promoters | 51.76 |

| Public | 48.24 |

| Total | 100 |

As all the shareholders of the demerged company, on Record Date, shall receive equity shares of the Resulting company in the same proportion as they hold shares in Demerged company, the post-arrangement, though each of the shareholders will receive 5 shares against 1 share held by each of them

Shareholders of the Demerged Company will hold the shares in two listed companies i.e Demerged Company and Resulting Company. There will not be any dilution in shareholding pattern. Pursuant to Point 4 of Part -II of SEBI’s Master Circular on scheme of Arrangement, since there is no change in the shareholding pattern, shares issued by the Resulting Company will not be under lock-in.

Unique clauses in the scheme:

- Issue of Shares Compulsorily in Demat Mode and Transfer of Physical shares to Trust:

Pursuant to clause 7.4 of the scheme of arrangement, new equity shares being issued by the Resulting Company will be issued in dematerialized form. It has been stated in the scheme of arrangement that if the shareholders holding shares in physical form do not provide the required details before the record date for conversion of such physical shares into Demat, Resulting company shall deal with such shares in such manner as may be permissible under the applicable law including transferring of such shares to the Trust to be created by the Company and Trustee will hold such shares on behalf of such shareholders. The respective shareholders shall have rights of shareholders including right to receive dividend, voting rights and other corporate benefits. Based on details as on 31st March circa 275000 shares amounting to circa 2.75% of the paid-up capital of the company.

- Transfer of immovable Properties

Pursuant to clause no. 4.2.5 of the scheme, notwithstanding anything contained in other clauses of the scheme with respect to the immovable properties forming part of the Demerged Undertaking in the nature of land and buildings situated in states other than the state of Gujarat, whether owned or leased, for the purpose of payment of stamp duty and vesting in the Resulting Company, if the Resulting Company so decides, the Demerged Company and/ or the Resulting Company, whether before or after the Effective Date, may execute and register or cause to be executed and registered, separate deeds of conveyance or deeds of assignment of lease, as the case may be, in favor of the Resulting Company in respect of such immovable properties.

One other important aspect is that APPOINTED DATE is EFFECTIVE DATE as per the scheme. It amounts to transfer of assets of The Demerged Undertaking not on The Appointed Date but before or after the said date.

Let us examine the implications of this clause from the Stamp duty angle.

Stamp Duty implications in Gujarat:

Since the Resulting Company and The Demerged company have registered office in Gujarat, primarily, stamp duty pursuant to Gujrat Stamp Act will be applicable.

Pursuant to the Article 20 of the Gujrat Stamp Act, 1958, stamp duty on an order of the National Company Law Tribunal under section 232 of the Companies Act, 2013 on the scheme is to be worked out as follows:

Subject to maximum of twenty-five crores rupees:- Higher of the following

- An amount equal to 1% of the aggregate amount comprising of the *market value of share issued or allotted in exchange of or otherwise, or the face value of such shares, whichever is higher and the amount of consideration, if any, paid for such amalgamation, or

- An amount equal to 1 % of the true market value of the immovable property situated in the State of Gujarat of the transferor company,

*The market value of share means in relation to the transferee company, whose shares are not listed or listed but not quoted for trading on a stock exchange means the market value of the share issued or allotted with reference to the market value of share of the transferor company.

Since the stamp duty in Gujarat will be applicable on the market value of shares or market value of immovable properties in Gujrat, it does not matter whether the property in Haryana is transferred before effective date or after effective date.

Stamp Duty implications in Haryana:

Pursuant to Article 23 A of The Indian Stamp (Haryana Second Amendment) Act, 1899; stamp duty on merger or Amalgamation/Demerger of Companies Act, 1956/2013 shall be chargeable @ 1.5% –

- Of amount of Fair Market Value** of property or;

- Of the amount consideration as mentioned in Order;

Higher of the above point (i) or (ii) shall be considered as amount payable towards stamp duty; subject to maximum duty of Rs. 7.5 Crore.

** Fair Market Value (FMV) is the price, in terms of cash or equivalent, that a buyer could reasonably be expected to pay, and a seller could reasonably be expected to accept, if the business were exposed for sale on the open market for a reasonable period of time, with both buyer and seller being in possession of the pertinent facts and neither being under any compulsion to act.

As of now, there is no provision for set-off of the stamp duty paid on the same property directly or indirectly (on the value of shares) in other states. In this case, since the registered office of the Demerged company is not in Haryana, whether stamp authorities of Haryana will apply stamp duty applicable in the case of Merger/Demerger or stamp duty payable on normal conveyance?

It seems it is beneficial to the company to pay stamp duty in Haryana based on separate conveyance document and not based on the consideration mentioned in the scheme, hence the specific clause relating to transfer before or after the order through a separate document. To avoid any liability and litigation with stamp authorities in West Bengal, the demerged company is into the process of shifting of registered office from West Bengal to Gujrat and its registered office will be in Gujrat before the Appointed Date/Effective Date.

The Demerged Company post demerger:

It will be left with only investments. One of the major investments of Oriental carbon is equity shares of Duncan Engineering Limited, a listed company engaged in Industrial Pneumatics and Off-Highway Tyre Valves (OTR) valves and accessories. Oriental Carbon holds a 50.01% equity stake in Duncan Engineering Limited. Apart from this, Oriental Carbon has also invested in other private companies, Alternative Investment Funds, Mutual Funds, Debentures etc. totalling circa Rs 200 crores. OCCL will be a pure-play chemical company which will focus on expanding the chemical business while Oriental Carbon will be an investment company having major holdings in other listed companies of the group i.e., Duncan Engineering Limited.

Conclusion:

It is good to look at various consequences of the scheme like shareholders holding shares in physical form and stamp duty liability which may arise on the scheme and specifically provide to mitigate any adverse consequences and capture positive benefits for all the stakeholders and minimise cost and cash outflow on the execution of the scheme,

Post-listing, sizable portion of current market capitalization i.e., circa INR 800 crore may be assigned to the Chemical Business and the demerged company is likely to trade with discount to the fair value of assets held by it as in the case of all holding and investment companies.

sir will be expected share price of demerged company post demerger and also of the resultant company rate post demerger

Hello Sir,

We cannot comment on the share price expected of either company. On approval of the scheme the Swap Ratio is mentioned as 5:1 as mentioned in the article. The team is going to write a case law on the delay and rights of NCLT on changing the effective date.

If one has holding a 100 eq shares of OCCL on 20th July 2024, what will be its current status in terms of Eq holdings ?

which two co share we will get on demerger of occl

Additional shares of the demerged company shall be given as per swap ratio to existing shareholders of OCCL. Refer the additional CASE LAW on the delay in approvals here. https://mnacritique.mergersindia.com/nclt-right-effective-date-occl-demerger/