No twist is too dramatic for serialised shows that are staple of nighttime television in India’s vast market for general entertainment. It’s no different, it appears, in the two-year-long saga that has sought to create the country’s largest entertainment company by a merger.

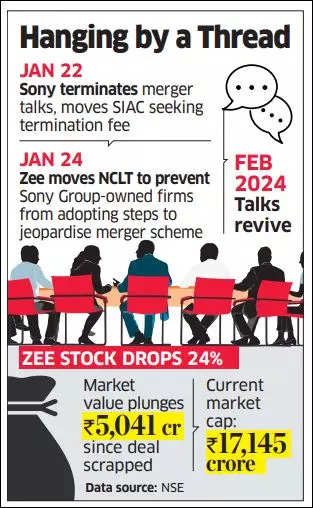

Zee Entertainment Enterprises (ZEEL) has re-engaged with Sony Group Corp in a last-ditch attempt to revive their $10-billion merger, which had been officially called off on January 22, people aware of the matter said.

Representatives from the two sides have held meetings across locations in Mumbai and efforts to salvage the deal have gathered momentum over the last fortnight. However, major differences are yet to be sorted out, and that could yet lead to the failure of the renewed talks, with both sides sticking firmly to their positions, as per executives aware of the matter.

Zee is expected to inform Sony over the next 24-48 hours if it’s willing to accept all terms and conditions, including conditions precedent (CPs), and go ahead.

Key Points of Difference

Else, by the end of this week, Sony is expected to pull its original merger application filed with the National Company Law Tribunal (NCLT) over two years ago, when the two had agreed to merge.

A reconciliation on the other hand would mean legal proceedings that have been initiated will be withdrawn. Sony and Zee have both approached various forums, including the Singapore International Arbitration Centre (SAIC) and the National Company Law Tribunal (NCLT) over the matter.

Among the key points of difference now is a $300 million write-off on cricket rights that needs to be settled before any agreement is signed. While Sony wants the write-off/impairment to be booked upfront, Zee is seeking a postponement.

On the other hand, Punit Goenka, MD and CEO of ZEEL is believed to have agreed to “relinquish” his previous demand of being made the CEO of the merged entity. Sony was completely opposed to him being the top boss of the merged company until he was cleared of charges related to money being diverted from Zee to closely held companies owned by his family’s Essel Group. Sony has maintained Goenka can at best be an adviser to the merged entity.

There is also disagreement over honouring some of the important CPs that are still “outstanding,” said the people cited above. Zee is pushing for any deal to be legally “irrevocable” once signed, but Sony is hesitant about making such a commitment. The original agreement between the two sides was signed in late 2021. Since then, significant value erosion has taken place and financials have worsened so Sony as an MNC does not want to get into any further binding agreements and is “hence uncomfortable with this”, said one of the executives cited.

Zee’s senior leadership on the other hand is confident that the company is on the mend after net profit in the quarter ended December jumped 141% to Rs 58.5 crore even as revenue dipped 3% to Rs 2,045 crore. Streaming arm ZEE5 is on an uptrend with the Q3 operating loss narrowing 13.4% to Rs 244 crore while revenue rose 15% to Rs 223 crore. On Monday, the Zee stock closed at Rs 178.65, down 3%.

A Zee spokesperson declined to comment, saying the matter is sub judice. Messages to Punit Goenka remained unanswered. Emails sent to Sony International did not get any response.

During an investor call on February 13, Goenka had said: “I certainly wanted the merger to be implemented. In line with this aspiration, we even took several steps towards divestment or closure of profitable businesses in the domestic and international markets. I personally offered several proposals and solutions to Sony, to address their demands, but unfortunately, they remained unaccepted.”

Legal Tussles

Following the termination of deal talks late last month, Mad Man Film Ventures, which Sony has called a proxy for Zee, moved the NCLT seeking implementation of the merger scheme between Sony and ZEEL. Sony’s India units Culver Max Entertainment and Bangla Entertainment have filed applications before the NCLT challenging the maintainability of ZEEL’s application seeking implementation of the merger scheme.

In its January 24 plea at the NCLT, Zee asked the tribunal to prevent Sony Group-owned firms from adopting any further steps that could jeopardise the implementation of the scheme.

The Mumbai bench of the NCLT has clubbed ZEEL’s plea with that of shareholder Mad Man Film Ventures and has posted the matter for hearing on March 12, ET reported February 6. Mad Man Film Ventures has also urged the tribunal to appoint a committee comprising two directors each from Zee and Sony to oversee the implementation of the composite scheme of arrangement.

On February 4, the SIAC denied emergency interim relief to the Sony Group-owned entities against Zee, stating it has no jurisdiction to prevent the latter from approaching the NCLT and that the tribunal is the appropriate forum to handle the dispute.

The Goenka family owns 3.99% equity in ZEEL. The rest is held by public and institutional shareholders.

After the two media giants terminated talks on January 22, Zee’s stock rose as much as 14%. However, over the past month, it’s dropped 24%. Indian mutual funds and insurance companies including LIC hold 31% of the company. FIIs owned 28.19% as per December 2023 data.

Zee had told analysts after its third-quarter earnings call that it plans to review the entire business portfolio following the collapse of the merger.

“We will be relooking at the entire portfolio of the business to see which businesses will add the maximum value to our portfolio and, therefore, what we need to focus on, and what we do not need to focus on going forward,” Goenka had told analysts.

Source: Economic Times