Private equity groups including TPG Capital, Warburg Pincus, Westbridge Capital and domestic fund Gaja Capital are in early stages of talks to acquire about 26% stake in BoB Financial Solutions, the credit card arm of Bank of Baroda (BoB), multiple people aware of the development told ET. The proposed deal will value BoB Financial Solutions at Rs 4,000 crore ($500 million), said sources. ICICI Securities is advising BoB on the stake sale.

Mails sent to Bank of Baroda, Warburg Pincus, Westbridge and Gaja Capital did not elicit any response until the publication of this report. A TPG spokesperson declined to comment.

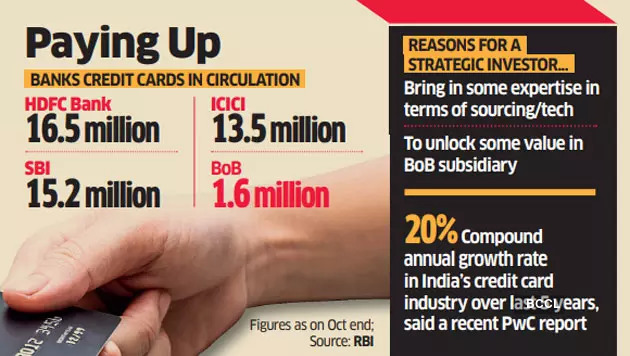

BoB Cards had 1.57 million credit cards in circulation at the end of October, trailing bigger peers such as HDFC Bank (16.54 million), ICICI (13.53 million) and SBI Card (15.16 million), central bank data showed.

In June, ET had reported citing CEO Shailendra Singh that parent Bank of Baroda (BoB) is seeking a strategic investor in the cards business as it looks to capitalise on India’s rising credit culture and increased penetration in smaller towns.

In FY22, BoB Financial had made a loss of Rs 10 crore, lower than the Rs 43.1-crore loss reported in March 2020. Singh said the company expects to make a profit in the current fiscal year.

Gross NPAs are down to 7.1% of loans, the lowest in four years.

Latest financial numbers for the end of September are not available. BoB was the first company to receive a licence to start an exclusive credit card company in 1994. However, BoB faced tough competition from private sector banks and the State Bank of India- (SBI) owned SBI Card.

A person familiar with the company’s plans said the bank expects to sell up to 26% of equity for its growth needs. “A couple of private equity funds are in talks, but there is no intention of selling more than 26%. The money will be used for the growth of the company,” this person said.

Speaking to ET in June, Singh said getting a strategic investor will help BoB unlock some value in its subsidiary and also bring in some sourcing or technology expertise.

Singh said the bank will tap sales through its branches, numbering more than 8,500 across the country and also from the open channels outside.

The credit card industry in India has witnessed a compounded annual growth rate (CAGR) of 20% in the past five years, said a recent PwC report. The number of credit cards crossed 78 million in July 2022. Credit card expenditure breached the Rs 1.3- lakh-crore mark in October, the biggest festival month in the country.

With the emergence of ecommerce, adoption of contactless payments and changes in the value proposition, the post-pandemic credit card space has undergone a considerable change and is evolving constantly, it added.

In 2017, The Carlyle Group had acquired 26% stake in SBI Card from GE group for Rs 2,000 crore. Carlyle has been exiting partly since SBI Card got listed in 2020.