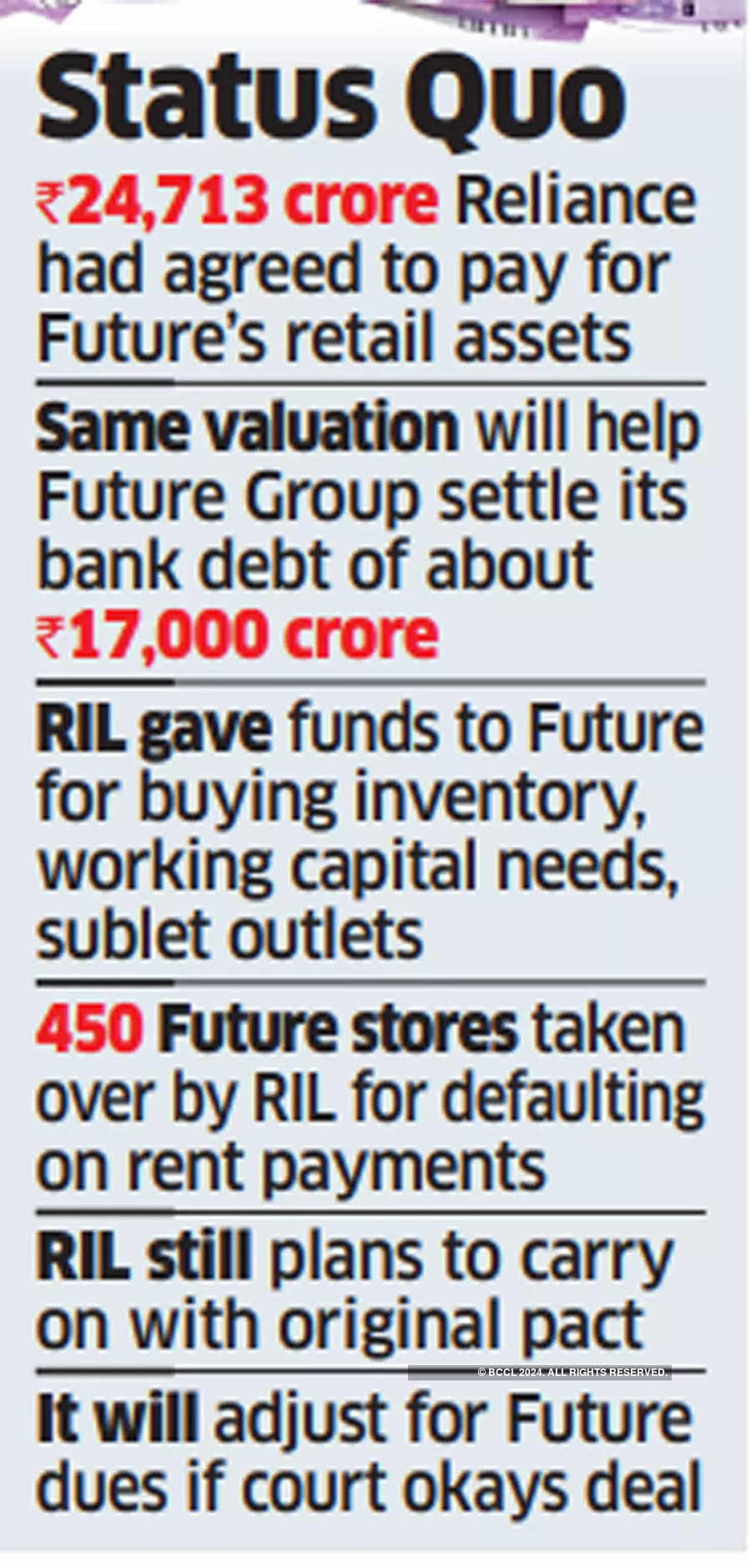

Reliance Industries (RIL) will not lower the purchase price of the Future Group’s retail assets from ₹24,713 crore which was originally agreed upon when the deal was announced if the court allows it to acquire the business. However, it will adjust over ₹4,000 crore which the Future Group owes to it for the last 15 months for payment of rent, purchase of inventory and toward working capital when the deal materialises, three senior industry executives said.

Over the weekend, RIL shut hundreds of Future stores and removed their signages in a bid to rebrand them as Reliance Retail outlets in the next few days. This was done after Future Group defaulted on rent payments for these locations to Reliance Retail.

Last year, Reliance Retail had become the tenant of these locations after Future Group failed to pay rent to landlords, and subsequently the company had sublet these locations to the latter. Despite this, Reliance does not intend to lower the original valuation of the Future’s retail assets, an industry executive familiar with the situation said.

Move to Help Future Clear Lenders’ Dues

“If the deal gets the go-ahead from the court, RIL will proceed as per the original scheme. However, since Reliance has become a creditor for Future Group for over a year now, the amount due of over ₹4,000 crore will get adjusted with the final payout,” the executive said.

Another executive said Reliance will not lower the valuation since it will allow Future Group to settle the outstanding bank debt of about ₹17,000 crore. Emails sent to Reliance and Future Group were unanswered as of Tuesday press time.

In total, around 450 Future stores have already been shuttered and will be replaced by Reliance Retail outlets. While Reliance Retail has taken control of several large stores of Future Group across its three formats – Big Bazaar, Central and Brand Factory, it is also in the process of taking possession of small store locations and rebranding them as well.

In addition to the store fronts, Reliance Retail will also acquire other parts of the business such as logistics, warehousing, rights over 80 private labels of Future Group, according to the original agreement. It will also buy the brand names of stores like Big Bazaar and Central which have a huge recall among consumers by being the early entrants into modern retail in the country.

Deadline Extended Thrice

The timeline for completing the Reliance Future deal has been extended thrice because of the legal battle with Amazon. The US ecommerce major – an investor in one of the Future Group holding companies – is opposing the deal over alleged breach of shareholder contract. The deadline for closing the deal as of now is September 30, 2022. “The repeated extension is an indication that Reliance wants to complete the deal as per original terms, even though Future Group has incurred additional losses of almost ₹5,000 crore since the time the deal was announced in August 2020,” an executive said.

Reliance has also helped Future Group with money to buy stock for its stores as well as to meet its working capital needs. Kishore Biyani-promoted company has used the cash generated from sales for running the business and settling some outstanding payments including employee salaries.

The legal battle between Amazon on one hand and Reliance Retail and Future Group on the other is being fought across multiple courts and tribunals in India as well as at arbitration court in Singapore. The NCLT on Monday allowed Future Retail to convene meetings of shareholders and creditors to approve the sale of its assets to Reliance Retail.