A Mumbai bankruptcy court acted on a petition by a trade creditor and began corporate insolvency proceedings against Future Enterprises (FEL).

The National Company Law Tribunal (NCLT) has appointed Jitendra Kothari as interim insolvency professional (IRP) for company, an order issued by the tribunal said. The division bench comprising Madhu Sinha and HV Subba Rao directed the operational creditor Foresight Innovations to deposit ₹5 crore toward initial corporate insolvency and resolution process (CIRP) costs.

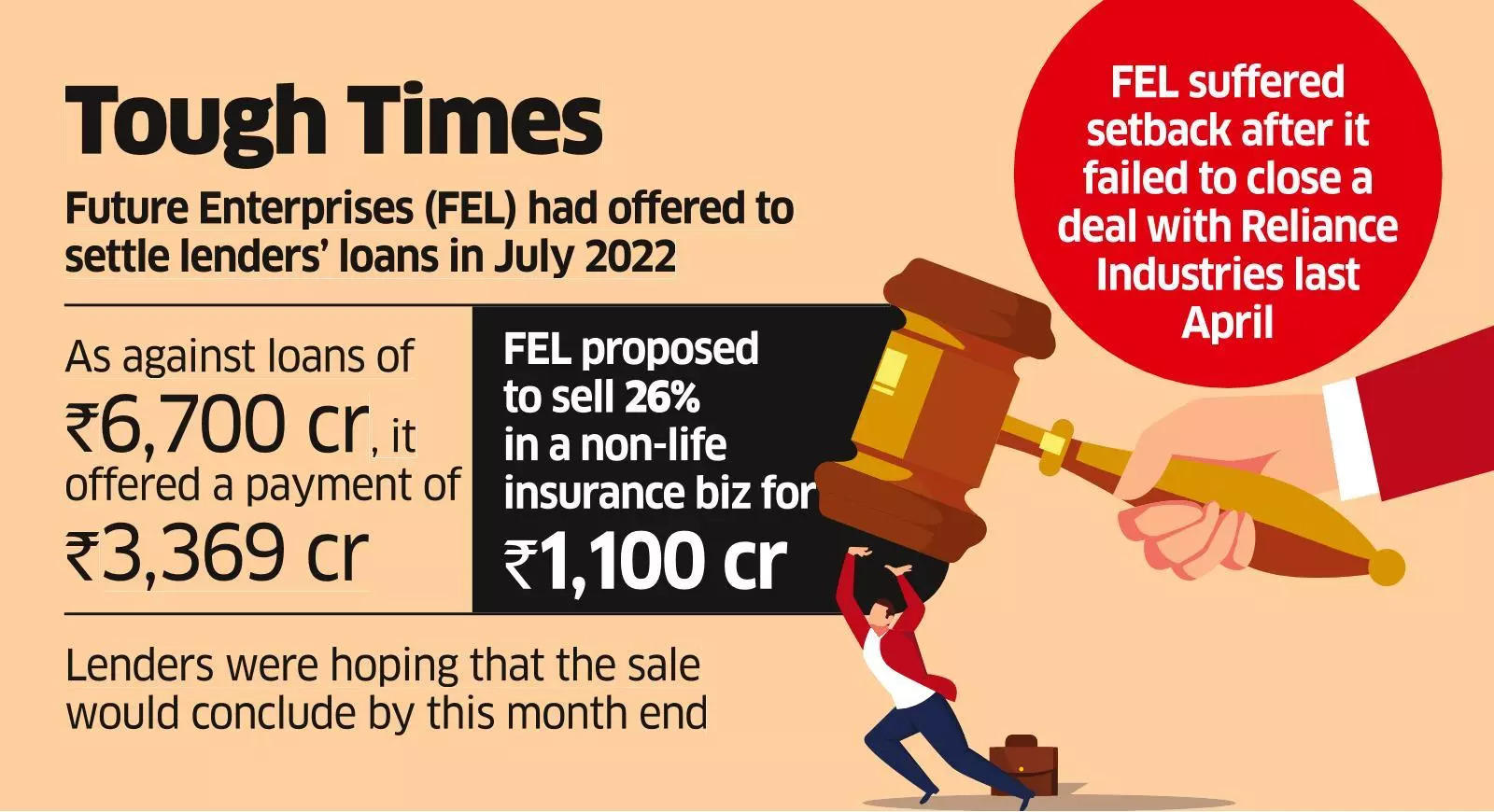

Kishore Biyani-promoted Future Enterprises – the key company that supplied designer apparel and holds a stake in some of Future Group’s ventures such as insurance – had proposed to settle creditors’ loans last July. Against total borrowings of ₹6,700 crore, the company had offered a settlement of ₹3,369 crore, as reported by ET on July 9. The talks on loan settlement between Biyani and the lenders had not progressed further.

Biyani’s flagship company Future Retail, which operates large-format hypermarkets, is undergoing insolvency proceedings since last July; it has failed to attract buyers, ET reported on March 1. The company has admitted claims of ₹19,185 crore from financial creditors.

Lenders of FEL refrained from referring the company for corporate insolvency process in the hope that Biyani would sell part of his stake in the insurance business by the end of this month and distribute the sale proceeds among lenders. FEL has proposed to sell 26% of its stake in a non-life insurance business for ₹1,100 crore by the end of this month. The company had earlier sold 25% stake in Future Generali India Insurance company for ₹1,266 crore to its joint venture partner Generali SPA.

“Lenders were of the view that if the company is admitted before the sale of equity stake in the insurance business, the resolution professional would be constrained from distributing the sale proceeds with them,” said one of the persons involved in the resolution process.

Lenders had planned to refer the company for CIRP (corporate insolvency resolution process) soon after the company sold its stake in the non-life insurance business. The trouble at Future group initially started with the nationwide lockdown in March 2020. Most of the malls where Future stores were located remained shut, thus affacting their cashflows.

It suffered another setback in April 2022 after it failed to clinch a ₹24,713-crore deal with Reliance Industries to sell its retail and wholesale business in a slump sale.

Source: Economic Times