Australia’s Macquarie Asset Management has called off plans to sell renewable energy platform Vibrant Energy due to a valuation mismatch in negotiations, said people aware of the development.

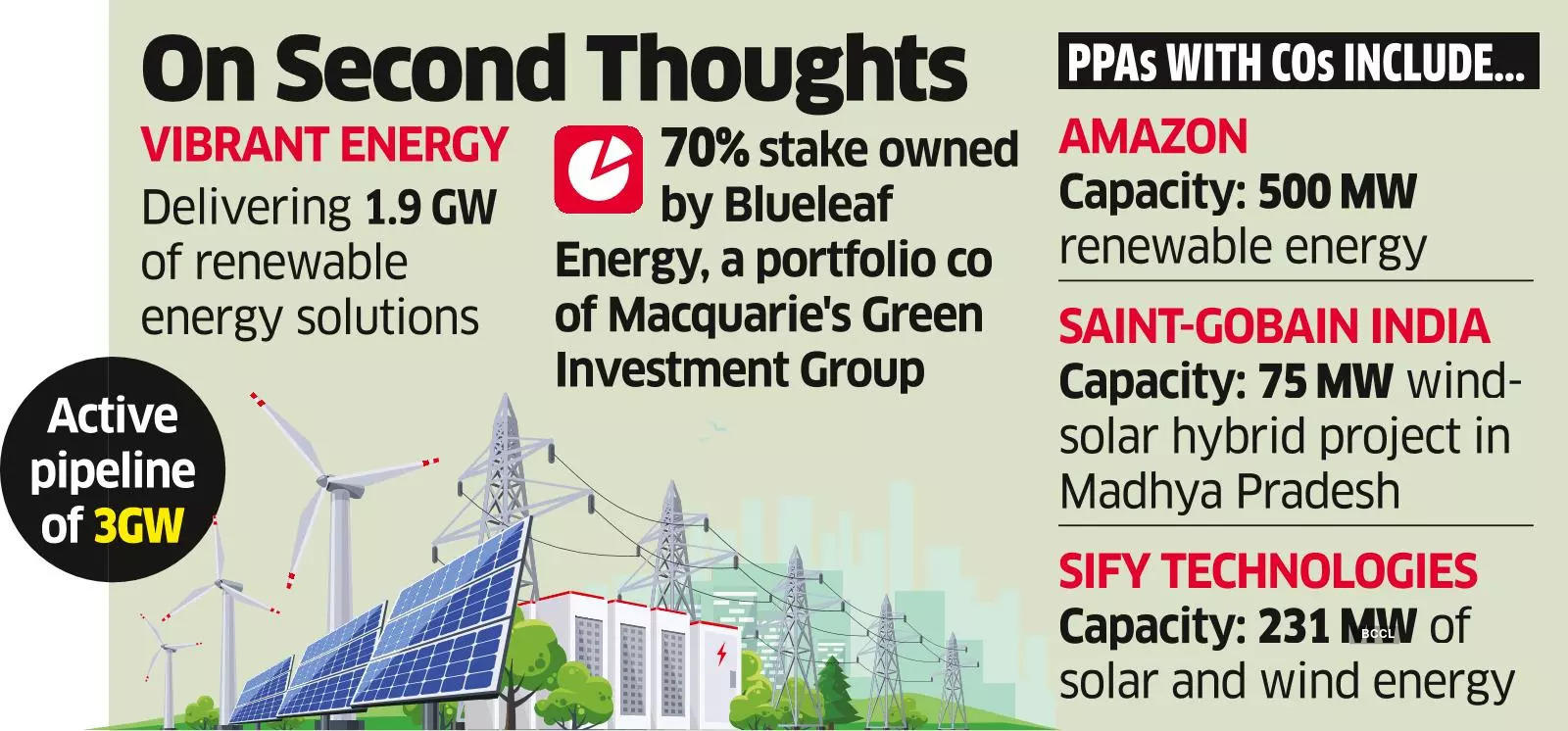

Vibrant, a portfolio company of Macquarie’s Green Investment, is currently operating and delivering 1.9 GW of renewable energy solutions to corporate clients across India. It has an active pipeline of 3 GW. The company was in discussions with several players such as Bain Capital, Sun Energy and Vitol earlier and was looking for an enterprise value of $500 million. JP Morgan was advising Vibrant Energy in the sale process.

However, Vibrant has decided to complete its existing projects and sell the business at a later stage. It develops open access renewable energy solutions (wind and solar) for corporate customers.

A Macquarie spokesperson declined to comment on the matter.

About 70% stake in Vibrant is owned by Blueleaf Energy, a portfolio company of Macquarie’s Green Investment Group, while the rest is held by US-based ATN International. In 2020, Blueleaf Energy Asia entered India by acquiring a majority stake in Vibrant Energy Holdings from ATN International. Macquarie’s GIG has a 90 gigawatt (GW) portfolio under development across 25 markets globally.

Vibrant has power purchase agreements (PPAs) with Amazon for the production of about 500 MW of renewable energy capacity in India. It has also signed a long-term PPA with Saint-Gobain India to set up a 75 MW wind-solar hybrid project in Madhya Pradesh and Sify Technologies for a total 231 MW of solar and wind energy capacity.

Vibrant had secured about ₹2,200 crore of project financing from Power Finance Corporation for the construction of 300 MW of wind-solar hybrid projects in Madhya Pradesh and Karnataka.

Macquarie Group has been active in India for around 19 years and has invested about $2.5 billion in equity capital in infrastructure firms. The commercial and industrial sector (C&I), which accounts for half the energy demand of the country, is growing at a faster pace.

India’s rooftop solar market is bubbling with new energy, overcoming major roadblocks and expected to add a record 4 GW of capacity in 2023-24, said a report last year by the Institute for Energy Economics and Financial Analysis and JMK Research & Analytics.