KKR is looking to acquire a minority stake in the Tandon Group-owned healthcare BPO Infinx Healthcare. The global private equity major is likely to invest about $150 million, or Rs 1,250 crore, to acquire about 26% stake in Infinx, two people aware of the development told ET.

“We expect this sector (healthcare BPO) to continue growing in India, driven by global demand, and believe that Infinx is well placed to meet this gap through its tech-enabled solutions,” Akshay Tanna, partner and head of India private equity at KKR, told ET.

“We will draw on our local knowledge and healthcare expertise to support Infinx’s growth and build a healthcare platform, including through organic and inorganic growth strategies.”

He refused to disclose further details, but said India is one of the world’s top providers of healthcare RCM solutions, given the depth of local talent and range of quality solutions. KKR is looking to build Infinx into a platform by doing bolt-on acquisitions – or, acquisition of smaller companies in the same line of business – over time and grow it, said one of the people cited above. Based in San Jose, Infinx Healthcare works with medical billing companies, radiology groups, physician practices and long-term care pharmacies, providing complete revenue cycle management (RCM) solutions.

RCM refers to the process of identifying, collecting, and managing incoming payments.

Launched in 2012 as Tandon Information Solutions, Infinx is also into medical transcription, eligibility and benefit verification, complete medical billing, medical coding (across specialty) and comprehensive account receivable management services.

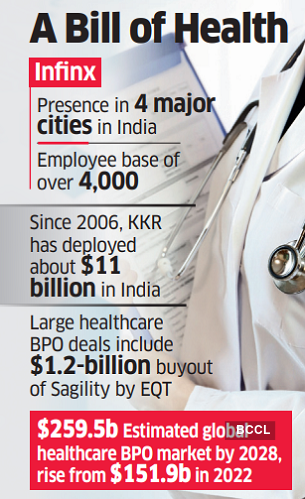

It has presence in four major cities in India and an employee base of over 4,000. “KKR’s investment is a testament to Infinx’s success over the past decade,” said Jaideep Tandon, chief executive of Infinx Healthcare. “Success of our customers is central to us at Infinx and with KKR’s support and experience in healthcare and technology we will be able to strengthen our capabilities to deliver innovative, AI-backed solutions to accelerate Infinx’s growth, and help healthcare providers to provide exceptional care to their patients,” he added.

Headquartered in Mumbai and Silicon Valley, Tandon incubates startups in India. Its operating companies include Infinx Healthcare, Isharya and Syrma Technology. One of its startups, FreeCharge was sold to Snapdeal in 2015 for Rs 2,400 crore, which is regarded as one of the largest internet M&A deals in India.

Founded in 1975, the group has invested in startups including payment gateway Razorpay, goods delivery platform Porter, used car platform Spinny, fast food delivery service Daily Ninja, and pharmacy Generico. It is promoted by chairman Manohar Lal Tandon, and his sons Sandeep, Jaideep and Sudeep who play leadership roles at Tandon Group.

KKR has been an active investor in the healthcare sector globally. Early this month, it acquired Indian medical devices company Healthium Medtech (formerly Sutures India) from Apax Partners for Rs 7,000 crore ($840 million) enterprise value, outbidding a consortium of Mankind Pharma and ChrysCapital.

Source: Economic Times