Sajjan Jindal-led JSW Cement has begun evaluating acquisition of the promoter stake in Orient Cement Ltd (OCL) from CK Birla, said people aware of the development, amid a consolidation wave in the sector that’s seen the Aditya Birla and Adani groups race to pick up assets across the country.

The development sees the entry of a third contender for OCL’s 8.5 million tons per annum (MTPA) capacity after the Adani and Aditya Birla groups, both of which have been in active discussion with Delhi-based CK Birla at various points since late last year when JP Morgan kicked off the sale process. ET was the first to report about these developments in editions dated October 18, 2022 and July 4th.

Jindal’s attempt to throw a hat in the ring for OCL’s 8.5 million tonnes per annum capacity will see the entry of a third contender in the race following Gautam Adani and Kumar Mangalam Birla, both of whom has been in active discussions with Delhi-based CK Birla, Kumar Mangalam’s uncle, at various points since late last year ever since JP Morgan begun a sale process. In 2022, all three went head-to-head for the $6.5 billion acquisition of Holcim’s India assets — biggest M&A in India’s building-materials industry – in which Adani eventually trumped the other two to overnight emerge as the 2nd largest player in the country, upending the pecking order. Since then, the two have acquired seven companies between them.

The promoter stake in Orient Cement – held by the Birla family and private investment vehicles – is 37.9%. An acquisition will also trigger an open offer for an additional 26% stake from minority shareholders. But OCL’s shares have appreciated 56% in 3 months in anticipation of a trade as CK Birla’s second generation is believed to not interested in running the business. At current market prices a transaction for the 63.9% could be as much as Rs 4546.54 crore. OCL’s current market value is Rs 7115.09 crore.

With Adani and Ultratech negotiations dragging on valuations and environmental clearance of key limestone mines, Jindal saw an opportunity to also join the fray as in the last one month when both Adani and Birla turned their focus down south with the former acquiring Penna Cement in June. Within days, Ultratech bought into India Cements, acquiring a minority stake, before ramping it up to a majority control last Sunday.

“JSW have been keen to acquire Heidelburg’s India assets, Penna and India Cement. Heidelburg has been insisting on an equal joint venture, while in Penna, they were in fact about to initiate due diligence when Adani leapfrogged ahead,” said a person aware of the ongoing negotiations. “Orient is also a medium scale asset and have been under their radar for a while once the sale process was launched. But the efforts have intensified in the last few weeks following the India Cements transaction.”

JSW Cement has been planning to list its cement business next year. An acquisition of OCL will also help it to reverse merge and get listed in the process.

Mails, calls and messages to CK Birla, chairman of the eponymous group and Deepak Khetrapal, MD and CEO of OCL remained unanswered. JSW spokesperson declined to comment.

There is still no guarantee that these discussions with lead to a transaction, warned the people mentioned above. “The shopping spree has become so intense that it is now a seller’s market,” said a CEO of a rival cement company. “Birla will sell to the highest bidder extracting maximum value.” OCL has a limestone mine of 8 MTPA that could help new suitors to take capacity to 16 MTPA.” In 2018 Orient Cement declared intentions to double its capacity with an investment of Rs 2000 crore based on the supply contract of limestone from Telengana State Mineral Development Corporation (TSMDC). Subsequently in its FY23 annual report, the company mentioned the reopening of its Rajasthan mines and its intention to enter Northern Indian markets with a greenfield capacity of over 3MTPA diversifying its geographical reach to mitigate risks. This strategic direction has contributed to it commanding a higher valuation compared to standalone regional cement companies.

According to sector analysts, Orient Cement promoters would be looking at valuations better than India Cements as their assets and balance sheet is superior compared to the southern players that got acquired in recent months. Penna’s sale of 12 MTPA translates to a valuation of $88/tonne and India Cements (14.5 MTPA) deal took place in two tranches between $93/tonne and $112 per tonnes.

Orient Cement is already trading at $100 EV per ton based on the current installed capacity. It is nearly debt free company with debt-to-equity ratio of just 0.07 at the FY24.

The company achieved 81% utilization in the fourth quarter, with sequential sales volume growth of 24% with increased focus on increasing the proportion of premium cement sales, which accounted for 22% of total volume in FY24, up from 14% in the previous fiscal year.

“OCL’s asking valuation should be more than $110-112 EV per ton that would translate into market cap of around Rs 8100 crore compared,” said another person familiar on condition of anonymity as the talks are in private domain.

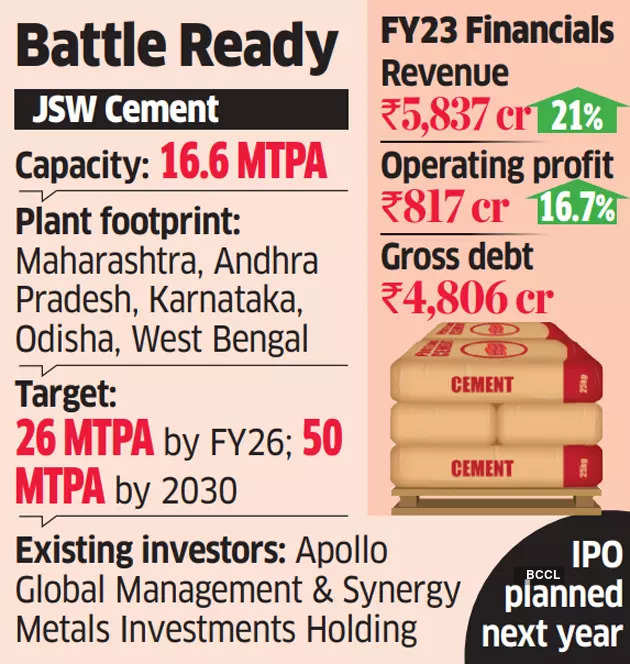

JSW Cement has a current capacity of 16.6 MTPA with units in Maharashtra, Andhra Pradesh and Karnataka but has aggressive plans to touch 26 MTPA by FY26 and 50 MTPA by 2030 through a combination of greenfield and brownfield expansion.

OCL’s manufacturing footprint spans across Devpur (Telangana), Jalgaon (Maharashtra), and Chittpur (Karnataka), but it supplies to 11 states across Central, Western, and Southern India. A significant portion of its sales originates from the Vidarbha and Marathwada regions of Maharashtra and Telangana. Western India contributes 67% to total sales, followed by South India at 24%, down from 27%, with the remaining from Chhattisgarh and Madhya Pradesh. A successful acquisition would therefore help ramping up capacity in complimentary markets as well as improve market share in some of its existing markets, feels industry players. Orient Cement has outlined a capital expenditure of Rs 1000 crore for the current fiscal year, with expansion plans at its Telangana and Karnataka plants.

Source: Economic Times