Naveen Jindal-promoted Jindal Power (JPL) gave a ₹4,203-crore, all-cash offer for acquiring Lanco Amarkantak Power, topping Adani Power’s ₹4,100 crore offer, said people with knowledge of the matter.

Last week, JPL sought the bankruptcy court’s approval to participate in the sale process of Lanco Amarkantak. On Friday, the Amaravati bench of National Company Law Tribunal (NCLT) directed JPL to submit a plan by Tuesday (January 16) to lenders along with a ₹100-crore bank guarantee. The NCLT will hear Wednesday JPL’s petition whether it can participate in the sale process.

The tribunal, last week, allowed lenders to hold a fresh auction for the sale of Lanco Amarkantak, taking cognisance of the belated offer by Adani Power made after majority lenders had approved a plan by a Power Finance Corporation-led consortium.

JPL appealed to the tribunal last week that wider participation from bidders will improve recovery for lenders, said the people cited above.

“Adani itself gave a belated offer that is 36% higher than that offered by PFC. This shows that there is merit in allowing Jindal,” said a legal expert.

JPL officials did not respond to ET’s request for comment.

If the tribunal permits, it will be the second instance wherein Adani Power will clash with JPL to acquire a distressed thermal power company.

Both companies participated in the Coastal Energen auction process that lasted two days and involved intense bidding. Adani Power emerged the winning bidder, offering ₹3,440 crore, as reported by ET on October 23.

ET Bureau

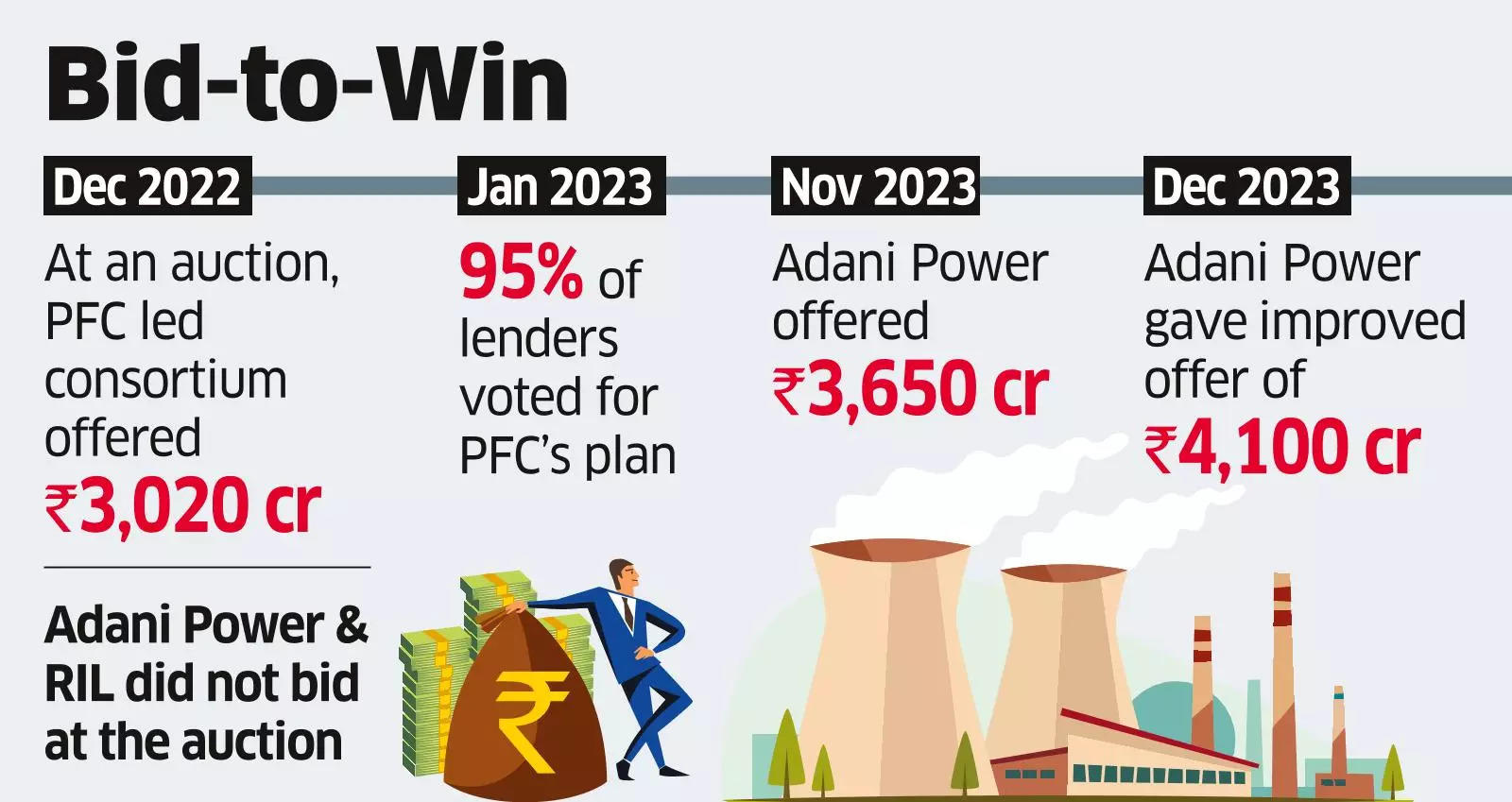

ET BureauIn the case of Lanco Amarkantak, at an auction in December 2022, only the PFC-led consortium participated. Adani and Reliance, which had made initial offers of ₹2,950 crore and ₹2,103 crore, respectively, did not participate in the auction, alleging violations in the sale process.

PFC’s plan offering ₹3,020 crore was approved by 95% of lenders and was pending before the tribunal for approval. PFC and REC jointly hold 41% of the debt in the power company. The Insolvency and Bankruptcy Code (IBC) does not prevent debtholders from bidding for a company.

Subsequently, Adani Power gave an unsolicited improved offer of ₹3,650 crore, as reported by ET on November 2. It later improved the offer to ₹4,100 crore, ET reported on December 13.

Lanco Amarkantak’s first phase, which is fully operational, has two units of 300 MW each. The second phase, under construction, comprises two units of 600 MW each. It has ₹1,800 crore cash in the company solely on account of operations from the first phase.

KPMG-backed RP Saurabh Kumar has admitted ₹14,632 crore of claims from 17 lenders.