Hindustan Zinc Ltd (HZL) could put on hold its restructuring plan to create two separate entities for now after the government, which owns a 29.54% stake in the miner, resisted that bid.

In a letter to the mines ministry this month, HZL said it wouldn’t push ahead with any demerger proposal that the government disapproves of and that it would take the Centre on board while adopting such a plan, people aware of the details told ET. “The matter is going to be put off, although the company would take a formal decision in due course,” one of them said.

Anil Agarwal-controlled Vedanta Ltd holds 64.92% in HZL.

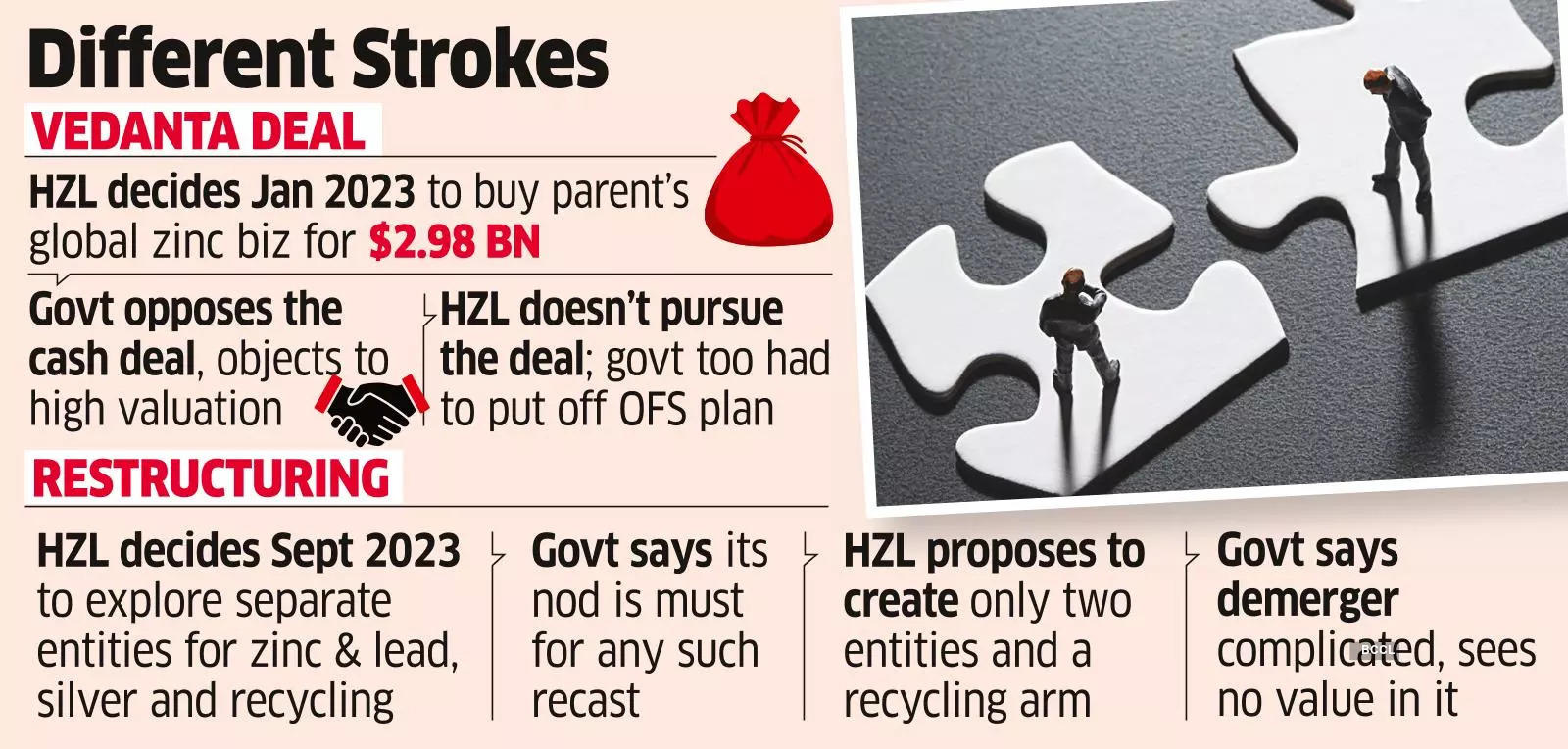

HZL’s letter came in response to the government’s rejection of the company’s proposal to create only two separate entities-one for zinc/lead and another for silver-while turning the recycling business into a subsidiary, they said. This is for a second time in just over a year that HZL’s proposals have been shot down by the government last one was about the miner’s acquisition of parent Vedanta’s global zinc assets in a $2.98-billion cash deal.

In a meeting on September 29, 2023, HZL’s board had asked the company to explore a corporate restructuring to create three separate legal entities for zinc and lead, silver, and recycling business to unlock shareholder value.

In signs of its discomfort with the plan, the Centre wrote to HZL in October 2023, making it clear that as per rules the approval of the government most important minority shareholder would be required for any such business reorganisation, ET had reported earlier.

Subsequently, HZL presented the government with the plan to create only two separate entities, said the people quoted earlier.

While rejecting this plan, the government cited the integrated nature of HZL’s business and argued that any segregation would only complicate the operations without adding any value for the company’s shareholders, they said. Also, the government doesn’t want any uncertainty around HZL to spook investors ahead of its plan to offload a part of its stake in the miner through an offer for sale in FY25, one of them said.

“The company’s proposal to the government also lacked the details as to how any such demerger will actually benefit shareholders. Also, it hasn’t presented any other restructuring plan for the government’s consideration,” said one of the persons quoted above.

Responding to ET’s queries, HZL chief executive Arun Misra said: “Based on the report submitted by the reputed consultant, we firmly believe that the exercise of demerging HZL to create a silver and zinc entity separately will help in improving the market cap of the company as a whole, resulting into value unlocking for all the shareholders”. The company hasn’t shared the consultant’s name. Misra added that the mines ministry’s response to the demerger proposal “is yet to be discussed in the board along with our observations”.

Interestingly, HZL’s parent Vedanta had also announced last year its plans for a broad overhaul that would create separately listed entities for aluminium, oil and gas, iron ore and steel.

HZL shares on the BSE inched up 0.77% on Thursday to ₹ 294 apiece, in sync with a 0.75% rally in the broader Sensex. However, the share is trading way below its 52-week high of ₹344.

Source: Economic Times