The homegrown PE fund ChrysCapital has invested about Rs 600 crore ($70 million) in Ahmedabad-based La Renon Healthcare, valuing it at $800 million. ChrysCap has acquired about 8% stake from the promoter family in a secondary transaction.

Incorporated in 2007 by Pankaj Singh, La Renon is engaged in the manufacturing and marketing of branded generic formulations. ChrysCapital is close to acquiring a minority stake in La Renon Healthcare via secondary sale of shares, at a valuation of Rs 6,500 crore ($800 million), ET first reported on February 12.

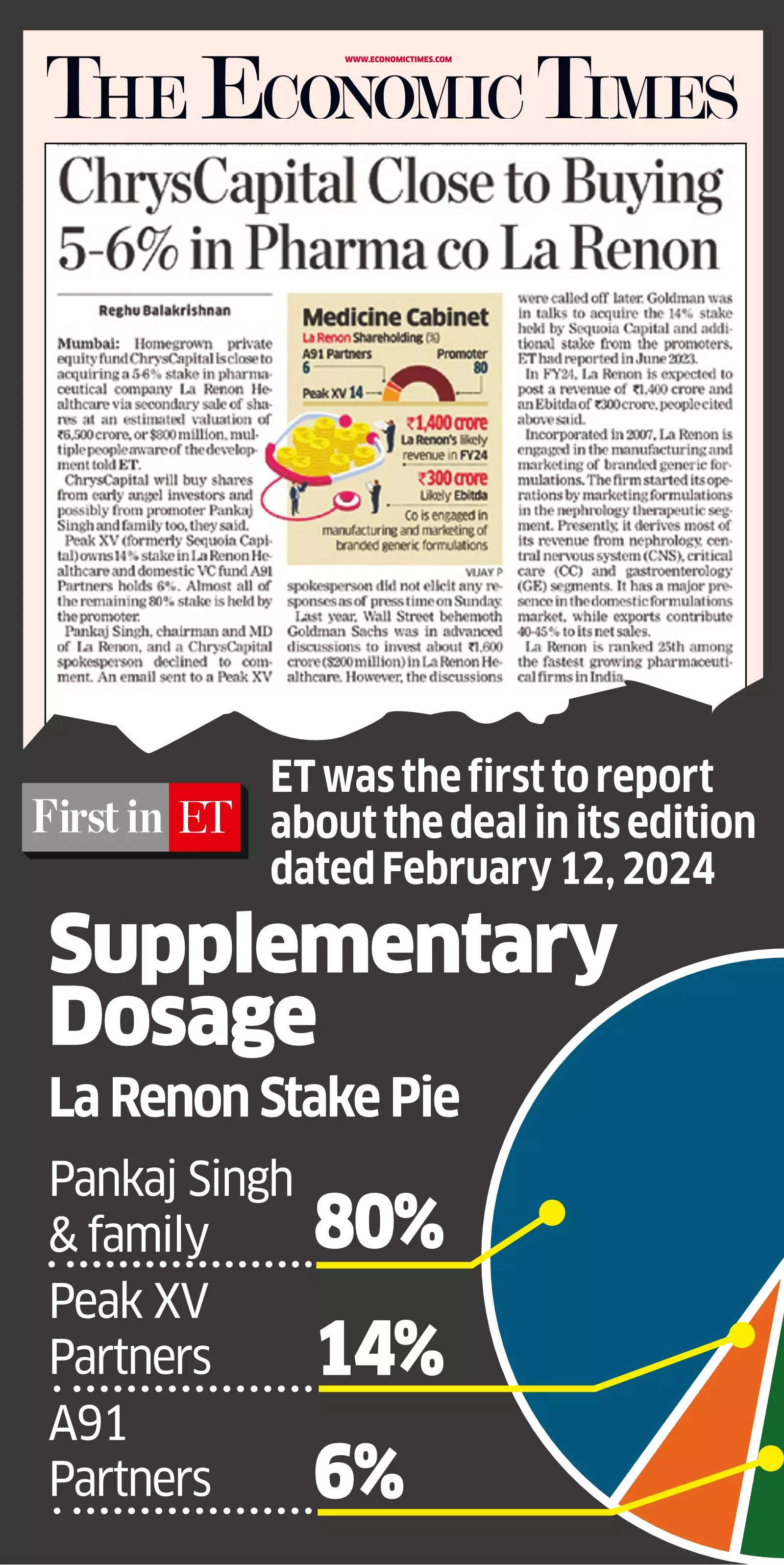

At present, promoter Pankaj Singh & family own about 80% stake in the formulations manufacturer while Peak XV Partners (formerly Sequoia Capital) owns 14% and domestic VC fund A91 Partners owns 6% stake in La Renon. In FY24, La Renon posted a revenue of Rs 1,400 crore and an Ebitda of Rs 300 crore, said sources. O3 Capital advised La Renon on the transaction.

Presently, La Renon derives most of its revenue from nephrology, central nervous system (CNS), critical care (CC) and gastroenterology (GE) segments. It has a major presence in the domestic formulations market, while exports contribute 40-45% of its net sales.

La Renon is ranked 24th amongst the fastest growing pharmaceutical companies in India. Its nutritional supplement brand – Nuhenz Tablet – is featured in the top 300 formulation brands in the domestic market.

“La Renon is among the fastest growing companies in this market and has attained leadership positions across several niche and chronic therapeutic areas, and ChrysCapital truly believes in its transformative potential,” said Kshitij Sheth, managing director, ChrysCapital.

“I am delighted to welcome ChrysCapital, one of the most sought-after investors, especially in the pharmaceutical sector, as a valued partner in the business,” said Pankaj Singh, chairman of La Renon. I am sure we will be able to leverage their expertise and experience in pharma in growing the company, he said.

La Renon also has entered consumer brands in the domains of oral health with its innovative brand Dente 91 and protein supplements with its brand Whey 91, respectively. With over 3,500 members, La Renon has at present two manufacturing units, two API units (one of them is USFDA approved) and an in-house R&D centre.

ChrysCapital’s major investments in the pharmaceuticals and healthcare sector include Intas Pharmaceuticals, Mankind Pharma, Corona Remedies and Eris Lifesciences, Curatio Healthcare and Torrent Pharmaceuticals. It has raised more than $5 billion across nine funds since it was founded in 1999 and made about 100 investments across sectors.

Source: Economic Times