Private equity groups Apax Partners, CVC Capital, and Thomas H. Lee Partners (TH Lee) are vying to acquire a minority stake in IBS Software, a leading SaaS solutions provider to the global travel industry, from their existing PE backer Blackstone. The three have submitted binding offers to acquire about 32% stake held by Blackstone in the company, said multiple people aware of the development.

This proposed transaction is likely to value IBS Software at $1.5 billion. JP Morgan is advising Blackstone to find a buyer for its stake. The deal is expected to get signed by the end of April, sources said.

Other investors like Carlyle and Temasek were also interested in the stake, said sources.

Spokespersons with Blackstone, Apax, TH Lee declined to offer comment for this story, while an email sent to CVC Capital did not elicit any response till press time.

Blackstone acquired the minority stake in IBS for $170 million in 2015.

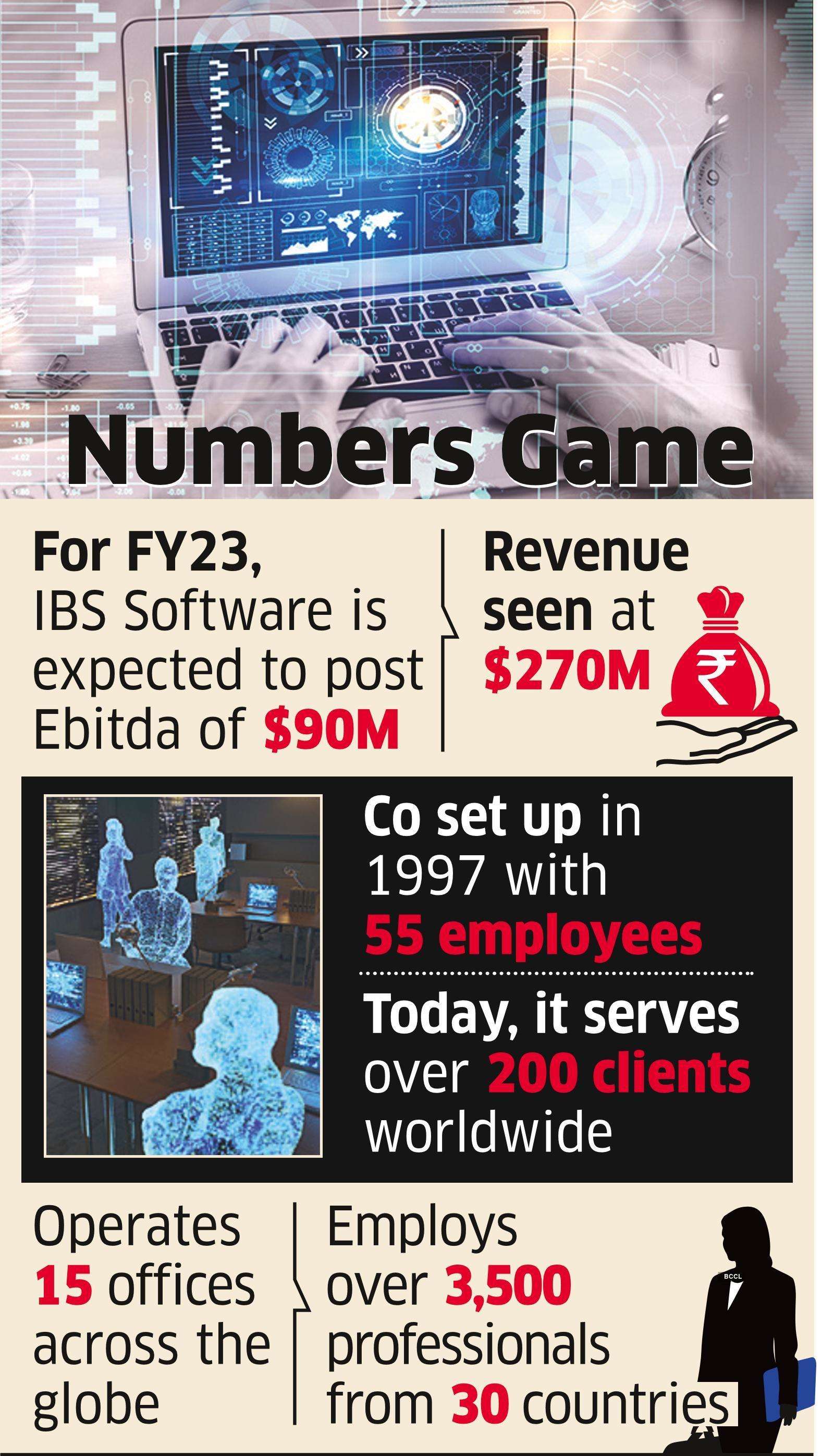

IBS Software’s solutions for the aviation industry cover fleet & crew operations, aircraft maintenance, passenger services, loyalty programs, staff travel and air cargo management. It is expected to post an Ebitda of $90 million and revenue of $270 million in FY23, added sources.

IBS was set up in Trivandrum in 1997 by VK Mathews with 55 employees. Today, it serves over 200 clients worldwide, employing over 3,500 professionals from 30 countries.

IBS Software has been expanding its footprint through multiple acquisitions. In February, IBS acquired Accenture Freight and Logistics Software to bolster air cargo capabilities and extend its presence into Ocean Freight & Logistics.

Its other buyouts include Ad OPT – a provider of crew planning optimization solutions; Atlanta-based Hotel Booking Solutions Incorporated (HBSi); Bengaluru-based Moveo Systems; the US-based VISaer; and Virginia-based Discovery Travel Systems.