Ahead of the three week long voting starting Monday to decide on the new owner of Dewan Housing Finance Limited (DHFL), Oaktree has fired yet another salvo by attacking the bid of its nearest competitor Piramal Enterprises.

In a letter sent on Sunday evening to members of the committee of creditors, the RBI appointed administrator, Oaktree has said it is concerned that despite its bid offering maximum value for all stakeholders, it appears “there is a consistent campaign to misrepresent information on Oaktree’s bid. Information is not only being presented in an incomplete and inaccurate manner but also in order to discredit Oaktree’s bid and favour the Second Highest Bidder.”

Oaktree does not name Piramal Enterprises anywhere in the letter. Instead, it refers to it indirectly calling it “the second highest bidder” throughout. The letter was sent by Fredrick Greyselle, Oaktree’s Singapore based in house legal counsel.

ET has reviewed its content.

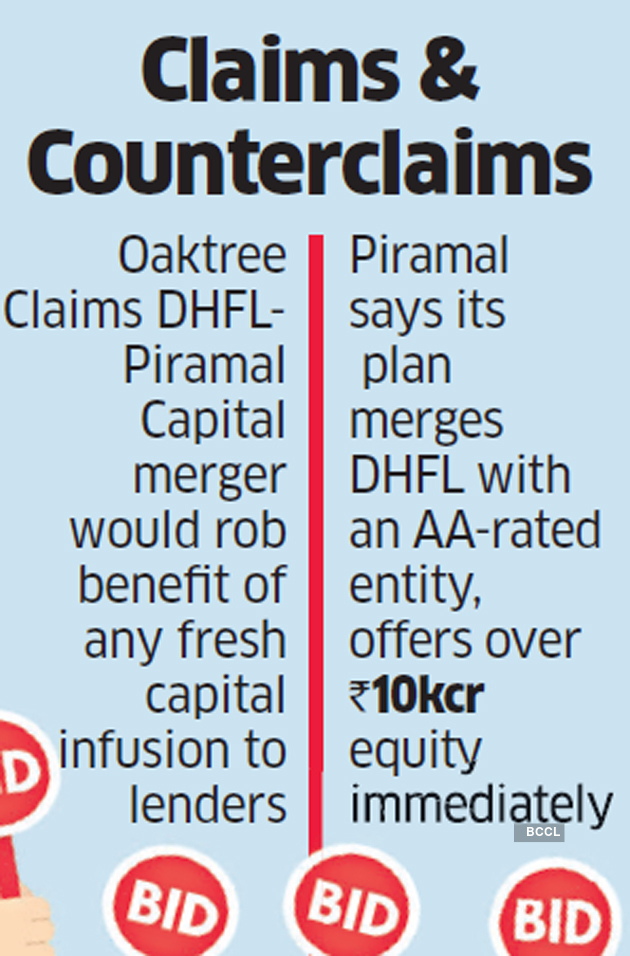

A key point that Oaktree is harping on is the structure Piramal’s have proposed in their business plan, that involves a merger between DHFL and Piramal Capital, its finance arm to swell the combined entity’s networth to more than Rs 18,000 crore and cushioning its ability to issue debt. However, Oaktree has argued that this structure would rob the benefit of any proposed fresh capital infusion to the lenders of the troubled home mortgage company. Instead, the “co-mingled” entity would be burdened by other liabilities. “By voting in favour of the second highest bidder’s plan, the CoC will be shifting its exposure to a new entity, whose assets have not been independently diligence or subject to an asset quality review. The CoC should consider the possibility that the merged entity could be subject to imminent stress in its predominantly wholesale lending business, given the current situation in the sector. It would be a mistake to put the second highest bid to vote without giving a true picture of this entity to the members of the COC,” Oaktree said.

It also said, Piramal’s fresh capital infusion of Rs 3800 crore to improve the operational performance of DHFL in the first 12 months post-implementation of the resolution plan, is without a firm commitment letter. In comparison, Oaktree’s offer of a Rs 1000 crore infusion as a cushion to DHFL lenders is backed by one.

The Oaktree letter states that CoC is discounting the upfront cash amount in Oaktree’s bid by Rs 2700 crores. “We want to categorically state that the total cash amount that would be received by the CoC immediately upon implementation of Oaktree’s Resolution Plan shall be Rs 17,400 crore. This would include, a value Rs 1000 cror valuation that was ascribed to DHFL’s stake in its insurance joint venture with Prudential. This amount says Oaktree, “ will be paid to the financial creditors on an unconditional basis by way of upfront cash prior to the implementation of the resolution plan.”

PIRAMAL RESPONSE: IMAGINARY CONSPIRACY THEORIES

In response a Piramal spokesperson said, all bidders had the opportunity to submit bids post clarifications on Dec 22nd. “After seeing our bid, and recognizing that their bid falls short on various dimensions, Oaktree is now sending this series of letters, to alter the substantive submissions they themselves have formally made.”

The Piramal plan, according to the company, merges DHFL with a AA rated entity, offers over Rs. 10,000 crore of equity immediately, and provides clarity on quality and secondary market valuation of the non convertible debentures (NCDs.) “The alternative plan is a highly leveraged structure with minimal equity.”

Piramal’s key contention is the Oaktree offer is short on upfront cash, on net present value (NPV), on overall score, un-implementable due to insurance related complications, and “leaves DHFL lenders with weak debt paper due to the sub debt structure offered by Oaktree to themselves.”

OAKTREE WARNS OF LITIGATION

Making its intention to litigate, if necessary, clear, Oaktree further warned, that if its offer is evaluated on the basis of incorrect information or an erroneous presentation of the financial proposal, such evaluation would almost certainly be subject to judicial, administrative and investigative review.

The Brookfield owned asset management fund had in the past written several letters to the CoC and even the RBI representatives alleging favouritism in the bidding process which is affecting the credibility of the whole IBC process among global investors. “We do not need to remind the CoC that, as guardians of public money and representatives of diverse group of individuals (including many retail depositors and investors who are very vulnerable), discounting or failing to consider the upfront cash amount to the extent of Rs 2700 crores would disregard the IBC’s objective of value maximisation, and be open to challenge.”

Both Oaktree and Piramal has revised their offers multiple times in the run up to voting.

Source: Economic Times