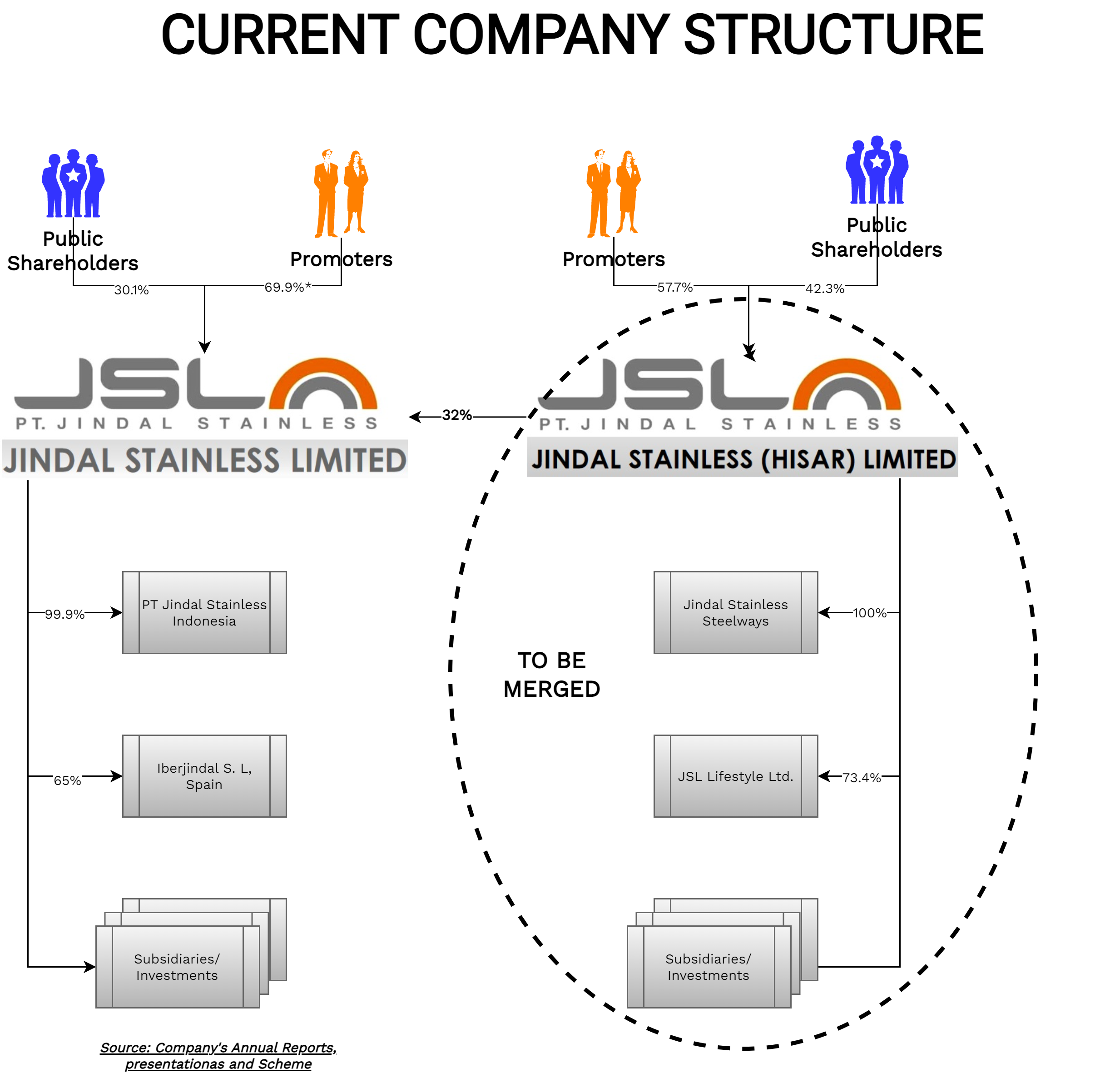

After having a roller-coaster decade, shiny days seem to be back for the Ratan Jindal Group. After a successful exit from the debt restructuring, the group announced the consolidation of two listed companies which were created as a part of debt restructuring. Last month, Hon’ble National Company Law Tribunal Chandigarh Bench heard the petition (of merger) & the matter is reserved for the order. This article covers their decadal journey & how the group managed to sail through the debt restructuring.

Jindal Stainless Ltd. (“JSL”) is amongst the leading stainless-steel manufacturing companies in the world and India’s largest stainless-steel manufacturer. The Company operates an integrated stainless-steel plant at Jaipur, Odisha. The complex has a total stainless-steel capacity of 1.1 million tonnes per annum. The equity shares of JSL are listed on nationwide bourses.

Jindal Stainless (Hisar) Ltd. (“JSHL”) is the largest specialty stainless steel producer in India with a diversified value-added product portfolio. The company operates an integrated stainless-steel plant at Hisar, Haryana. JSHL has a total melting capacity of 0.8 million tonnes per annum. The equity shares of JSHL are listed on nationwide bourses. JSHL holds 32.02% equity stake in JSL.

History:

With establishing its first stainless steel plant in Hisar in 1970, JSL grew to become the largest stainless steel producer in India. To integrate its operation, the company set up Ferro Alloy plant in 1987 & Research & Development center in 1991. In 2008, the company announced an o.8 MTPA integrated plant in Odisha.

In 2010, on account of the operations of the Company remaining under strain due to various factors the ability of the Company to meet its repayment obligations/liabilities under the facilities availed by it from the Lenders were adversely affected and it had requested the Lenders to restructure such facilities to support the Company. Accordingly, the Company was referred to the Corporate Debt Restructuring forum, for the efficient restructuring of corporate debt (“CDR”) and a CDR package for the Company was approved by the Empowered Group of CDR (“CDR EG”).

Despite, the above restructuring the operations of JSL did not improve as envisaged due to various external factors pertaining to the economy and industry. As a result, the ability of the Company to meet its repayment obligations/ liabilities under the facilities was adversely affected and the Company approached the CDR-EG for a reworked CDR package which was subsequently approved.

The Company, after having various rounds of discussions with the CDR Lenders, and finalized a comprehensive plan of Asset Monetization cum Business Reorganisation Plan (“AMP”). The AMP was approved by the CDR EG, which entailed monetization of identified business undertaking(s) of the Company through demerger/slump sale(s) and utilization of the proceeds of the slump sale(s) in reduction of debt of the Company by an amount of ₹ 5,500 Crore.

Besides reworking of its domestic term debt obligations as stated in above, the Company also completed the restructuring of its debt obligations in relation to USD 250 million ECB facilities, outstanding of USD 147.19 million (USD 196.88 million) availed for the part financing of Odisha Phase II project.

As a part of the above said AMP, the Board of Directors of the Company in their meeting held on 29th December 2014 approved a Composite Scheme of Arrangement between the Company and its three wholly owned subsidiary companies viz. Jindal Stainless (Hisar) Limited (JSHL), Jindal United Steel Limited (JUSL) and Jindal Coke Limited (JCL) and their respective creditors and shareholders which inter-alia provided for:

- Demerger of Mining Division and Ferro Alloys Division of JSL and vesting the same in JSHL

- Slump sale of manufacturing facility at Hisar from JSL to JSHL for lump sum consideration of INR 2809 crore

Transfer of Hot Strip Mill and Coke Oven Plant from JSL to JUSL and JCL for lump sum consideration of INR 2412 crore & 492 crore respectively.

[rml_read_more]

Later, the consideration as mentioned above was paid by the resulting /transferee companies through equity infusion/raising debt. Significant ownership with controlling interest in JUSL & JCL was divested by JSL to private promoter entities.

Post-arrangement, both JSL & JSHL started nurturing businesses & bringing efficiencies in the respective businesses. JSL did ramp up its capacity utilisation and announced small capex year-on-year. JSL & JHSL though remained in identical products, started foraying into new sectors and launched several different products. Several initiatives were taken to bring in efficiencies in its operations like railway siding, foray into critical sectors etc.

Soon the restructuring paid off and in FY 2016-17, JSL declared net profit for the first time in its history. In 2018, the next generation, Mr. Abhyuday Jindal appointed as Managing Director. Meanwhile, JSHL also raised funds from promoters through issue of equity warrants.

In FY 2020, JSL approved the fund raise of INR 1200 crore through combination of Debt & Equity which was partly used to successfully exiting CDR framework by paying the lenders and redeeming the Optionally Convertible Preference shares issued to them. It also announced doubling the melting capacity at Jaipur from 1.1 MTPA to 2.1 MTPA.

Reversing the Compulsory Decision

Post successful exit from CDR, both JSL & JHSL decided to reverse the decision of separating Ferro Alloy & Hisar division by merging JSHL into JSL.

Please note that the promoter stake* in JSL changed to 70.10% pursuant to a preferential allotment. Post-merger, promoter stake in JSL will be circa 57%. One of the reasons for not merging JSL into JSHL could be transfer of regulatory mining licenses with JSL. It took almost 2 years to complete the procedural aspect of the merger. On 22nd December 2022, the Hon’ble Chandigarh Bench of the National Company Law Tribunal heard the petition, and the matter is reserved for the order. The Scheme likely to be completed in Q4FY 23.

In FY 2022, JSL also announced the acquisition of 74% stake in JUSL from promoter entity. The proposed acquisition of 74% stake in JUSL shall be made at an aggregating consideration of INR 958 Crore which is lower than the assigned value for Slump Sale.

Financials of the Companies:

Let us first understand the financial position of the group before its first restructuring:

Clearly, JSL was in deep distress and its interest cost was higher that the operational profits. Borrowings went to such a level that it was impossible to repay. JSL was on the verge of collapse, but the restructuring saved it and provided a ray of hope to not only survive but also to scale significantly.

Performance of JSL after CDR restructuring:

Though FY 2022 financials may not be normal (on account of sudden spike in prices), with new initiatives and increase in capacity utilisation, JSL has managed to successfully turn around its operations after restructuring. The Company has also decided to double its capacity on account of demand from newer sectors.

Related Party Transaction for FY 2022 by JSL:

| Particulars | Amount |

| Purchases through JSHL | 1012 |

| Job work charges paid to JUSL | 1161 |

| Sale of Goods to JSHL | 1152 |

| Sale of Goods to JSHL Subsidiaries | 1543 |

| Sale of Goods to JUSL | 747 |

| Support services charges received from JUSL | 74 |

| Corporate Guarantee Given to JSHL | 3143 |

| Borrowings from JSHL | 1050 |

Apart from the core objective of simplifying the group structure, the merger will overcome inter-company transactions. Every year, there is significant amount of related part transactions taken place between JSL, JSHL & JUSL. The merger of JSHL with JSL will help the companies in reducing the taxation of those transactions (Direct Taxes, GST, etc.) and reduce the regulatory compliances work.

Based on FY 2022 figure, tentatively merged company will have:

| Particulars | Amount |

| Revenue | 36,300 |

| EBITDA | 5,300 |

| EBITDA % | 14.6% |

| Borrowings | 4951 |

Above data is without giving effect to inter-company transactions.

With a significant expansion in JSL & JSHL coupled with increased domestic demand, the merged entity will likely to be well placed to increase its revenues and further strengthen the financials.

Overall improvement in Valuations:

As the financials of both entities started improving, the valuations of the entities also started increasing. Both entities also got re-rated based on improvement of financials and ratings.

| Particulars | 2016 | 2022 |

| JSL | 388 | 11,800 |

| JSHL | 613 | 10,000 |

Source: Ace Equity

Conclusion

JSL & JSHL are being one of the few entities that successfully exited through CDR process and created value for stakeholders. The companies are the market leader in Stainless steel and change in commodity cycle and increased manufacturing activities contributed to its revival and growth and gave healthy balance sheet. The merged company will be able to grow faster and will be able to capture newer opportunities for accelerated growth.