In 2021, Naveen Jindal Group’s flagship company, Jindal Power & Steel Limited announced the divestment of its subsidiary entity engaged in power generation business: Jindal Power Limited to a private entity owned by promoters. The transaction was objected by several investors & proxy advisory firms. Despite objection, the group was able to conclude the transaction. Soon after taking it private, the group announced internal restructuring of its power business.

Worldone Private Limited (“WPL” or Transferor Company 1”) is incorporated under the Companies Act, 1956 with registered office at Chhattisgarh and is one of the holding company of Naveen Jindal Group. WPL through JPL has been involved in the power related sectors. The equity shares of the company are held by Naveen Jindal family. WPL’s debt are listed on BSE Limited.

On 7th August 2021, WPL entered into a share purchase agreement with Jindal Steel & Power (JSPL) for purchase of 96.47% stake of JPL. As on date, WPL holds entire shareholding of the Transferee Company/JPL.

Jindal Power Limited (“JPL” or “Transferee Company”) is incorporated under the Companies Act, 1956 with registered office at Chhattisgarh. The Company is preliminary engaged in the business of generation of power in the thermal energy spectrum with installed capacity of 3400 MW. As on date, the entire equity shares of JPL are held by WPL.

Simhapuri Energy Limited (“SEL” or “Transferor Company 2”) is incorporated under the Companies Act, 1956 with registered office at Chhattisgarh. SEL is primarily engaged in the business of generation of power in the thermal energy spectrum with installed capacity of 600 MW. SEL was being acquired by JPL on going concern basis under the provisions of Insolvency and Bankruptcy Code, 2016 on 29th June 2022.

The Transaction:

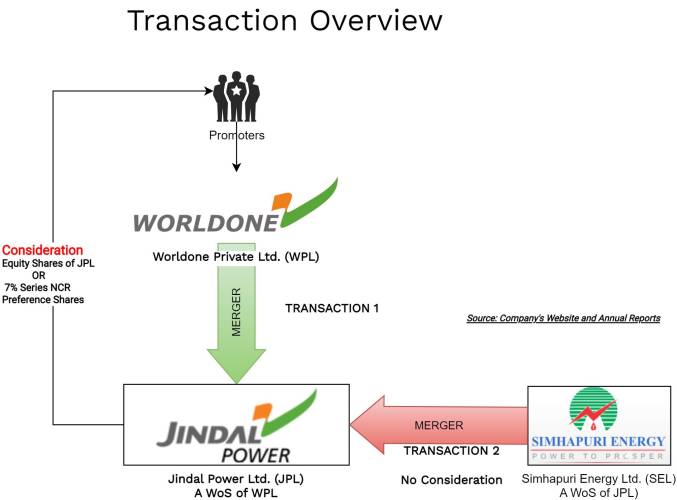

The Board of Directors of WPL have approved a composite scheme of arrangement (“Scheme”) which inter-alia provides for:

- Amalgamation of Worldone Private Limited (i.e., the Transferor Company 1) with Jindal Power Limited (i.e., the Transferee Company); and

- Amalgamation of Simhapuri Energy Limited (i.e., the Transferor Company 2) with Jindal Power Limited (i.e., the Transferee Company).

Effectively, through a composite scheme, the group will not only consolidate thermal power business under one roof but also give shares of operating company i.e., JPL directly to the ultimate shareholders.

Some of the rationale’s as envisaged under the scheme:

- Streamlining of the overall shareholding structure

- Simplification of the overall structure

- Greater management focus and speedy decision process

Appointed Date for the merger of WPL with JPL is 1st June 2022 or such other date as may be approved by the Board of Directors of Transferor Company 1 and Transferee Company or such other date as may be fixed or approved by the NCLT while for the merger of SEL with JPL Appointed Date is 1st March 2023 or such other date as may be approved by the Board of Transferor Company 2 and Transferee Company or such other date as may be fixed or approved by the NCLT.

WPL acquired 96.42% equity stake in JPL for total consideration of circa INR 7410 crore from Jindal Steel and Power Limited with effect from 30th May 2022. The remaining stake in JPL has been acquired by WPL in December-2022 quarter, making it a wholly-owned subsidiary. The Appointed Date for the merger of WPL with JPL has been chosen as immediate day after effective acquisition of 96.42% stake of JPL by WPL. For FY 2023, the total finance cost debited to profit & loss account of WPL was circa INR 635 crore. Post-merger, the merged entity can effectively serve debt through cash flows of JPL & can be tax efficient as well.

The Appointed Date for merger of SEL with JPL can provide efficiency in absorbing the unabsorbed losses of SEL by the merged entity.

Share Capital of the entities involved:

Share capital as on 16th December 2022:

| Particulars | WPL | JPL |

| Ordinary Equity Shares of INR 10 each | 1,05,000 | 1,34,88,00,000 |

| Class II equity shares of INR 10 each | 52,600 | – |

| 7% non-cumulative optionally redeemable preference shares of INR 10 each | 1,64,877 | – |

| 5% non-cumulative, non-convertible redeemable preference shares of INR 10 each | 705,52,61,535 |

Please note that:

- Class II equity shares of INR 10 each are entitled for no voting rights but superior dividend which is 50% over and above the normal rate of dividend as available to ordinary equity shares.

- 7% non-cumulative optionally redeemable preference shares of INR 10 each can be converted into Class II equity shares of INR 10 each.

All ordinary equity shares, Class II equity shares & optionally convertible preference shares of WPL are held by promoters and/or entities pertaining to them.

Consideration:

For Transaction 1: Merger of WPL into JPL

The shareholders (both equity & preference shareholders) of WPL will have an option to either take equity shares of JPL or optionally convertible preference shares.

- 2,29,799 ordinary equity shares of Transferee Company having face value of INR 10 fully paid up for every 100 ordinary equity shares of Transferor Company 1 of face value of INR 10 each fully paid up or 9,78,807 6.5% non-cumulative optionally convertible redeemable preference shares of the Transferee company of INR 10 each fully paid up for every 100 WPL Equity Shares.

- 2,08,909 JPL Equity Shares for every 100 WPL Class II Equity Shares of Transferor Company 1 of INR 10 each fully paid up or 8,89,825 JPL 6.5% OCRPS for every 100 WPL Class II Equity Shares;

- 2,21,992 JPL Equity Shares for every 100 WPL 7% OCRPS held by Ambitious Asset Private Limited, or 9,45,552 JPL 6.5% OCRPS of the Transferee Company for every 100 WPL 7% OCRPS held by Ambitious Asset Private Limited;

- 48,043 JPL Equity Shares for every 100 WPL 7% OCRPS held by Nalwa Steel and Power Limited or 2,04,633 JPL 6.5% OCRPS for every WPL 7% OCRPS held by Nalwa Steel and Power Limited; and

- One 7% Series III non-cumulative redeemable preference share of Transferee Company having face value of INR 10 each fully paid up for every 1 WPL 7% NCRPS.

Further, Upon the date of coming into effect of the Scheme, the Transferee Company shall, without any further act or deed or instrument, issue and allot same number of non-convertible debentures (NCDs) of face value of INR 10,00,000 each to the holders of Existing NCDs as on the Record Date in lieu of the Existing NCDs held by them in the Transferor Company 1.

For Transaction 2: Merger of SEL into JPL

Transferor Company 2 is a wholly owned subsidiary of Transferee Company and its

entire share capital is held by Transferee Company and its nominees. Accordingly, upon the merger, no consideration will be discharged.

Thus, effectively, the shareholders of WPL will get direct holding of JPL & will have a flexibility to either to opt for equity shares or optionally convertible shares.

Financials of WPL

| Particulars | Amount* |

| Revenue from Operations | 1 |

| Investments | 7754 |

| Net worth | (346) |

| Borrowings | 7483 |

*All Figs in ₹ Crores for FY 2023The entire acquisition of 96.47% equity interest in JPL from Jindal Power & Steel Limited plus remaining equity interest by WPL was financed through borrowing. Promoters used WPL as a special purpose vehicle to take complete control over JPL. Soon after concluding the acquisition transaction, WPL will get merged with JPL and effectively JPL cash flows will be utilised to pay the outside borrowings raised to acquire JPL. Further, giving option of either equity shares or optionally convertible preference shares will allow shareholders of the WPL to effectively upstream their capital investments in WPL. For the listed entity, Jindal Power & Steel Limited, the transaction will have no impact and any remaining consideration (if any) now will be paid by the operating company i.e., JPL directly.

Conclusion

In 2021, Naveen Jindal Group took decision to take its thermal power generation business private through transferring the stake of JPL from Jindal Power & Steel Limited to promoter group entity. That time, many shareholders objected the transaction mainly on account of lower valuation assigned to JPL.

Naveen Jindal group funded the acquisition transaction through borrowings. Now, immediately after concluding the transaction, the group will merge the special purpose vehicle into operating company so that the borrowings taken for financing the acquisition transaction will be paid through cash flow generated by the operating company. Interestingly, the scheme will provide option for consideration for the merger to the shareholders of WPL, which will enable them to upstream the invested amount in WPL is so desired by them.

Going ahead, the group will focus on expanding the energy arm and we may see strategic investment or initial public offering of JPL in future at significantly higher valuations.