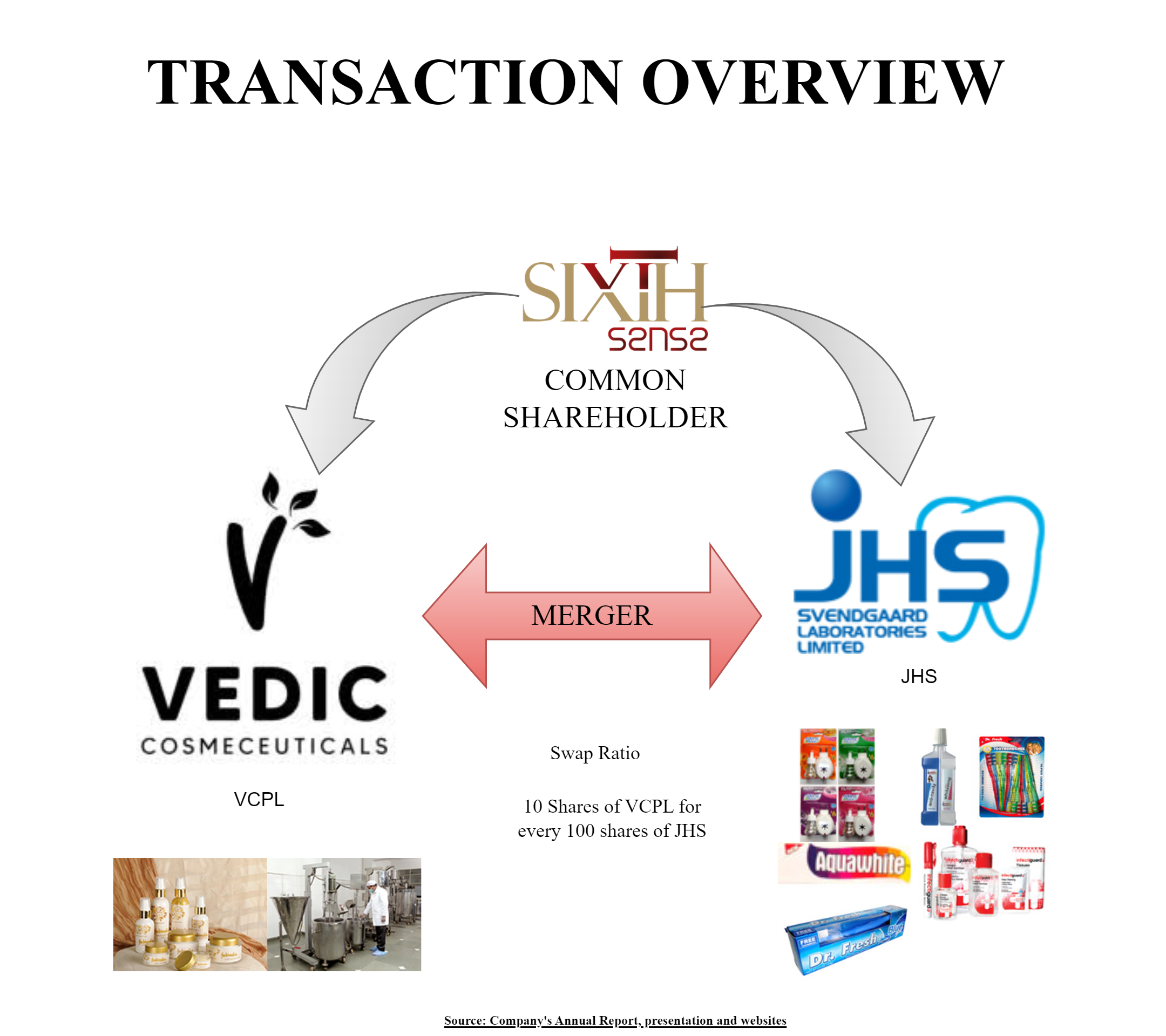

The Board of Directors of JHS Svendgaard Laboratories Limited announced merger of the company with private company Vedic Cosmeceuticals Private Limited. As acclaimed by the management, the product portfolio of Vedic Cosmeceuticals Private Limited is complimentary to that of JHS Svendgaard Laboratories Limited’s products. Interestingly, the merger is reverse merger in which listed company will merge with unlisted private company which will get listed (and converted to public company) post the reverse merger. Both companies have common shareholder: Sixth Sense India Opportunity Fund, a venture capital fund. Let us understand the different facets of the transaction.

JHS Svendgaard Laboratories Limited (“Transferor Company”) is a listed public limited company engaged in Personal Care Industry. This company is engaged in manufacturing and selling (Exports) of Toothbrushes, Toothpastes, Mouthwash, Denture Tablets, and other allied Oral care Products. Apart from working on its own brands the company also offers Contract Manufacturing Partnership to brands in the domestic and the international market. The registered office of the company is situated in the state of Himachal Pradesh.

Recently, JHS Svendgaard Laboratories Limited completed demerger & merger transaction. Please read our article in M&A Critique to understand earlier transaction in detail.

Vedic Cosmeceuticals Private Limited (“Transferee Company”) is a company engaged in Personal Care Industry. This Company is engaged in developing, manufacturing, and selling of high-quality cosmetics products like Baby Care, Skin Care (Eg: Sunscreen, Face Mask, etc.), Body Care, Hair Care, Intimate Care, Pet Care, Spa products, Grooming, etc., that are made with natural ingredients. The registered office of the Company is situated in NCR, Delhi however the company is in the process of shifting its registered office to Haryana.

The Transaction:

The Scheme of Amalgamation inter-alia provides for:

- The merger of JHS Svendgaard Laboratories Limited with Vedic Cosmeceuticals Private Limited

- Recording of understanding between promoter groups (JHS & Vedic) on managing the merged company

Rationale as envisaged under the scheme:

- The Transferor Company is engaged in the business of manufacturing, selling, and exporting Toothbrushes, Toothpastes, Mouthwash, Denture Tablets, and other health care products such as Hand Sanitizer, Room Fresheners etc. Apart from this, the Transferor Company also offers contract Manufacturing Partnership to Domestic and International market. On the other hand, the Transferee Company is engaged in developing, manufacturing, and selling of high-quality skincare products for Baby care, Hair Care, Body Care, Intimate Care, Pet care, Spa Products and Grooming products. Some prominent brands with whom the Transferee Company is currently working are Unilever, Nykaa, St. Botanica, The Moms Co., Sugar, Sirona, Bombay Shaving Company, Colorban, Beardo, New U, Skinraft, Arata, TNW.

- The Transferor Company and Transferee Company belong to the Fast-Moving Consumer Goods (FMCG) Industry and having a similar line of Business and same customer base. Further, the product base of Transferee Company is wider in comparison to that of the Transferor Company and at the same time, has more growth potential from prospects considering the usage of advanced technology in production.

- Other benefits such as competitive strengths, better management, better customer reach etc.

The Appointed Date for the merger is 1st April 2024. Post-merger, the equity shares of the transferee company will be listed on the bourses.

Swap Ratio & Capital Structure:

As a consideration for the merger, transferee company shall issue 10 equity shares for every 100 equity shares of transferor company.

| Particulars | JHS | Vedic-Pre | Vedic-Post |

| No. of Paid-up equity shares | 7,83,96,762 | 43,63,640 | 1,22,03,316 |

| Face Value | 10 | 10 | 10 |

| Promoters Holding | 37.02 | 68.80 | 48.82 |

Recently, Vedic announced bonus issues in the ratio of 19:1 which significantly increased its paid-up share capital. Further, it also converted compulsorily convertible preference shares issued to venture fund into equity shares. The merged entity will be jointly managed by the promoters of JHS & Vedic. The merged entity will be owned 64% by JHS shareholders & 36% by Vedic shareholders. In the merged entity, JHS promoters will own 24.2% in the merged entity while Vedic’s promoters will own 24.6%.

The common shareholder; Sixth Sense India Opportunity Fund which currently owns 31.2% in Vedic & 8.99% in JHS will own 17.06% stake in the merged entity, the largest shareholding post promoters.

One of the key reasons for reverse merger could be to commensurate the capital of the merged entity with size of its operation. JHS existing capital is too large. By merging into Vedic, the merged entity will right-size its share capital.

Other terms as provided in the scheme:

- Upon the scheme coming into effect, Article of Association shall be restated & amended with terms & conditions as mutually decided between JHS & Vedic promoters.

- The merged entity shall have minimum 6 board of directors with each promoter group have right to nominate equal directors.

- Mr. Nikhil Nanda (promoter of JHS) will be chairman while the managing director of the merged entity shall be appointed amongst the promoters of Vedic.

- The chairman & managing director shall be joint signatory of the bank accounts of the merged entity.

- Effectively, it appears that day-to-day operations will be managed by Vedic with casting vote available with JHS. Further, the composition of board will have equal representatives of both groups.

- Transferee Company shall be converted into Public limited company

- As change of control, the assets & liabilities of the transferor company shall be recorded at fair values in the books of transferee company. Effectively, through reverse merger, the assets & liabilities of JHS will be recorded at fair values in the books of Vedic.

Financials

Though the above numbers for JHS are before considering the impact of the recently completed (merger+ demerger) transaction. However, considering the FY 2022 financials, there will not be any significant impact of the transaction on JHS’ numbers. For FY 2023, both JHS & Vedic struggled to generate profit after tax. Focus for the merged company will be new initiatives & combined portfolio may give edge in generating sustainable profits.

Conclusion

Clearly, the aim for the restructuring will be to create larger portfolio and indirect listing of Vedic. Considering the shareholding pattern, it can be concluded that the merger has been arranged by the venture fund. Further, the timing of the scheme is also seeming to be special. As soon as the earlier scheme announced by JHS became effective, this proposed scheme has been announced. It looks for announcing the proposed scheme, stakeholders were waiting for giving effect to the earlier scheme.

The key question remains why reverse merger? What is apparent from the disclosure is that it will facilitate reasonable capital size as value per share of Vedic is almost two times that of JHS. Further, it will also bring JHS assets at fair value. Over and above, there could be commercial as well as other aspects such as tax, place of the registered office of the merged entity, accounting or saving on stamp duty for finalising the reverse merger. JHS being larger & listed entity, ideally Vedic should have been merged into JHS. This would have been better for minority shareholders as their shares would have continued to remain listed however in the proposed scheme, JHS will get delisted and merged entity Vedic will take some time for getting listed.

Although driven by a VC, only time will tell whether JHS & Vedic be able to derive the synergies & creates value for all stakeholders.