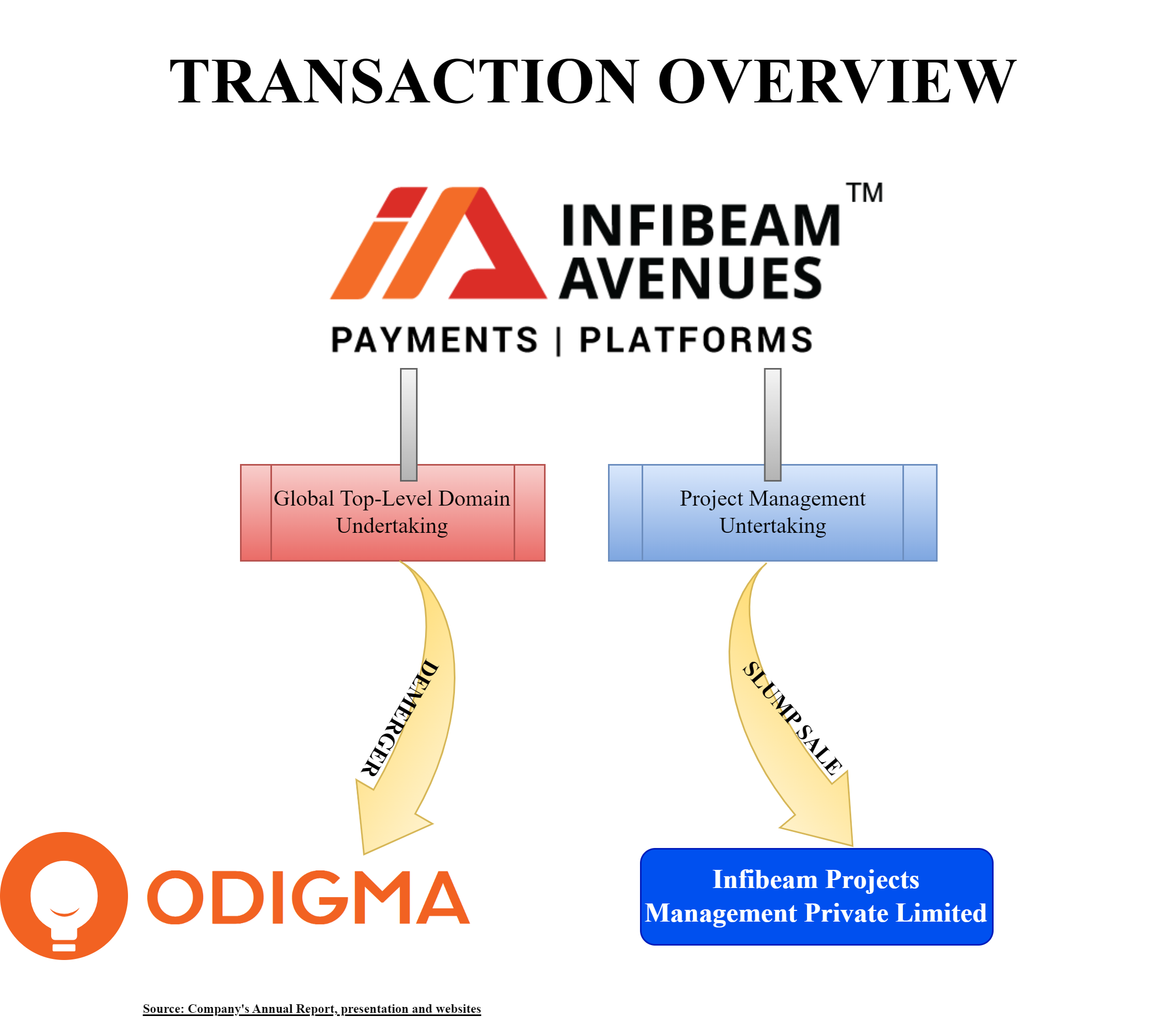

Recently, the management of Infibeam Avenues Limited announced an internal restructuring which will pave the way for separate listing of its Global Top Level Domain business and will carve out immovable property at Gift City into a separate wholly owned subsidiary.

Infibeam Avenues Limited (“Infibeam” or “Demerged Company” or “Transferor Company”) is engaged in the business of digital payment, E-Commerce services, comprehensive suite of web services spanning digital payment solution, data centre infrastructure, software platform, etc. The equity shares of Infibeam are listed on nationwide bourses.

Odigma Consultancy Solutions Limited (“ODIGMA” or “Resulting Company”) is a wholly owned subsidiary of Infibeam engaged in activities relating to e-commerce.

Infibeam Projects Management Private Limited (“IPMPL” or “Transferee Company”) is a wholly owned subsidiary of Infibeam.

The Proposed Transaction:

Board of Directors of Infibeam Avenues Limited (“Infibeam” or “Demerged Company” or “Transferor Company”), at its meeting has considered and approved a Composite Scheme of Arrangement between the Company, Odigma Consultancy Solutions Limited (“ODIGMA” or “Resulting Company”) and Infibeam Projects Management Private Limited (“IPMPL” or “Transferee Company”) and their respective shareholders and creditors (“Scheme”) under Sections 230 to 232 read with Section 66 of the Companies Act, 2013 (“Act”) and other applicable laws including the rules and regulations which inter-alia provides for

- The demerger, transfer and vesting of Global Top-Level Domain (“GTLD”) Undertaking from the Company to the Resulting Company on a going concern basis;

- transfer and vesting of the Project Management Undertaking of the Company, as a going concern on Slump Sale basis, to the Transferee Company;

The Appointed date for the transaction is 1st April 2023.

Demerger

Global Top Level Domain Undertaking: Global Top Level Domain Undertaking covers entire global top level domain business commonly known as .OOO, accepted by leading global domain registrars, as an alternate domain registration solutions to people who are unable to locate their brand name or business names on popular domains and includes all the businesses, assets, properties, investments, liabilities and activities, of whatsoever nature and kind, pertaining to global top level domain business.

Interestingly, the turnover of the demerged division i.e., GTLD Undertaking for the financial year ended 31st March 2023 was INR 194.69 Lacs representing 0.11% to the total turnover of INR 45 crores of Infibeam for the financial year ended 31st March 2023.

Infibeam’s total equity investment in Odigma as on 31st March 2023 was INR 64.7 crore. A major part of the undertaking getting transfer will consist of equity investment in Odigma.

Some of the rationale for demerger as envisaged in the scheme:

- Future growth and expansion of the GTLD Undertaking would require differentiated strategy.

- Allow management to peruse independent growth strategies.

- Value unlocking for shareholders.

- Enhance competitive strength, cost reduction and bringing efficiencies.

Consideration:

Pursuant to the demerger, 1 fully paid-up equity share of the Resulting Company of the face value of INR 1 each shall be issued and allotted, at par as fully paid-up to the equity shareholders of the Demerged Company for every 89 equity shares of INR 1 each held by the shareholders of the Demerged Company, as on the Record Date.

Odigma being wholly owned subsidiary of Infibeam, the share entitlement ratio being discovered based on the management’s proposed entitlement ratio. There will not be any change in the beneficial interest of the shareholders in the resulting company post-demerger.

The equity shares to be issued and allotted by the Resulting Company shall be listed on the BSE Limited and the National Stock Exchange of India Limited.

Share Capital

| Particulars | Infibeam | Odigma (post-transaction) |

| Paid up No. of Shares of INR 1 each | 268,33,74,886 | 3,0150,280 |

| Promoter Holding | 30.56% | 30.56% |

Slump Sale:

The Project Management Undertaking comprises, inter alia, the GIFT City Tower Two building and related amenities. For FY 2022-23, the turnover of the Project Management Undertaking was INR 76.18 Lacs, which was 0.04% to the total turnover of the Company in the financial year ended 31st March 2023. As of 31st March 2023, the Project Management Undertaking’s net worth was INR 11,881.38 Lacs, which is 4.01% to the total net worth of the Company as of 31st March 2023.

Some of the rationale’s for slump sale:

- Separation of non-core activities.

- Providing increased capital and focused operations for tapping the opportunities available in GIFT City.

- independent management set up paving way for growth and development of each of the business.

Consideration for Slump Sale:

In consideration of the transfer and vesting of the Project Management Undertaking into Transferee Company pursuant to the provisions of this Scheme, Transferee Company shall pay consideration equal to the Net Worth of the Project Management Undertaking.

The Transferee Company shall pay the consideration by way of issuance and allotment to the Transferor Company, 55, 78,114 equity shares of face value of INR 10 each at share premium of INR 203 which translates to INR 118.81 crore. The substantial value is attributable to fixed assets located in Gift City.

Slump Sale will be taxable in the hands of the transferor company however, the consideration is equal to networth getting transferred, direct tax liability in the hands of Infibeam will be optimum.

Conclusion:

The undertaking which is getting transferred pursuant to the demerger is miniscule compared to the overall operations of the Infibeam. The segregation move was taken to separately list its subsidiary “Odigma.” However, considering the size of the business Odigma has, management may consider inviting some strategic partner or divest stake into particular company.

In 2019, Infibeam has demerged its small E-Commerce & Theme Park and software business into different companies which was later listed separately. Both demergers failed to create any value for shareholders with e-commerce business eroded more than 95% value post its listing. It will be interesting to see how proposed demerger creates any value for shareholders.

Through slump sale, the immovable property located in gift city will be parked under wholly owned subsidiary which will provide flexibility to Infibeam if desire to monetise in future.