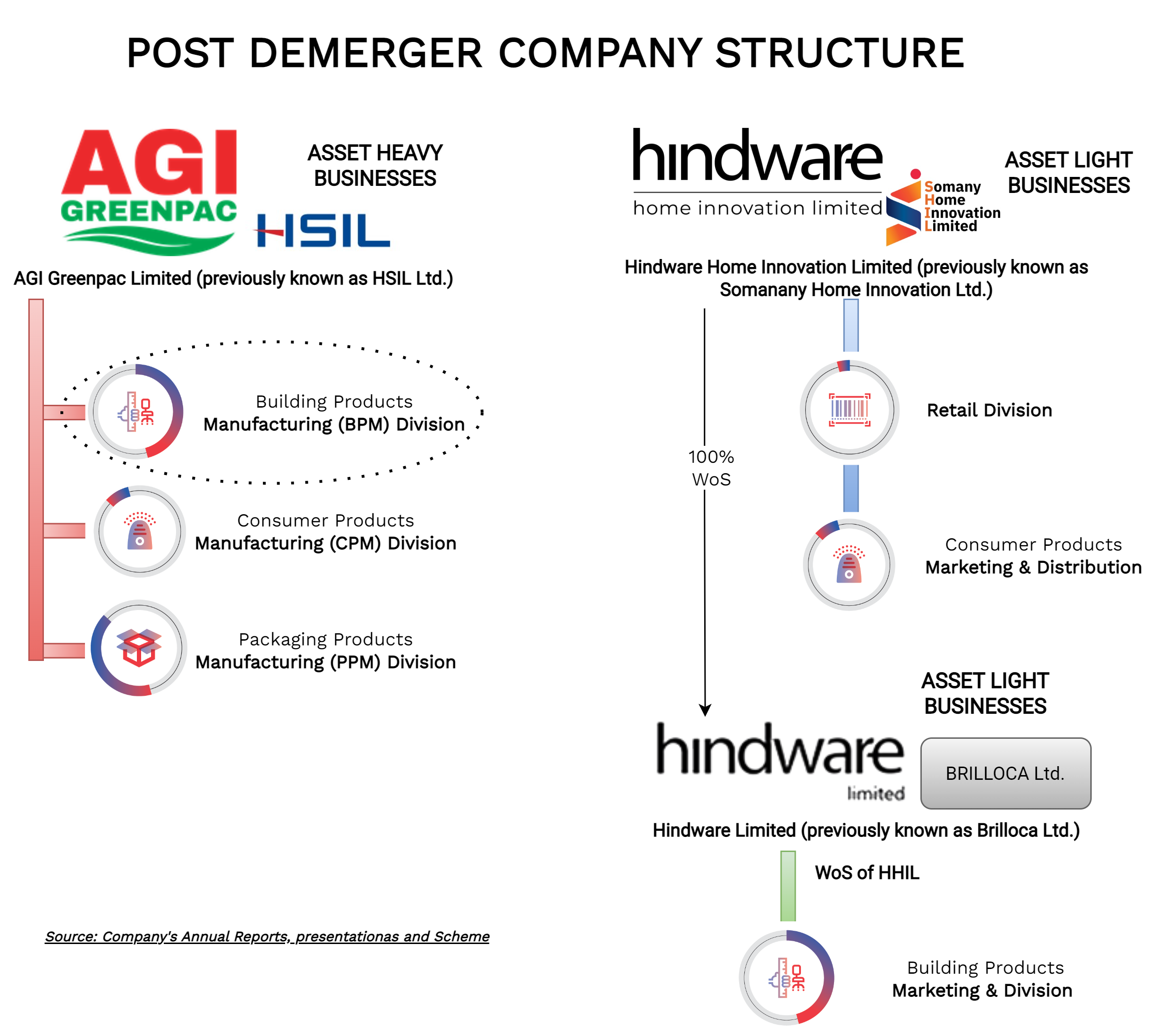

From its presence in sanitaryware & packaging in 2011, over the years, the Hindware Group expanded to numerous consumer facing businesses like Faucets, Appliances, Plastic pipes & fittings, Fans, Kitchen fittings, Furniture etc. This obviously ushered in a mismatch of risk & return among different business verticals. So, management decided in FY 2018 to demerge B2C businesses into Hindware Home Innovation Limited (Earlier known as Somany Home innovation Limited or Resultant company) and keep manufacturing assets heavy businesses in AGI Greenpac Limited (Historically known as HSIL Limited or Demerged company). In a complete U-turn of the strategy based on which demerger was done, in FY 2022, manufacturing facilities for building products and consumer products were sold on slump sale basis to the resulting company. Currently, the group operates two listed companies post demerger and slump sale.

AGI Greenpac Limited (Historically known as HSIL Limited) is India’s leading Packaging Products Company that manufactures and markets various packaging products, including glass containers and Polyethylene Terephthalate (PET) bottles, products & security caps, and closures.

Hindware Home Innovation Limited (Earlier known as Somany Home innovation Limited) is recognised by its Brand Hindware, engaged in the Indian Consumer Appliances and Building Products segment. The company is involved in manufacturing, branding, marketing, sales & distribution, and service of various product categories. The company through its wholly owned subsidiary, Hindware Limited (Earlier known as Brilloca Limited) has a versatile range of best-in-class sanitaryware and faucets products with brands catering to a wide pricing spectrum, from luxury to mass.

Demerger to separate asset light business from manufacturing:

In 2018, pursuant to the composite scheme of arrangement, HSIL Limited (“HSIL” or “AGI”) now known as AGI Greenpac Limited demerged marketing & distribution of Consumer Products and Retail Divisions to Somany Home Innovation Limited (“SHIL” or “HHIL”) now known as Hindware Home Innovation Limited. Further, marketing and distribution of Building Products of HSIL Limited was demerged into Brilloca Limited (“Brilloca”) now known as Hindware Limited, a wholly owned subsidiary of SHIL.

Before demerger, AGI was engaged in four divisions:

- Building Product Division

- Consumer Product Division

- Retail Division

- Packaging Division

[rml_read_more]

Through demerger, the group separated marketing & distribution of Building products, Consumer products & retail division into a separate listed entity while retaining the manufacturing facilities catering to those divisions along with the entire operations of packaging division. In short, the objective was to separate consumer facing businesses and create an asset-light company. It was thought that it will entail both entities to grow faster.

Please note:

- Above numbers are including inter-segment numbers but exclude other & unallocated numbers.

- The financial is inclusive of manufacturing facilities which was retained by AGI. Total Assets & Liabilities transferred to HHIL & Brilloca (now known as Hindware Limited) as on Appointed Date 1st April 2018.

After demerger, both entities continued to expand their respective areas. HSIL announced capex for building additional capacities while SHIL & its subsidiary Brilloca focused on innovations and digitalisation. HSIL continued to manufacture goods for SHIL.

The related party transactions by HSIL for FY 2021 & FY 2022:

INR in Crore

| FY 2021 | FY 2022 | |||

| Particulars | SHIL | Brilloca | SHIL | Brilloca |

| Sale of Goods | 5 | 596 | - | 935 |

| Payment for management services to | 12 | - | 17 | |

Effectively sale to Brilloca accounted for circa 47% & 65% in FY 2021 & FY 2022 respectively of total sales by HSIL. Around 70% of the raw material of Brilloca was sourced from HSIL.

Reversing the Decision: Asset light to Asset heavy

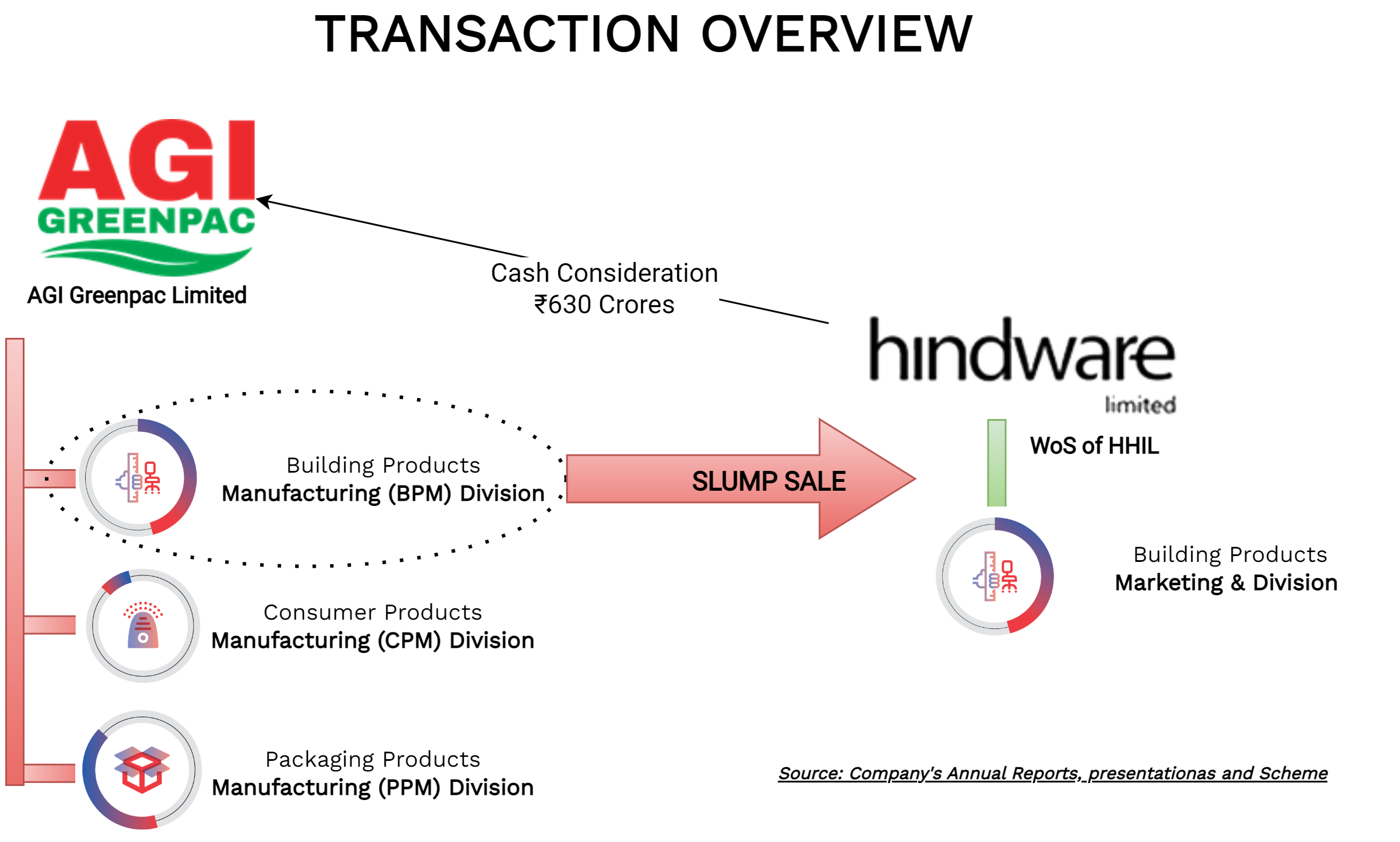

Considering the complexity & quantum of related party transactions between the group’s two listed entities (including its subsidiary) ushering from this structure, the management decided to reverse its decision by consolidating the manufacturing activities related to the demerged segments.

In 2022, the board approved & transfer manufacturing facilities related to Building Products Business (BPD) of HSIL into Brilloca through Slump Sale at a lump sum consideration of INR 630 crore. The BPD Undertaking of HSIL broadly comprised of two sanitaryware manufacturing plants and one manufacturing plant each for faucets and plastic pipes (PVC and CPVC) and fittings. The slump sale was made effective on 31st March 2022. The consideration for the slump sale of INR 630 crore was largely financed by Brilloca through raising borrowing. HSIL recognised a gain of Circa INR 58 crore on this transaction.

The details of BPD for FY 2022

INR in Crore

| Particulars | Amount |

| Revenue | 881 |

| EBIT | 58 |

| PAT | 12 |

| Networth (as on 31st March 2021) | 475 |

Why Slump Sale & not demerger:

Interestingly, unlike the earlier transaction, the transfer was through a slump sale. One of the key reasons could be the mode of consideration. HSIL received the consideration in the form of ‘Cash’ which HSIL effectively used for deleveraging its packaging business & to use for further expansion of its packaging business.

Other Initiatives:

SHIL also formed a 50: 50 joint venture with Groupe Atlantic of France for consumer water heaters and electric heating segment. Under JV, the Company did greenfield expansion by setting up a manufacturing plant in Telangana, India.

Change of Names

As part of the strategy, both companies renamed themselves. Somany Home Innovations Limited was renamed as Hindware Home Innovation Limited while its key subsidiary Brillioca Limited changed its name to Hindware Limited. HSIL Limited also changed its name to AGI Greenpac Limited.

Changes in Shareholding Pattern

On the record date of demerger (2019), the promoter holding 49.34% in HSIL got mirrored in SHIL on the listing. The promoters increased their holding in SHIL to 51.2% while in HSIL, the promoter holding jumped to 60.24%. the increase was through secondary market purchases.

Financial performance of both Companies:

Please note:

- FY 2022 PAT consists of an exceptional gain of circa INR 100 cr.

- Increase borrowing in 6M FY 2023 pertains to additional borrowings raised for discharging slump sale consideration.

Comparative change in financial performance:

INR in Crore

| Particulars | FY 2018 | FY 2022 (AGI +SHIL) |

| Revenue | 2297 | 3795 |

| EBITDA | 281 | 509 |

| PAT | 74 | 317 |

| Networth | 1487 | 1918 |

Please note that FY 2022 combined figures (for AGI & SHIL) are without eliminating significant inter-company transactions. Considering the inter-company sales of INR 935 crore (from HSIL to Brilloca for FY 2022, the combined revenue after eliminating inter-company transactions stands at INR 2860 crore. Thus, there is hardly any growth in revenues for the entities after a demerger.

Changes in valuation

Table stating changes in valuation for the group as a whole:

| Particulars | Amount(INR in Crore) |

| Market Capitalisation on 31st March 2017 | 2530 |

| Market Capitalisation of HHIL | 3000 |

| Market Capitalisation of AGI Greenpac Ltd | 2100 |

Effectively, the return generated by the shareholders over a period of almost six years is circa 102% translating to 12.3% Compounded Annual returns.

Conclusion

The intention behind the demerger in 2018 was to create two sets of listed companies, one having an asset-light company focused on consumer facing marketing & distribution business while the other continues to do manufacturing. The move was aimed to create value for shareholders by fetching a multiple equivalent to other listed peers and facilitating a structure to invite strategic partners in all key divisions.

Soon after the demerger, the group realized the inter-company transaction & its impact on indirect taxes & compliances which made it reverse the decision by combining the manufacturing facilities with marketing & distribution divisions. In the entire process, one may need to evaluate whether the strategy truly worked for public shareholders.