Gokaldas Exports Limited (GEL) is a leading readymade garment manufacturer and exporter in India, engaged in the business of design, manufacture and sale of a wide range of readymade garments for men, women and kids, for all seasons. The Company presently exports to more than fifty countries where its customers include prominent international brands in North America, South America, Europe, Africa, Oceania, and Asian countries. The equity shares of GEL are listed on nationwide bourses.

Atraco Group has been a leading manufacturer of apparel since 1986. Headquartered in Dubai, UAE, with a network of five manufacturing units across Kenya and Ethiopia. The company employs over 13,000 people and has strong relationships with global retailers. The group’s operations have been carried out through different unlisted entities.

The Transaction

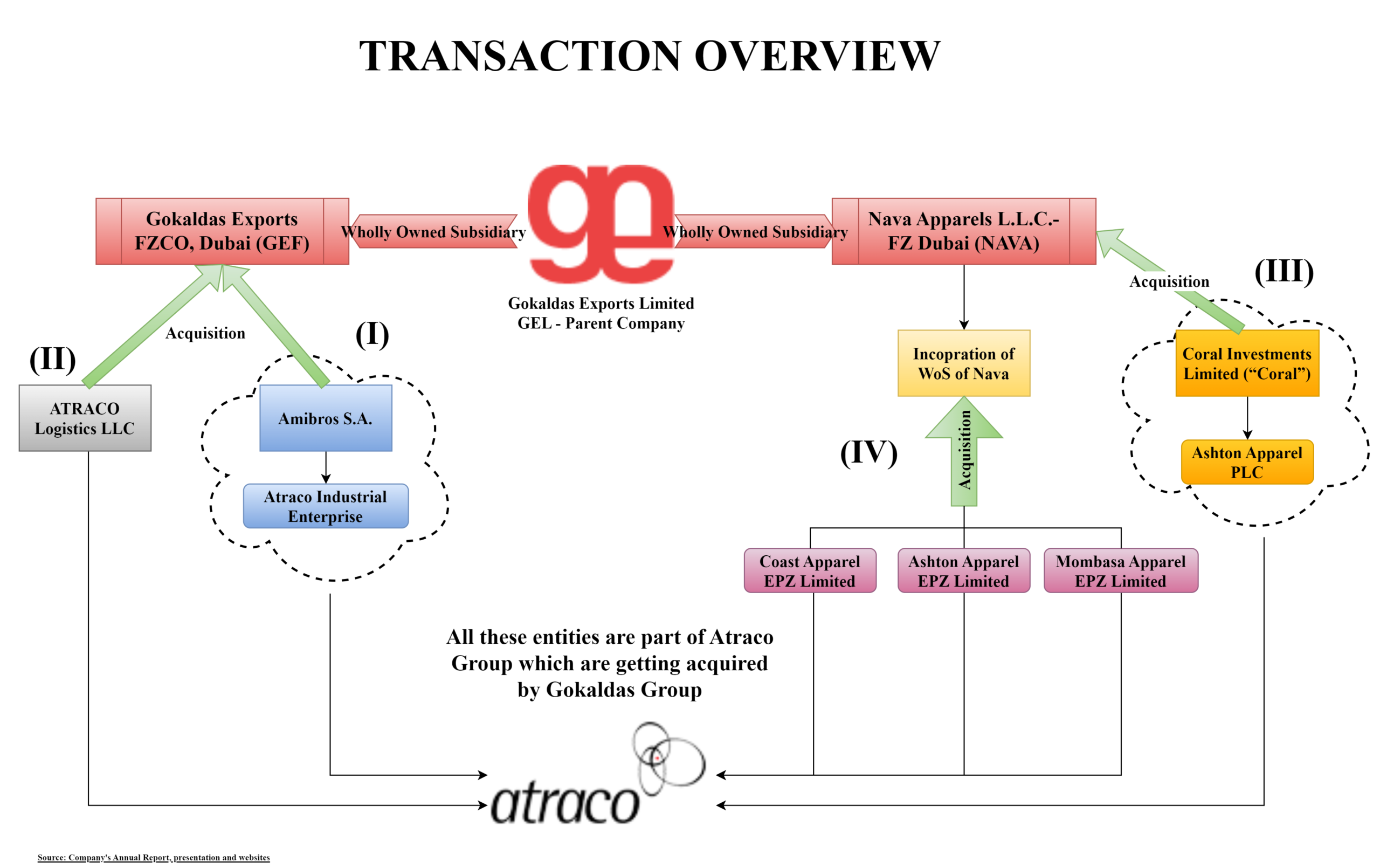

The Board of Directors of Gokaldas Exports Limited at their meeting approved the acquisition of shares and/or assets (as the case may be) of the various entities belonging to Atraco Group through the wholly owned subsidiaries of GEL namely, Gokaldas Exports FZCO, Dubai (“GEF”) and Nava Apparels L.L.C-FZ, Dubai (“Nava”) at an aggregate consideration of USD 55 Million (circa INR (Indian Rupees) 450+ crore). The proposed acquisitions by GEF and Nava are set out below:

a) GEF to acquire:

(I) 100% shares of Amibros S.A. from Solaris – II Investments Group Limited pursuant to a share purchase agreement (and consequently acquire Atraco Industrial Enterprise, a branch of Amibros S.A.); and

(II) 100% shares of Atraco Logistics Co LLC (and consequently acquire its branch) pursuant to a share purchase agreement.

b) Nava to acquire:

(III) 100% shares of Coral Investments Limited (“Coral”) pursuant to a share purchase agreement. As a result of this, Nava will also indirectly acquire approximately 100% shares of Ashton Apparel PLC which is a subsidiary of Coral; and

(IV) all assets of Coast Apparel EPZ Limited, Ashton Apparel EPZ Limited and Mombasa Apparel EPZ Limited pursuant to asset purchase agreements with respective parties.

All the acquired entities pertain to the Atraco group. Amibros, S.A., operates its operations through its branch ATRACO which is headquartered in Dubai, UAE. Atraco Logistics LLC (“ALL”) is engaged in freight and clearing services, cargo loading and unloading, cargo packaging, shipping line agents and general warehousing purposes. Coral Investments Limited currently owns Ashton Apparel Manufacturing PLC (“AAM”), an entity incorporated under the laws of Ethiopia.

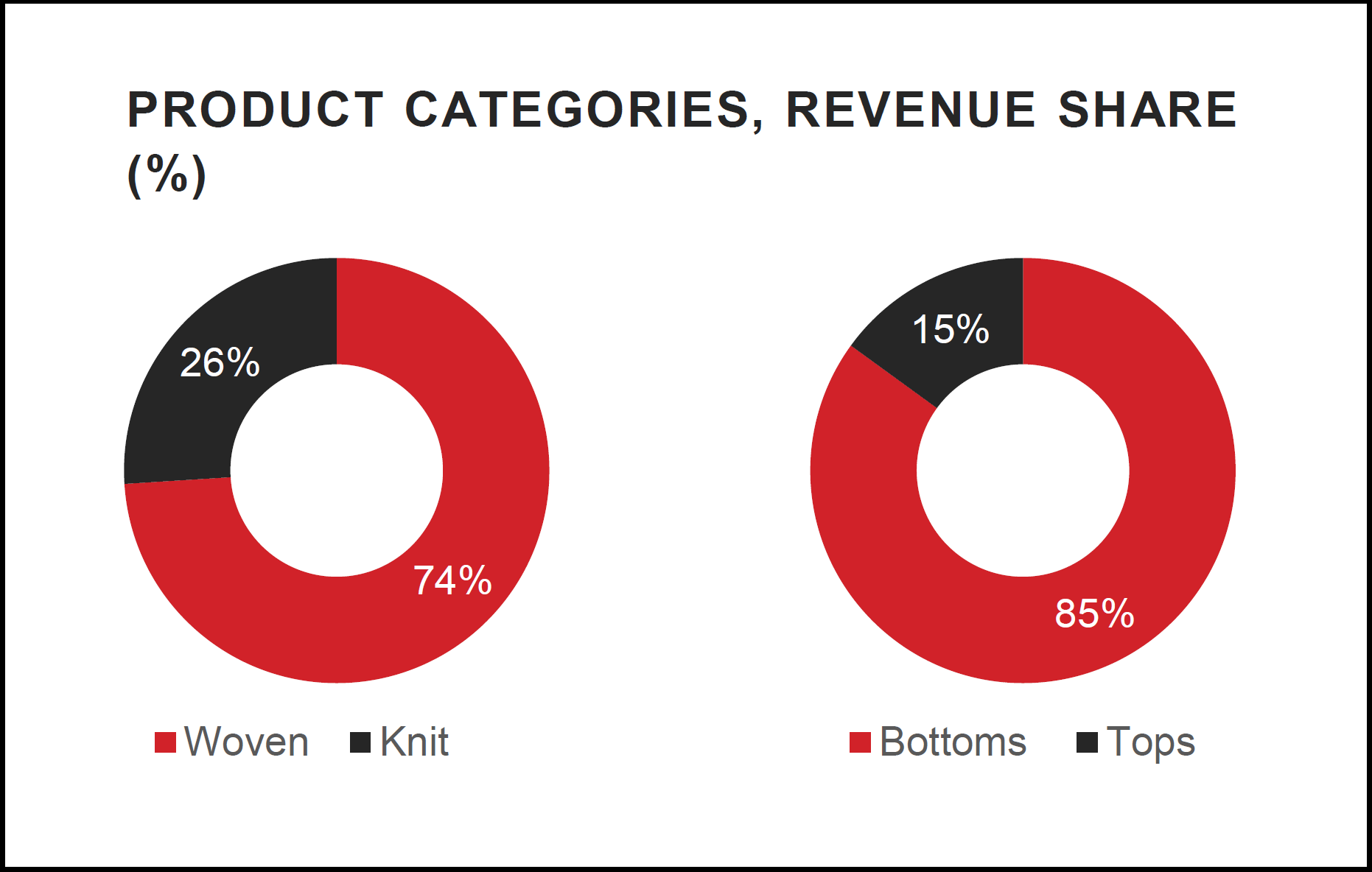

Atraco Group is a leading manufacturer of apparel with a strong market position and customer relationships across the USA and Europe. Their product range includes shorts, pants, shirts, t-shirts, blouses, and dresses catering across age groups.

Key benefits to GEL from this acquisition:

- Wider customer base- ATRACO has a strong customer relationship with global brands and currently exports 95%+ output to the USA.

- Atraco has manufacturing facilities in Kenya & Ethiopia which gives GEL duty-free access to the world’s largest market USA and to European region. Using these factories, GEL can also serve its existing customers in the USA & the European region with a significant duty advantage.

- Large scale production facilities in a low-cost location

- Diversified product base: The manufacturing entities produce a wide range of products such as casual wear, including shorts, pants, shirts, blouses, t-shirts, and dresses.

Consideration & Valuation

The aggregate consideration for the proposed acquisition is USD 55 million. It comprises of the following:

a) USD 45 million is required to be paid on the date of closing of the proposed transactions.

b) USD 10 million to be paid on or before March 31, 2024.

Effectively, equity consideration for the proposed acquisition will be circa INR 454 crore. Atraco has net debt of INR 135 which will be taken over by GEL. Thus, the enterprise value assigned to the acquisition is INR 589 crore.

INR in Crore

| Particulars | Amount |

| Equity Valuation | 454 |

| Add: Net Debt | 135 |

| Enterprise Value | 589 |

| CY 2022 EBITDA | 77 |

| EV/EBITDA | 7.65 times |

| Implied PE Multiple | 7.96 times |

Compared to GEL which has a valuation of EV/EBITDA 11.4 times & PE 21.5 times, Atraco seems to be a bargain purchase for GEL.

Financials

Though Atraco has only 5 manufacturing facilities, they all are big and have tremendous scope for expansion. The existing capacity utilisation is also low. Further, these facilities are located in low-cost regions with several duty benefits for exports and near to its core USA market. GEL can work out scaling Atraco’s business and shifting some of its existing business to Atraco’s facilities.

GEL will fund the acquisition through a mix of internal accruals & debt. Out of a total consideration of USD 55 million, USD 15 million will be sourced from internal accrual (cash & cash available) while the remaining funds through debt.

| Particulars | Amount (INR in Crore) |

| Total Consideration | 454 |

| Internal Accruals | 124 |

| Debt financing | 330 |

The proposed acquisition will increase the debt for GEL INR 465 crore. Its debt equity ratio (considering the existing NetWorth of GEL) will be 0.53 times after the proposed acquisition so GEL will still be in a comfortable position. As the acquisition will be funded through cash (including debt), there will not be any dilution for existing shareholders of GEL. Considering the additional interest payment & loss of return of existing surplus cash (to the tune of INR 124 crore), Earning Per Share for GEL shareholders on consolidated basis likely to increase by ~17%.

Conclusion

In 2017, the existing promoter of GEL, Mr. Mathew Cyriac acquired a controlling stake from Blackstone Group for a consideration of INR 42 per share. Mr. Cyriac comes from investment banking background with decadal experience with Blackstone India. Post his acquisition he has subsequently reduced his personal stake to Circa 10% and is serving as Chairman & Non-Executive Director on the board of GEL.

The Atraco acquisition might be his last or the latest strategic move for GEL’s value creation. Through proposed acquisition, though small, GEL is likely to obtain multiple strategic benefits. Further, the consideration payable for the acquisition is well within GEL’s comfort level and internal accruals for a year or two will be sufficient to repay long-term debt. Very few Indian entities have been successfully able to integrate & create value from outbound acquisitions. Let us hope this one will be successful.