Genus Group operates with three listed companies with minuscule size of business except for business smart power meter in flagship company and market cap and considerable number of subsidiaries, associates and group companies with cross-holdings and related party transactions, it also makes investments like investment companies in listed securities and mutual funds. There is no commercial rational for the structure and the operations. The group did one demerger of paper business in the year 2011 and till date its market cap is almost same and no growth in business. It is apparent that the flagship business generates high cash surplus and the management in wisdom diversify and allocate capital in unrelated areas and all these businesses generate return much below the cost of capital. Now the management wants to hive off into assets and business worth more than ₹100 crore into another listed group company having market cap of less than 2 crores at the time announcement and hardly any business and loss of more than 20 crores.

Genus Prime Infra Limited (GPIL) is listed on BSE and it engages in the business of infrastructure activity and purchases, sell, exchange and/or transfer of securities shares, debentures, and all other forms of investment and to carry on all kinds of investments activities.

Star Vanijya Private Limited (SVPL) is engaged in the trading business and it is Wholly Owned Subsidiary (WoS) of GPIL.

Sunima Trading Private Limited (STPL) is engaged in the trading business and it is Wholly Owned Subsidiary (WoS) of GPIL.

Sansar Infrastructure Private Limited (SIPL) is engaged in the trading business and it is Wholly Owned Subsidiary (WoS) of GPIL.

Genus Power Infrastructure Limited (GPOWER) is listed on BSE and NSE and it engages in the business of (a) manufacturing and providing metering and metering solutions and undertaking engineering, construction and contracts on Turnkey basis (core business division) through itself or through its subsidiaries and (b) making strategic investment activity where under investments are made in shares and securities basis a thorough and systematic evaluation by the company and the management on a going concern basis with dedicated personnel and technical staff.

Yajur Commodities Limited (YCL) is engaged in the business of manufacturing and trading coke and coal.

The Transaction

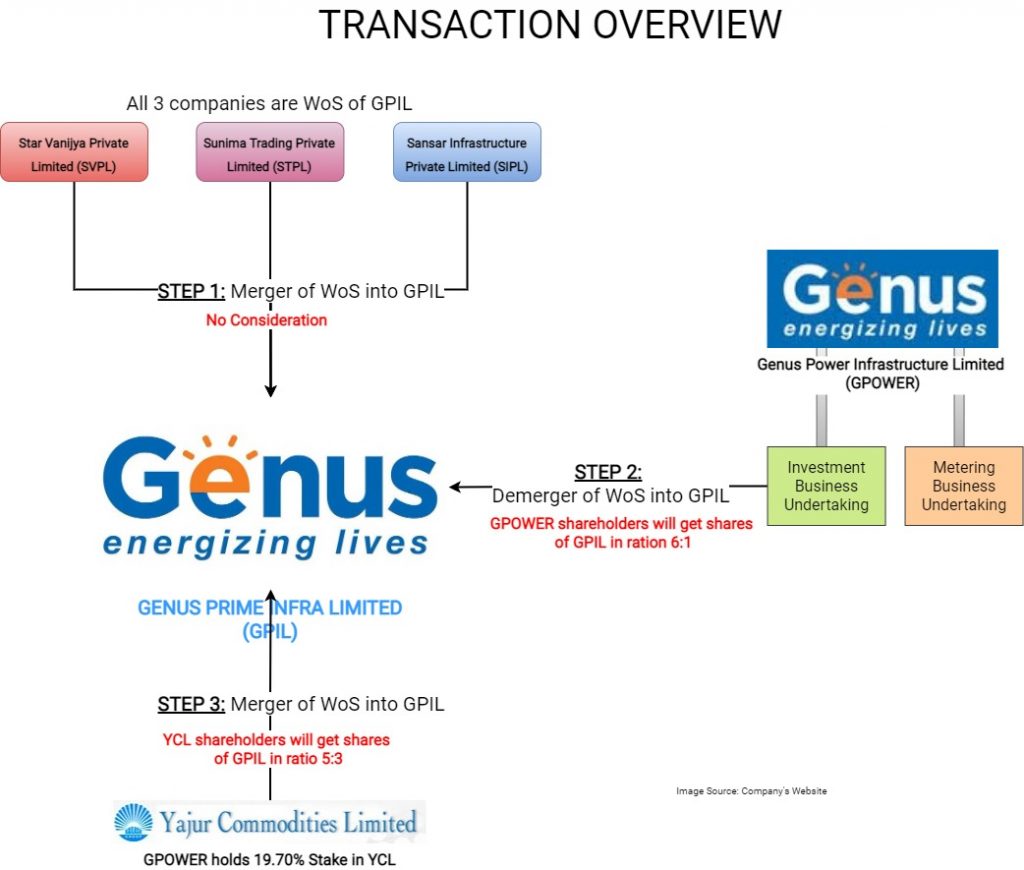

The arrangement is done in three steps as follows:

Step 1: Merger of SVPL, SIPL and STPL with GPIL and

Step 2: Demerger of “Investment Undertaking” of GPOWER into GPIL (as a part of demerger GPOWER transfer share of YCL held by it.) and

Step 3: Merger of YCL with GPIL.

Appointed of New Director:

In December FY 2020-21, GPOWER appointed two new Directors.

Appointed & Effective dates:

- For step 1 and step 2 is date on which scheme sanctioned by NCLT and

- For step 3 (i.e., merger of YCL (Yajur Commodities Limited) with GPIL (Genus Prime Infra Limited)) is the effective date.

Effective date for both the transaction is the date on which certified copy of order filed with MCA.

Financials:

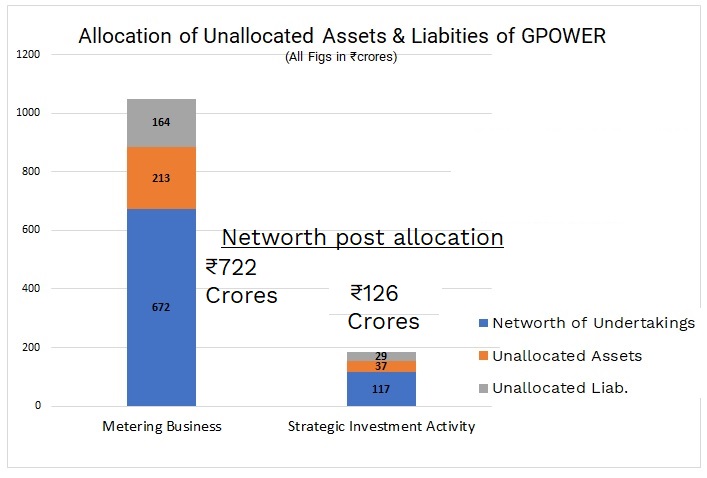

Now let us look at the financials. In FY 2019-20, GPOWER shown only one segment which is ‘Power segment’. However, from June 20 quarter it shows two segments namely ‘Metering business’ and ‘Strategic Investment Activity’. That means it is started looking at either exit or invite a strategic partner.

Total value of assets of ‘Strategic Investment Activity’ division as per segment report H1 20-21 is ₹117.54 crore with the liability of Rs 6 lakh.

The total valuation given to ‘Strategic Investment Activity’ division is Rs 123.53 crore (as per valuation report).

Note:- Unallocated assets and liabilities allocated based on net worth of segment.

In FY 2019-20, Strategic Investment Activity division revenue is ₹ 3 crore with the investment of ₹ 117 crore.

Table1: Financial Statements of GPIL (All figs in ₹ lacs)

| Particulars | FY 2019-20 | FY 2018-19 |

| Revenue | 22.78 | 18.12 |

| PBT | -16.13 | -21.66 |

| Depreciation | – | – |

| Finance Cost | – | – |

| EBITDA | -16.13 | -21.66 |

| Net- Worth | 5,618.84 | 6,850.19 |

| Debt | 1,137.42 | 1,190.80 |

| Debt-Equity Ratio | 0.20 | 0.17 |

Table 2: Financial Statements of YCL (All figs in ₹ Crores)

| Particulars | FY 2018-19 |

| Revenue | 311.99 |

| PBT | -2.05 |

| Depreciation | 3.12 |

| Finance Cost | 14.43 |

| EBITDA | 15.50 |

| Net- Worth | 112.08 |

| Debt | 54.03 |

| Debt-Equity Ratio | 0.48 |

Valuation

For the purpose of valuation, the summation method is used. The summation method is used in case where the assets base dominates earnings capability.

Swap ratio

| S. No. | Particulars | Ratio |

| 1. | Step 1 (Merger of SIPL (Sansar Infrastructure Private Limited), SVPL (Star Vanijya Private Limited) and STPL (Sunima Trading Private Limited) with GPIL) | NA |

| 2. | Step 2 (Demerger of Investment Undertaking of GPOWER into GPIL) | 6:1 (i.e., 1 equity share of FV ₹2 of GPIL for every 6 shares of FV ₹1 of GPOWER) |

| 3. | Step 3 (Merger of YCL with GPIL) | 5:3 (i.e., 3 equity share of FV ₹ 2 of GPIL for every 5 equity shares of FV ₹10 of YCL) For Preference shares is 1:1 |

Shareholding pattern of GPIL:

| Particulars | SHP Pre | % | SHP Post | % | Increase in Nos. of Shares |

| Promotors | 1,11,89,523 | 75% | 4,51,13,213 | 64% | 3,39,23,690 |

| Public | 37,36,917 | 25% | 2,49,80,526 | 36% | 2,12,43,609 |

| Total | 1,49,26,440 | 100% | 7,00,93,739 | 100% | 5,51,67,299 |

After scheme of arrangement of the nos. of equity shares of GIPL increases by 3.70 times.

Taxation

Whether transfer of Investment in associates and in other companies constitutes undertaking as per section 2(19AA) of Income Tax 1961 is a challenge which the company will face even if the scheme is approved by the NCLT as they are getting transferred as a part of demerger.

Strategic for going ahead

M&A as jargon is frequently used to justify schemes in order to consolidate or segregate businesses and its subsidiaries. But any financial structure will not create any value, if it is not supported by strategy, business case and real profit based on prudent capital allocation. The scope of smart electronic meter is increasing in India. As per the recent announcement in budget 2021 government of India is planning to convert all-electric meter into smart electric meters and Atamnirbhar Bharat initiative shall impose restriction and heavy duties on import from China This will give impetus to domestic players to venture into smart electric meters manufacturing. So, GPOWER will have an opportunity to create huge wealth on its own or with strategic partners, after failing to create any substantial value since the last scheme of demerger in 2011. Let us hope this time at least it will create value for its small public shareholders.

Add comment