In 2021, The Securities and Exchange Board of India (“SEBI”) came out with an alternative delisting route for the listed subsidiary. The circular takes the tedious process of delisting to be simplified at least for the listed subsidiary whose holding company is also listed and carrying on the same business. The first company to do so is ICICI Securities Limited & ICICI Bank Limited.

ICICI Bank Limited (“ICICI Bank” or “Holding Company”) is a scheduled commercial bank, is engaged in the business of providing a wide range of banking and financial services including commercial banking and treasury operations. The equity shares of the Holding Company are listed on the BSE and NSE and the American Depository Receipts (ADRs) are listed on the New York Stock Exchange. The NCDs issued by the Holding Company are listed on BSE and NSE, SIX Swiss Exchange Limited, Singapore Stock Exchange and India Inx-India International Exchange IFSC Limited.

ICICI Securities Limited (“ICICI Securities” or “Subsidiary Company”) is engaged in the business of broking (institutional and retail) including allied services of extending margin trade finance and ESOP finance, distribution of financial products, merchant banking and advisory services. The equity shares of the Subsidiary Company are listed on the BSE and NSE. The Holding Company is a promoter of the Subsidiary Company and holds ~74.85% equity shareholding in the Subsidiary Company as on the date of approval of the Scheme by the Boards of the Companies.

The Transaction:

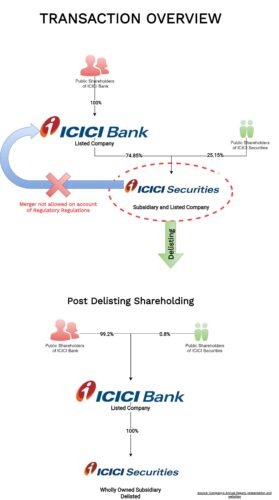

The Board of Directors of ICICI Bank & Securities at their respective board meetings have approved a Scheme of Arrangement (“Scheme”) which inter-alia provides for delisting of equity shares of ICICI Securities by issuing equity shares of ICICI Bank to the public shareholders of ICICI Securities in lieu of cancellation of their shares in ICICI Securities. The proposed scheme is presented under section 230 and other applicable provisions of the Companies Act, 2013.

Effectively, post implementation of the scheme, ICICI securities will become a wholly owned subsidiary of ICICI Bank and be deemed to have been delisted from the BSE and NSE.

The “Appointed Date” for the transaction is the Effective Date. Rationale for the transaction as envisaged under the scheme:

- While there are business synergies between the Holding Company and the Subsidiary Company, a consolidation by way of merger of the Subsidiary Company with the Holding Company is not permissible on account of regulatory restrictions on the Holding Company from undertaking securities broking business departmentally.

- With the Company as a 100% subsidiary, it is expected that both entities would be able to better capitalize on the synergies in line with the Customer 360 focus of the Bank.

- Such delisting would provide significant benefits for the Public Shareholders as they will get equity shares in the Holding Company thereby providing them access to a much larger and more diversified business with greater stability in revenue unlike the securities business which is inherently cyclical as it is significantly dependent on the macro-economic environment and buoyancy in equities market, resulting in volatility in financial performance and share price. The Public Shareholders would also be part of a more liquid stock of the Holding Company.

Consideration:

Pursuant to the proposed scheme, 67 equity shares of the Holding Company of face value INR 2 each, credited as fully paid-up for every 100 equity shares of the Subsidiary Company of face value of INR 5 each. All employees holding employee stock options and employee stock units in ICICI Securities will receive employee stock options and employee stock units, as applicable, from ICICI Bank based on the Share Exchange ratio and the stock options and employee stock units granted by ICICI Securities shall stand cancelled.

Paid-up Capital changes on account of Scheme:

| Particulars | Pre | Post | |

| ICICI Bank | ICICI Securities | ICICI Bank | |

| No. of Paid-up equity shares | 698,28,15,731 | 32,28,67,726 | 703,72,29804 |

| Face Value | 2 | 5 | 2 |

In lieu of cancellation of 8,12,15,034 equity shares of ICICI Securities (representing 25.15% of paid-up capital), ICICI bank will allot 5,44,14,073 equity shares (representing 0.77% of post-issue share capital).

Valuation

To determine the relative exchange ratio, both the companies have appointed joint registered valuers and obtained fairness opinion from the merchant banker.

| Particulars | ICICI Bank | ICICI Securities |

| Arrived fair value per share | 960.8 | 645.2 |

The above fair value of ICICI Securities translates its market capitalisation to circa INR 20,830 crore. Interestingly in 2018, following the trend, ICICI Bank decided to list equity shares of ICICI Securities on nationwide bourses. An offer for sale issue size of circa INR 4000 crore, share price of ICICI Securities was discovered as INR 520 per share. In an undersubscribed IPO, ICICI bank collected over INR 3480 crore for selling 20.78% stake. In 2020, bank further divested stake to 75% for an amount circa INR 644 crore. Later, on account of ESOP’s ICICI Bank stake reduced to 74.85%.

Tentative Gain realised by ICICI Bank till date from selling shares:

| Particulars | Amount in crore |

| Offer for sale | 3480 |

| Further divestment in 2020 | 644 |

| Total amount fetched by ICICI Bank by selling shares of ICICI Bank | 4124 |

| Market value of shares ICICI Bank issuing to make ICICI Securities its WoS | 5240 |

In terms of valuation, in last 5 years, there was not much changed for ICICI Securities.

INR in Crore

| Particulars | FY 2018 | FY 2023 |

| Total Revenue | 1859 | 3425 |

| Profit After Tax | 557 | 1117 |

| Networth | 834 | 2852 |

| Client Base | 4 million | 9.1 million |

Despite significant improvement in all the numbers, ICICI Securities valuation has not been improved so much. Interestingly, the multiples assigned during Delisting are significantly lower than what was assigned while IPO.

| Particulars | For IPO | For Delisting |

| Per Share Value | 520 | 645.2* |

| Market Capitalisation in crore | 16,750 | 20,830 |

| Profit Earning Multiple (PE) | 30 | 18.6 |

| Revenue Multiple | 9 | 6 |

| Market Value per client | 41,878 | 22,892 |

*: The fair value of ICICI Securities arrived in the Valuation Report pertaining to the scheme.Accounting Treatment

The Holding Company shall issue and allot equity shares to the Public Shareholders of the Subsidiary Company and will credit the aggregate face value of its equity shares to its share capital account. The difference between the fair market value of equity shares as on the Effective Date and aggregate face value of the equity shares to be issued by the Holding Company shall be credited to the securities premium account. The Holding Company shall increase the cost of its existing investment in the Subsidiary Company by the aggregate of the fair market value of the equity shares as on the Effective Date.

Effectively, the net worth of the holding company will increase to the extent of fair value of its shares issued to the public shareholders of ICICI Securities.

The Subsidiary Company shall cancel the equity shares held by the Public Shareholders and credit the “Deemed equity contribution from the Parent/Group” account.

Taxability

The above exchange of ICICI Securities share with ICICI Bank’s share will amount to “transfer” under section 45 of the Income Tax Act, 1961 (provided held as capital asset) and will attract capital gains in the hands of public shareholders of ICICI Securities. The ICICI Securities shareholders will have to pay capital gain tax on exchange.

The consideration for tax purposes will be the price of ICICI Bank Share as on Effective Date. Further, the benefit of lower rate of taxation under section 111A/112A of the Income Tax Act, 1961 will not be available as no Securities Transaction Tax will be paid during selling of ICICI Securities share. Further, withholding taxes also required to be paid for shares held by non-residents.

| Particulars | Exchange of Shares through Scheme | Direct Selling on Exchange before Effective Date |

| Tentative Consideration (As on 29.8.2023) | 620.20 | 620.20 |

| Cost (for reference) | 500 | 500 |

| Tax | Capital Gains | Capital Gains |

| Rate of Long-term capital gain tax* | 20% | 10% |

*: Excluding cess & surcharge, if any.Considering current prices, tentative calculation for minority shareholder holding 100 equity shares of ICICI Securities who wishes to swap shares:

| Particulars | Through Scheme | Through Exchange |

| Value of 100 shares of ICICI Securities (Value per share = INR 620.2) | 62,020 | 62,020 |

| Value of 67 shares of ICICI Bank (Value per share = INR 967.8) | 64,843 | 64,843 |

| Assumed Cost of ICICI Securities | 50,000 | 50,000 |

| Long Term Capital Gain | 14,843 | 12,020 |

| LTCG Tax (Excluding surcharge & Cess) | 2969 | 1202 |

| Net Amount Available | 59,051 | 60,818 |

From the perspective of public/minority shareholder, it makes more sense to swap the shares directly through exchange than through the scheme.

Further questions which need to be understand:

- Will there be any implications under section 56(2)(x) for shareholders on account of receipt of shares of ICICI Bank?

- Will there be any cost step up for ICICI Bank for shares held by it in ICICI Securities?

- How withholding tax on shares held by non-resident will be paid?

- Though not applicable to this case, in such arrangements, whether benefit of grandfathering will be available to the shareholders?

SEBI Circular & its impact on the current scheme:

SEBI, in 2021, came out with standard operating procedure for listed company desirous of getting delisted through a scheme of arrangement wherein the listed parent company and the listed subsidiary are in the same line of business. They have also clarified on “same line of business.” The move was to provide a flexible opportunity to the groups whose holding & subsidiary companies are listed & engaged in same set of business but could not consolidated on account of certain regulatory or cost challenges.

Now in particular case under consideration, ICICI Bank is engaged in “Core Banking Operations” while ICICI Securities is engaged in “Broking and allied services.” However, SEBI through a letter dated 20th June 2023 has granted exemption to them from the strict enforcement of Regulation 37 (1) of the SEBI Delisting Regulation read with SEBI Circular in 2021 regarding the requirement of listed holding & subsidiary company in the same line of business.

Effectively, for delisting of ICICI Securities, there will not be any requirement of the reverse book building process and thus, risk of failing of the delisting offer on account of price difference will not be there.

Litmus Paper Test: Approval from Public Shareholder

For sanctioning of the proposed scheme, the scheme is required to be approved by the 2/3rd majority of the public shareholders of ICICI Securities. Of the 25.2% public shareholding of ICICI Securities, 9.48% are held by Foreign Portfolio Investors, 5.08% by domestic institutions and only 7.12% held by the small shareholders (resident individual holding nominal share capital up to INR 2 lacs). Thus, Foreign Portfolio Investors & Domestic Shareholders holds the key for scheme to sail through.

Conclusion

It is the first scheme based on the above-mentioned circular. Though the scheme makes sense for ICICI Bank, in our opinion, ICICI Securities shareholders deserves better treatment.

If one compares the valuation multiple used while deciding IPO price as compared to valuation multiple given by the valuer while working out the swap ratio for the proposed exchange scheme, it may look unfair to ICICI securities shareholders.

On the other hand, if the scheme goes through with all the proper approvals, it should set a precedence for other listed subsidiaries to take a step in this direction while keeping in mind limited value destruction for all stakeholders.