The Board of Directors of DCM Shriram Industries Limited approved a Composite Scheme of Arrangement (“Scheme”) which inter-alia provides for separation of Rayon & Chemical undertakings into respective separate companies along with streamlining the promoter structure.

DCM Shriram Industries Limited (“DCM” or “Demerged Company”) was incorporated in 1989 is engaged in the manufacturing of sugar, alcohol, fine chemicals, industrial fibres, and Defense & Engineering products. The equity shares of the DCM are listed on nationwide bourses.

DCM Shriram Fine Chemicals Limited (“DSFCL” or Resulting Company 1”) was incorporated in 2021, is a wholly owned subsidiary of DCM. The current DSFCL is not engaged in any business operations. Post-demerged, DSFCL will house existing Chemical undertaking of DCM.

DCM Shriram International Limited (“DSIL” or “Resulting Company 2”) was incorporated in 2022, is a wholly owned subsidiary of DCM. Currently, DSIL is not engaged in any business operations. Post-demerged, DSIL will house existing Rayon undertaking of DCM.

Lily Commercial Private Limited (“Lily” or Transferor Company”) was incorporated in 1985, is owned by promoters of DCM. Lily acts as an investment company for the promoters through which promoter holds 18.76% equity shares of DCM.

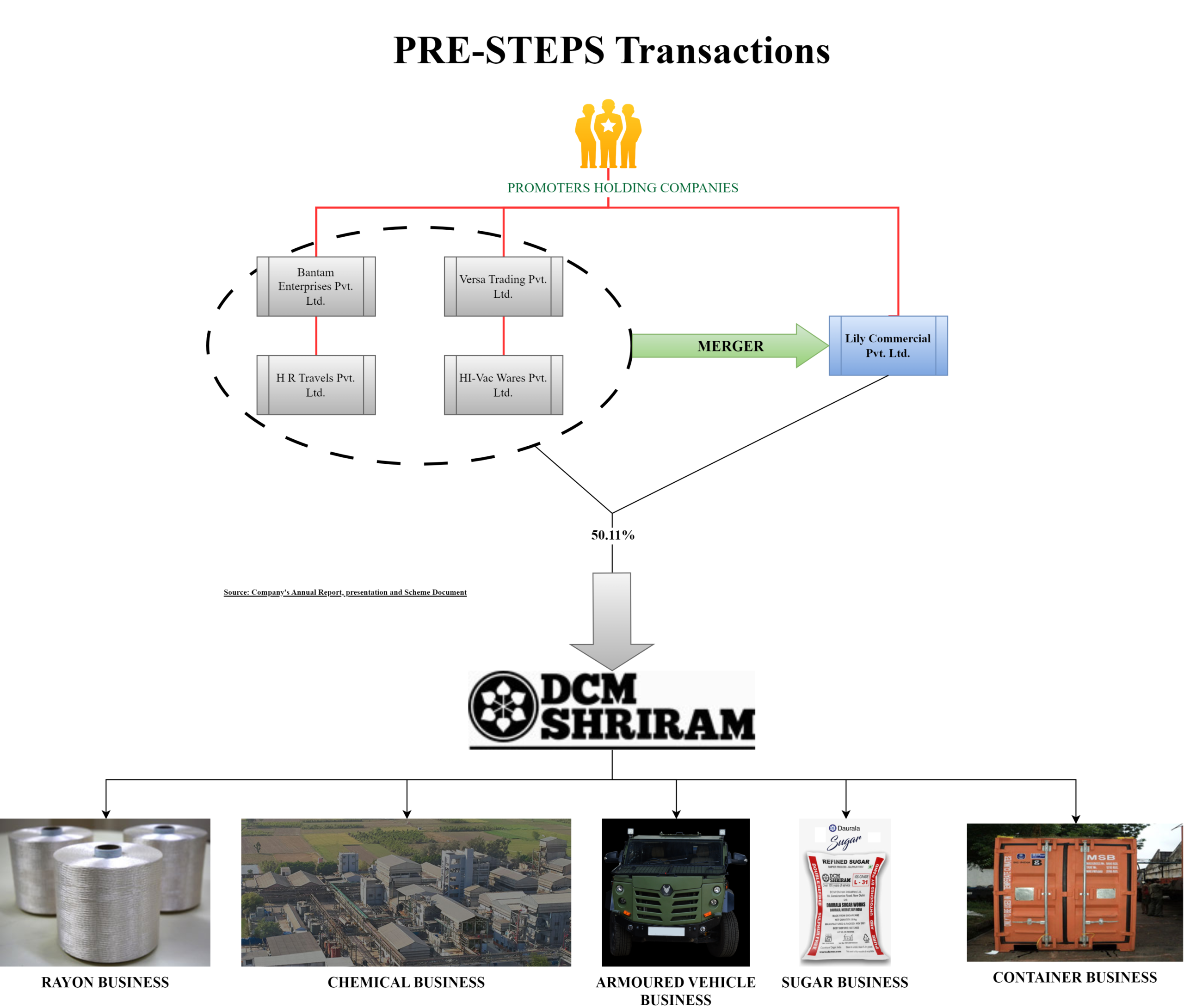

Pre-Step: Streamlining Promoters Holding

Currently, the promoters of DCM hold their entire holding in DCM (50.11%) through 5 investment companies.

| Company Name | % shares of DCM held by the company |

| Bantam Enterprises Private Limited | 7.80% |

| Versa Trading Private Limited | 15.29% |

| H R Travels Private Limited | 3.69% |

| Hi-Vac Wares Private Limited | 4.56% |

| Lily Commercial Private Limited | 18.76% |

In April 2023, the board of directors of all the companies approved a scheme of amalgamation (Consolidation Scheme) which inter alia provided for consolidation of all the investment companies into Lily Commercial Private Limited through the merger. The scheme is yet to be approved by Hon’ble National Company Law Tribunal (NCLT) Delhi bench. As per clause 7.1 of the proposed scheme, amalgamation is precondition for successful implementation of the proposed scheme.

The Appointed Date for consolidation scheme is the same as the proposed scheme i.e., 1st April 2023.

Effectively, the entire promoters’ holding will get consolidated in Lily and subsequently, Lily will get merged with DCM and in effect, promoters will be able to hold shares of DCM directly. After March 2023, Lily has made a right issue of INR 4,50,00,000. It is not clear the purpose of right issue and utilisation of funds raised. It may result in a change in shareholdings and take care of expenses to be incurred for this part of the scheme.

The Proposed Transaction:

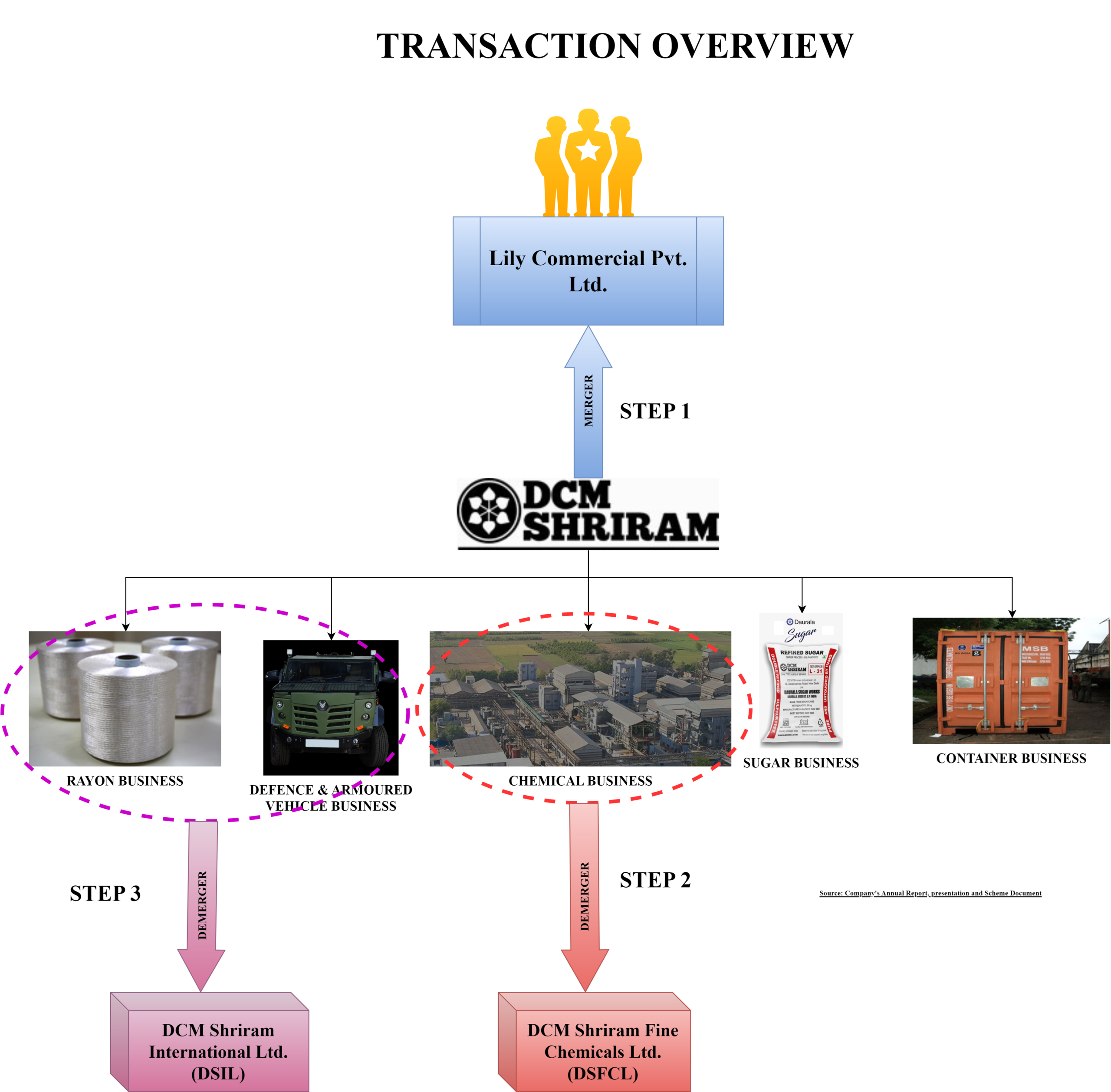

In August 2022, DCM constituted a restructuring/reorganization committee compromising of independent directors to explore possibilities of restructuring the operations of DCM with a view to unlocking the shareholders’ value. The committee provided its recommendation in August 2023 which was subsequently approved by the board of directors. The proposed scheme inter-alia provides for (in chronological order):

- Amalgamation of Lily into DCM;

- Transfer of Chemical undertaking of DCM to DSFCL through demerger;

- Transfer of Rayon undertaking of DCM to DSIL through demerger.

As per clause 7.2 of the proposed scheme, the scheme will become operative only in the above-mentioned sequence. Thus, promoters will be able to hold shares of all three companies (DCM, DSFCL and DSIL) directly.

It is clarified that the Rayon undertaking will include industrial fibers and Defense & Engineering products and chemical business will include fine chemical business of DCM. Sugar business verticals (including alcohol and power) will continue to remain with DCM. The Appointed date for the proposed transaction (all 3 events) is 1st April 2023.

The key rationale for the restructuring:

- Greater management focus on each of the business verticals;

- Operation rationalization, organization efficiency and optimum utilization of resources;

- Allow shareholders to have choice of investment;

- Better price discovery

- Streamlining promoters holding by eliminating shareholders tiers and simplification of shareholding into clear structure identifiable with the promoters

- Facilitating succession planning in future in an orderly and strategic manner.

Shareholding pattern & swap ratio

Swap Ratio for the proposed transaction is as follows:

- For Amalgamation of Lily: DCM will issue 1 equity share of INR 2 each for every 1 equity share of INR 2 each held by Lily in DCM. These shares will be received by the shareholders of Lily in proportion to their shareholding in Lily as on record date.

- For both demergers, DSFCL & DSIL will respectively issue 1 equity share of INR 2 each for every 1 equity share of DCM of INR 2 each.

Capital Structure Pre and Post the scheme fully implemented will be as follows: –

| Particulars | DCM-Pre | DCM-Post | DSFCL-Post | DSIL-Post |

| No. of Shares | 8,69,92,185 | 8,69,92,185 | 8,69,92,185 | 8,69,92,185 |

| Face Value | 2 | 2 | 2 | 2 |

| Promoters Holding | 50.11% | 50.11% | 50.11% | 50.11% |

Currently, both DSFCL & DSIL are the wholly owned subsidiaries of DCM which are yet to commence any business operations. During FY 2023, DCM increased the paid-up capital of DSFCL from INR 1 lac to INR 20 crore. This could be to provide additional support for its chemical business as the share capital will be cancelled due to the demerger and the new shares will be issued directly to the shareholders of DCM.

Pursuant to the merger of Lily, the existing equity share capital of DCM equivalent to 50.11% which will be held by Lily post consolidation scheme will get cancelled and equivalent shares will be issued by DCM to the shareholders of Lily.

As per the valuation report, DCM will issue 1 equity share for every equity share held by Lily in DCM which will be proportionately issued to the shareholders of Lily. Effectively, the only asset of value held by Lily will be an investment in DCM which shall get extinguished, and the same number of shares will be issued by DCM to shareholders of Lily. The value of other assets (net of liabilities) will be equivalent to the cost of this part of the merger. As mentioned in the scheme, shortfall/excess if any will be reimbursed by or to the promoters. As equivalent shares will get issued, there will not be any change in the shareholding pattern of DCM.

As the ratio for demerger is 1:1, each of the businesses will have paid-up capital equivalent to existing capital for the merged businesses.

Other clauses of the Scheme:

- Upon the merger of Lily, the authorized share capital of Lily will be consolidated with DCM and there will be re-categorization of the authorized preference share capital of Lily into equity shares of DCM. Upon the demerger, the authorized capital of DCM shall be reduced by INR 56,00,00,000 which shall be transferred to both DSFCL & DSIL as INR 15,52,50,000 and INR 40,47,50,000, respectively.

- The annexures to the scheme provide details of licenses & immovable properties forming part of demerged undertakings.

- The Accounting treatment followed by the companies will be in accordance with the provisions of Appendix C of Ind-AS 103: Business Combination of entities under common control.

- The Appointed date for the consolidation scheme & proposed scheme is similar i.e., 1st April 2023. To achieve the commercial objective, a consolidation scheme shall be given effect first followed by the proposed scheme. However, the same has not been mentioned in clause 7.2 of the scheme provides for the manner in which the scheme will be given effect.

- Clause 7 of the scheme talks about the conditions precedent to the scheme which includes approval of consolidation scheme. Further, it also envisages a sequence in which scheme will be given effect.

- As per clause 1.1.6 & 3.5.4 of the Scheme, all costs, and charges for amalgamation of Lily will be borne by the promoters.

- The scheme provides for the mechanism whereby the entire transaction cost regarding amalgamation will be borne out of the surplus assets available with Lily. In case of deficiency, the promoters/shareholders of Lily will bring the deficit amount in the manner as maybe decided by them. Any excess surplus amount left after transaction cost will be returned to shareholders of Lily. The same will be evaluated as on record date, after the scheme’s effective date. The intention of the clause is to have no cost burden on the shareholders of DCM on account of this merger. Currently Lily has surplus assets (apart from investment in DCM) of Circa INR 5.5 crore.

- It is not clear whether surplus or deficit will be given/brought by shareholders in Lily or DCM and in which manner.

- Whether the same will be given/returned to all shareholders proportionately or to selected shareholders and in consideration of what. One need to determine its legal & tax implication on the company & its shareholders

- Further, it is also important to evaluate whether the same will be in accordance with section 2(1B) of the Income Tax Act, 1961 which requires all property and liabilities of the transferor company shall become property & liabilities of transferee company.

- The equity shares of DSFCL & DSIL shall be listed post demerger.

- Clause 6.2 & 6.3 of the Scheme specifies the manner in which pending legal, tax or other proceedings shall be continued or if instituted in future be dealt with. It also provides a cost mechanism for how each of the companies shall bear the cost for the same. Clause 6.8 provides for sharing of power between DCM & DSFCL post demerger transaction.

Financials

The Rayon undertaking achieved the highest turnover and operating profits in FY 2023. Further, the company is also expanding the capacity of its rayon business. Further, the company’s defense equipment manufacturing business (which will be part of rayon undertaking) is also slowly picking up. The company has also signed couple of MoU’s for its defense vehicles including Ford Motors USA.

The sugar industry is cyclical & regulated thus the revenues & margins are volatile. The company’s chemical division is performing well and has the highest return on capital employed.

As informed by the company, the net assets transferred as part of the chemical undertaking will be INR 175.42 crore & INR 223.87 crore as part of the rayon undertaking.

Tentative figure as on 31st March 2023 basis the communication done by DCM:

| Particulars | Chemical Undertaking | Rayon Undertaking |

| Assets | 281 | 492 |

| Liabilities | 106 | 269 |

| Net Assets | 175 | 223 |

| Unallocated assets getting transferred | 46 | 12 |

| Unallocated liabilities getting transferred | 42 | 133 |

Conclusion

Two different schemes were combined into a composite scheme of arrangement. The first part of the scheme, being the merger of a promoter entity with the DCM, is to streamline the promoters' holding by giving shares of DCM directly to end promoters. Though enough safeguards have been envisaged under the scheme whereby there will not be any implications for the public shareholders of the DCM on account of the merger, there will not be any benefit out of the amalgamation scheme. However, for some reason the consolidation scheme or Lily merger has not been approved by the Hon’ble NCLT, the demerger scheme will also fail.

Promoters have aligned the transactions in a manner which will allow for all holding companies to get merged into one followed by its merger with the listed company. The demergers will be given effect post amalgamation which will pave the way for individual holding in all the entities/businesses. DCM is one of the oldest groups and direct holding will help in succession planning with optimum cost.

The rayon & chemical businesses are smaller compared to DCM’s core business but are margin accretive and have better return on capital employed. Post-demerger, we may see reshuffling of shareholding between family members including management control.