Recently, Borosil Limited announced the demerger of its “Scientific and Industrial Products business” into Klass Pack Limited, a Subsidiary of Borosil Limited..

Borosil Limited (“Borosil” or “Demerged Company”) is the market leader for laboratory glassware and microwavable kitchenware in India. The Company has two divisions:

- Scientific and Industrial Products (SIP)

- Consumer Products (CP)

Borosil’s Scientific and Industrial Products division manufactures laboratory glassware, instruments, liquid handling systems and explosion proof lighting glassware etc. The products find use in areas as diverse as Microbiology, Biotechnology, Photo Printing, Process Systems and Lighting. Consumer Products division sells microwavable and flameproof kitchenware and glass tumblers. In recent years, Borosil has introduced a range of kitchenware appliances that offer a complete range to its customers.

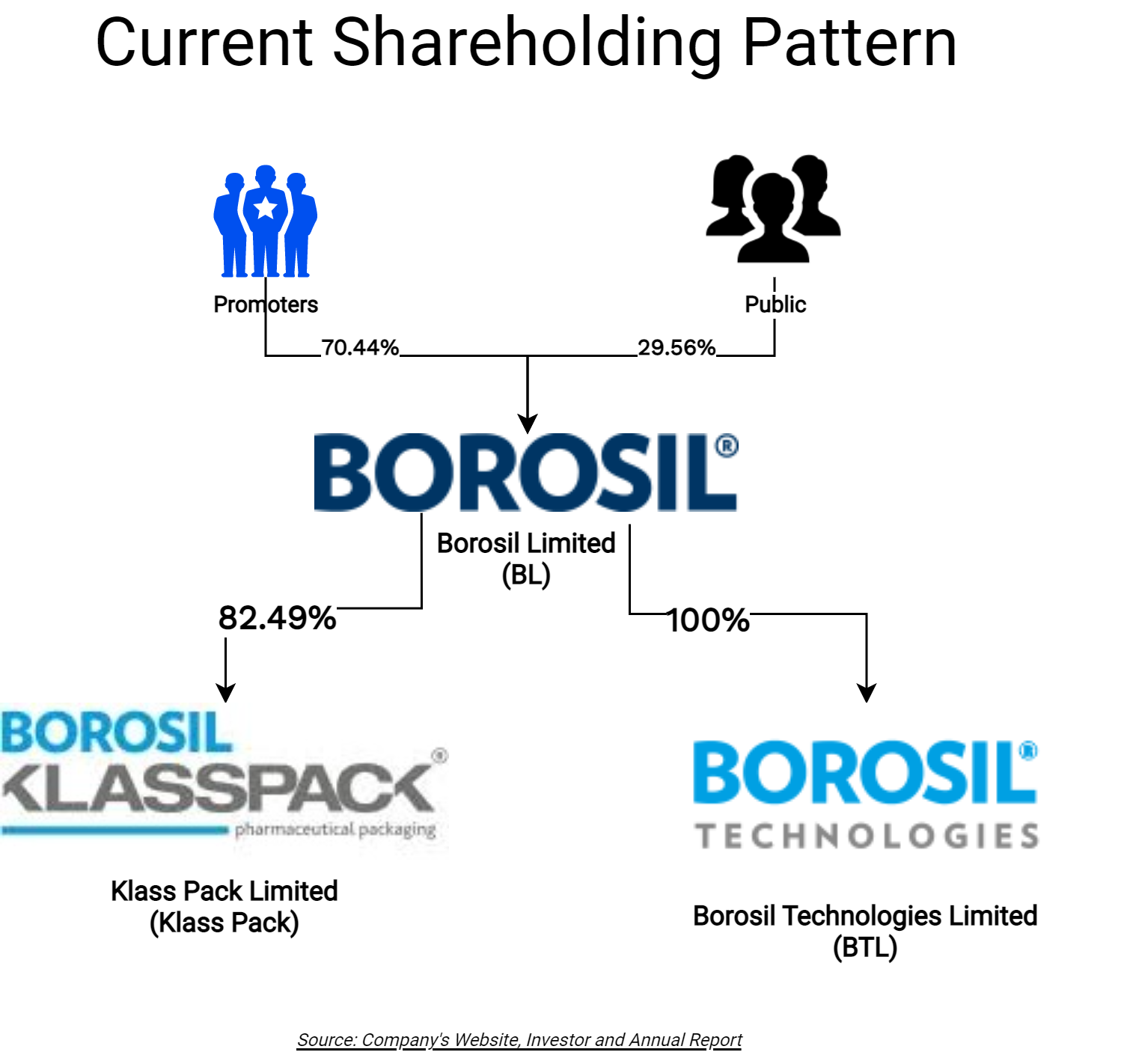

The equity shares of Borosil Limited are listed on nationwide bourses.

Klass Pack Limited (“Klass pack” or “Resulting Company” or “Transferee Company”), incorporated in 1991 is engaged in the manufacturing and supply of pharmaceutical vials and ampoules to the pharmaceutical industry for many years and has its manufacturing facilities at Nashik, Maharashtra.

In 2016, Borosil acquired 60.3% stake in Klass Pack Limited and thereafter increased its holding. Currently, Klass Pack is a subsidiary of Borosil & Borosil holds 82.49% equity stake in Klass Pack. The remaining shares of Klass Pack are continued to be held by original promotors i.e. Amin Family (before Borosil Acquisition).

Borosil Technologies Limited (“BTL” or “Transferor Company”) is a wholly-owned subsidiary of Borosil engaged in the business of manufacturing scientific instruments under the brand name of LabQuest). Currently, BTL supplies its entire production to Borosil.

The Transaction

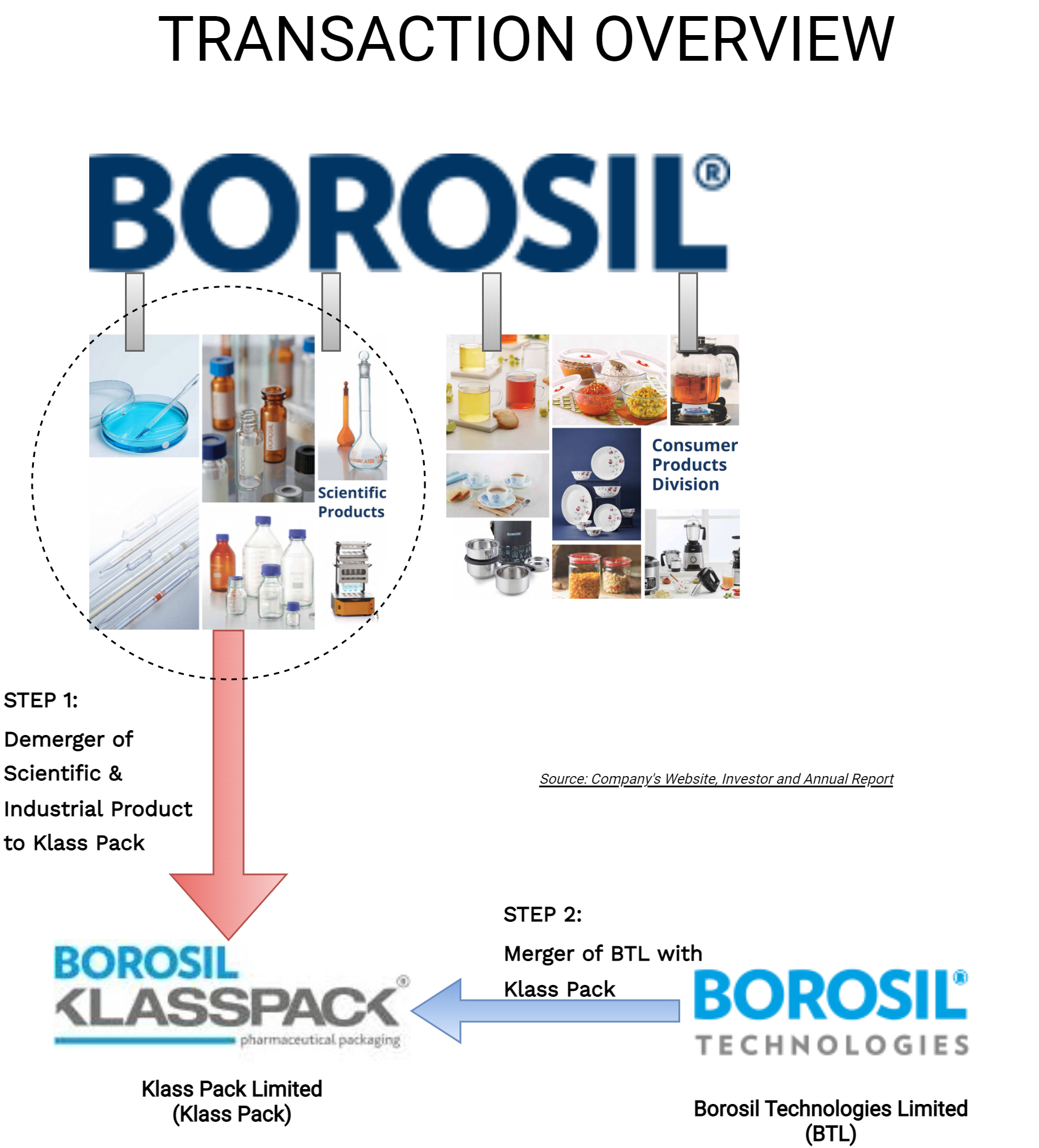

The Board of Directors of Borosil have considered and approved a Composite Scheme of Arrangement amongst Borosil Limited and Klass Pack Limited and Borosil Technologies Limited and their respective shareholders and creditors inter alia providing for:

- Demerger of Scientific & Industrial product division of Borosil Limited into Klass Pack Limited

- Amalgamation of Borosil Technologies Limited with Klass Pack Limited

It is also proposed to reduce and re-organize the existing share capital of Klass Pack Limited to facilitate optimal capital structure post–demerger as a listed entity.

The Appointed Date of the Scheme is April 1, 2022, or such other date as may be decided by the Board of the Parties. It is proposed to rename Klass Pack Limited to Borosil Scientific Limited and list it on the BSE as well as the NSE.

Demerger & Merger

Some of the Rationale as envisaged under the Scheme:

Both the businesses have been functioning as separate profits centres with separate business heads and largely independent teams. Each division is responsible for delivering on its own P&L and this has been the case for quite a few years now. Going forward each of these businesses has distinct capital and operating requirements. The growth path and organic and inorganic growth potential is different which entails different capital raising requirements.

Listing Borosil Scientific Limited on the stock exchange will help to unlock the value of the business for the investors and they can choose to be invested in one or the other or both the businesses.

In the last few years, Borosil is expanding its CP division by aggressively adding new product lines and SKUs other than its original Glassware business. In terms of revenue, these other divisions are now bigger. Non-glass business now constitutes circa 36% of overall CP division and its acquired Opalware business (Larah) constitutes 39% of overall CP division.

For SIP division, Borosil has embarked upon a strategy to add new avenues of growth to supplement its domestic lab glassware by foraying into the export markets for lab glassware and to introduce a range of lab instrumentation in India. Klass Pack exports its products to countries namely USA, Romania, Italy, Saudi Arabia, Bangladesh, Turkey, etc.

Borosil has planned various capital expenditure for both divisions. Regarding CP division, it is expanding its capacity for Opalware production in Jaipur from 42 tons per day to 84 tons per day. This would entail an investment of about Rs.175 Crores. It is also creating a capacity for Borosilicate glass products in India entailing an investment of about Rs.75 Crores also in Jaipur.

Regarding its SIP division, recently board approved an upstream project for the manufacturing of glass tubing. The company currently imports its tubing requirements. The project is expected to cost about Rs.100 Crores. Further, the company undertaking an expansion of capacity of vials and ampoules under Klasspack entailing a Capex of about Rs.75 Crores over the next three years.

Swap Ratio & Shareholding pattern

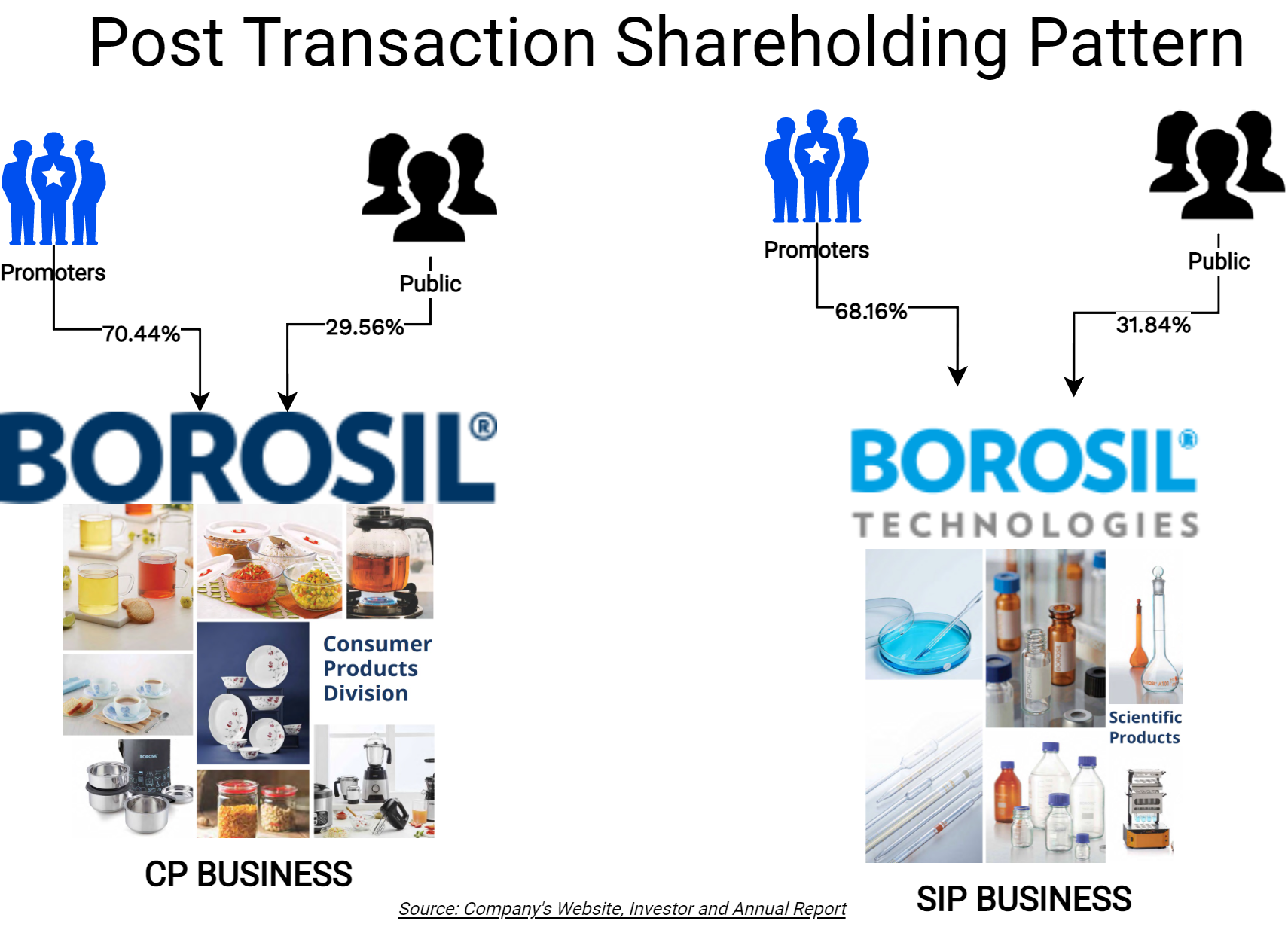

As consideration for the demerger, Klass Pack will issue 3 (Three) equity shares of INR 1 /- each credited as fully paid up (post proposed re-organisation of share capital), to the shareholders of Borosil for every 4 (Four) equity shares of INR 1/- each fully paid up of Borosil

Immediately upon the effectiveness of the demerger, BTL will become a wholly-owned subsidiary of Klass Pack. Accordingly, upon an amalgamation of BTL with Klass Pack, there shall be no issue of shares as consideration.

Pursuant to the scheme, paid-up share capital of the Klass Pack will stand changed from INR 16,32,94,900 divided into 16,32,949 equity shares of INR 100 each to 8,84,75,820 shares of INR 1 each.

Upon listing of the equity shares of Klass pack, Amin Family will hold circa 3.34% shares in Klass Pack & be classified as “Public Shareholders.”

Sharing of Common Facilities:

Clause 25 of the Scheme inter-alia provides for sharing of office space, land, building, manufacturing facility, brands, trademark and other common services including administrative things on such terms and conditions as may be mutually agreed by both the companies post listing.

Accounting Treatment:

The demerger will be recorded in the books of Borosil as well as Klass Pack as per the applicable accounting principles as laid down in Appendix C of the Indian Accounting Standard 103 (Ind As 103) and other Indian Accounting Standards as applicable.

Reduction & Re-Organisation of Equity Shares of Klass Pack Limited

The Scheme inter-alia provides for Reduction & Re-organisation of Equity Shares of Klass Pack before the demerger. Firstly, the face value of the equity shares will be reduced without any payment to shareholders followed by a split for every 1 equity share to 10 equity shares.

The proposed reduction and re-organization are done to achieve an optimum equity share capital of Klass Pack that commensurate with business activities and to match the face value of equity shares of Klass Pack with Borosil.

There will be no consideration for the shareholders of Klass pack for aforesaid reduction and reorganisation.

Table showing re-organisation of capital of Klass Pack Limited

| Particulars | Existing | Post-Reduction & Reorganization | Post-Demerger |

| Paid Up Capital | 16,32,94,900 | 1,63,29,490 | 8,84,75,820 |

| No. of Shares | 16,32,949 | 1,63,29,490 | 8,84,75,820 |

| Face Value | 100 | 1 | 1 |

Earlier Transaction & Value Creation

A couple of years ago in June 2018, Borosil group simplified its group structure by merging group entities and completely separated Scientific ware & Consumer ware business from the group’s solar glass manufacturing business (carried through a listed subsidiary). This restructuring along with tailwinds for the business has created enormous value for minority shareholders.

The Value Creation for Both Entities:

| Particulars | Circa market Capitalisation as on 31st May 2018 | Market Capitalisation on 04.04.2022 |

| Renewable Business | INR 661 crore | INR 8450 crore |

| Borosil (CP+SIP) | Circa INR 1600s crore (excluding investment in the solar glass business) | INR 4350 crore |

We covered the deal in our September 2018 issue.

Financials

Financials for FY 2021

INR in Crore

*: Excluding Common/unallocable

Financials of two divisions for 9 months ending 31st December 2021:

Borosil has surplus cash & cash equivalent of circa INR 220 crore which is divided almost equally between the two divisions.

Valuation

Recently, Tarson Products Limited got listed on nationwide bourses. Though the company is not engaged in comparable products (Borosil in glassware vs Tarson in plasticware) both are targeting the same customer segment of the scientific labware market. Just to set a context/valuation of SIP division, we have tried to compare both companies.

*: Entire Market Cap of entire Borosil Limited.

In the valuation report given, Klass Pack has been valued as circa INR 250 crore & Borosil SIP division has been valued as circa INR 1300 crore (including investment in Klass Pack).

Conclusion

Borosil group has learnt the art of value creation through the demerger. Within a couple of years, Borosil has decided yet another demerger. The last demerger created enormous value for all the stakeholders, especially shareholders. This time, chances of immediate value creation look remote. However, it will facilitate the invitation of new strategic partners and investors to fund future growth.

Add comment