Recently, Aster DM Healthcare Limited (“Aster”) announced much-awaited news for its stakeholders. The Board of Directors of Aster announced the separation of its India & GCC (Gulf Corporation Council) business by selling GCC business held by it.

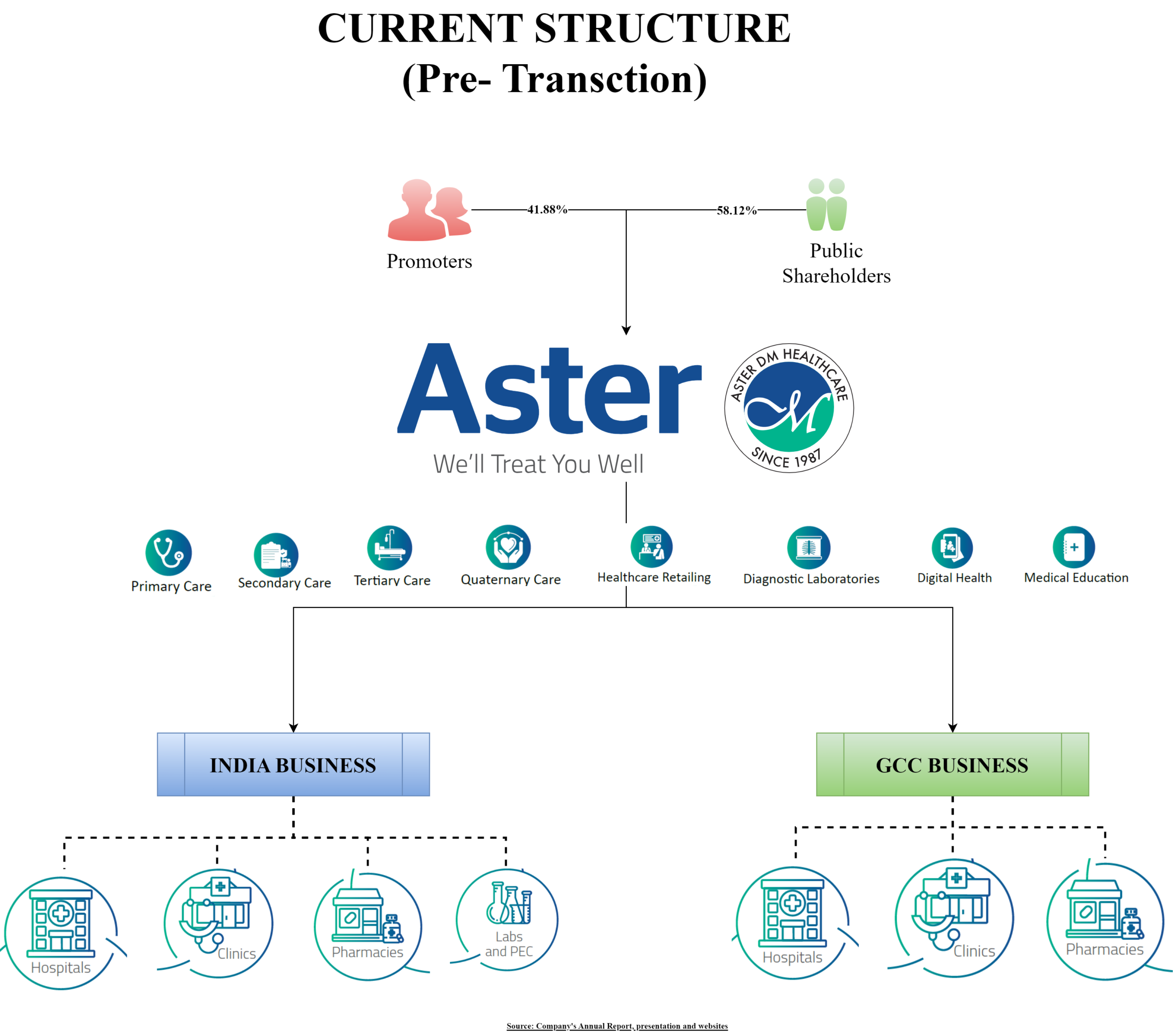

Aster DM Healthcare Limited (“Aster”) is one of the largest healthcare service providers operating in India with a strong presence across primary, secondary, tertiary, and quaternary healthcare through 19 hospitals, 13 clinics, 226 pharmacies (operated by Alfaone Retail Pharmacies Private Limited under brand license from Aster), and 251 labs and patient experience centres across 5 States in India. The equity shares of the Company are listed on nationwide bourses. Currently, Aster has two major geographies in which it operates:

- India

- GCC

Aster DM Healthcare FZC in GCC is a leading integrated healthcare service provider across six countries in the GCC. With a robust integrated healthcare model encompassing 15 hospitals, 118 clinics and 276 pharmacies. Entire stake of Aster DM Healthcare FZC has been held by Aster through a Mauritius entity; Affinity Holdings Private Limited.

The Transaction

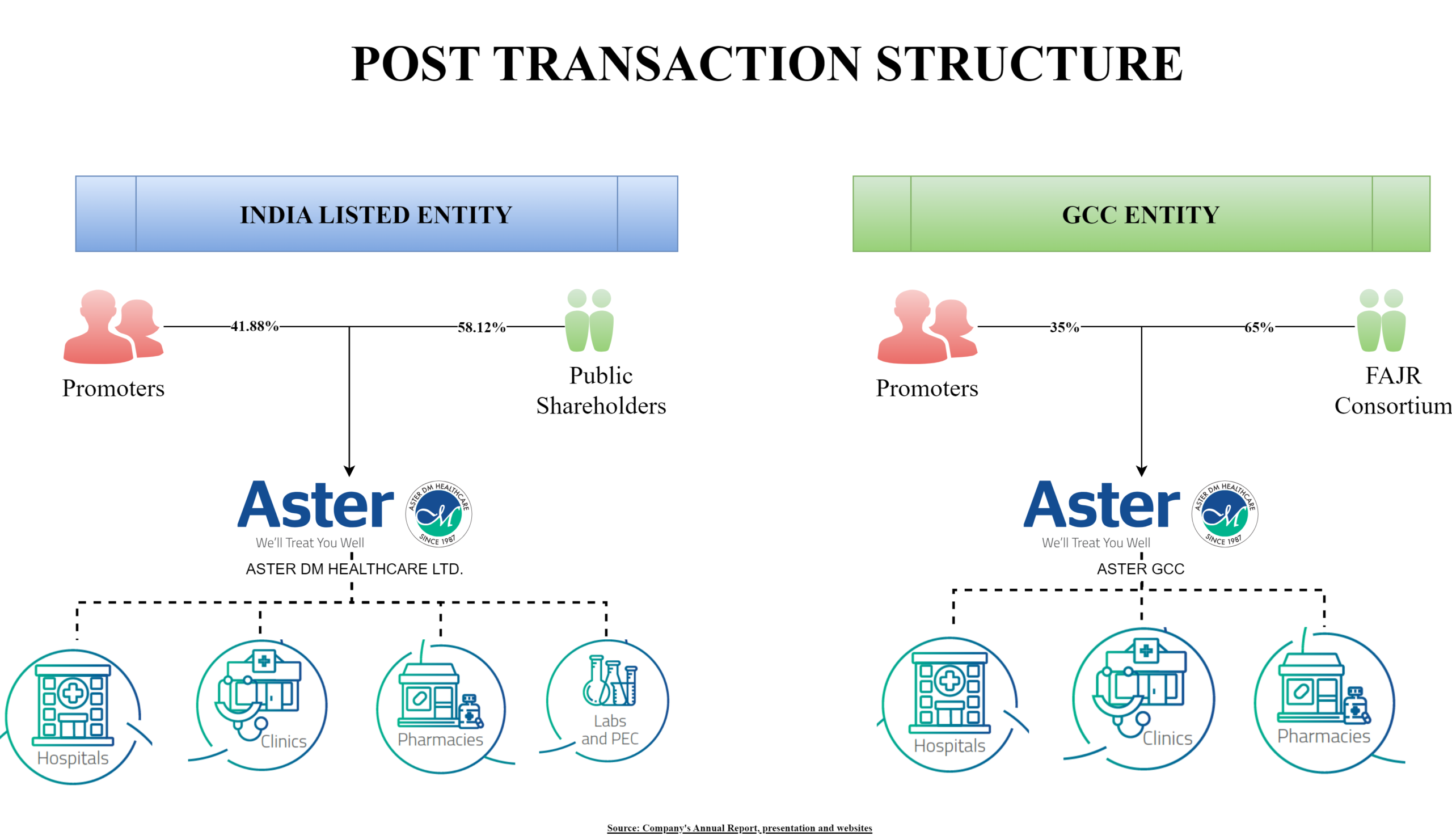

Under the separation plan, Affinity has entered into a definitive agreement with a consortium of investors led by Fajr Capital, a sovereign-owned private equity firm headquartered in the UAE along with Promoters of Aster to divest its 100% equity interest in GCC business. Post-separation Aster will be completely focused on Indian operations.

The enterprise value assigned to GSS business is INR 13,540 crore (USD$1651.2 million). The consideration split is envisaged below:

The transaction is expected to be closed by Q4 FY 2024. Post completion, Dr. Azad Moopen will continue as the Founder & Chairman of Aster overseeing both India and GCC entities. Ms. Alisha Moopen will be promoted to Managing Director and Group CEO of the GCC business to lead a long-term strategy that will unlock value as a pure-play GCC operating company. The Indian entity will continue to be led by Dr. Nitish Shetty as Chief Executive Officer, who will focus on the growth of the India business, aimed at creating value for its shareholders.

As part of transaction documents, Aster has also executed a non-compete and brand co-existence agreement. There will be Perpetual restrictions on the Indian Entities from using/ registering/ enhancing certain identified trademarks (including ‘Aster’) and associated intellectual property in the GCC and MENA regions. There is a similar perpetual restriction on the GCC Entities from using/ registering/ enhancing certain identified trademarks (including ‘Aster’) and associated intellectual property in the SAARC and ASEAN regions.

Rationale

Some of the Rationale as envisaged by the management for separation:

- Creating a pure-play India operating entity

- Clear capital allocation strategy for India business

- Allowing for potential value unlocking

- Enables better understanding of India business by investor community.

Aster came up with an IPO (Initial Public Offering) in 2018 by projecting India + GCC business as its crore strength. GCC business was much larger than the India business. However, GCC being mature business, it never fetched that much interest from investors as by other hospital chains in India. The management realise the mistake of listing GCC business on India markets and imitate steps for separations in early 2022. By reversing the decision, management looking to re-rate its growing India operation as well as funding its capex.

Another reason as envisaged by the management is interest of private equity in pure-play India business. Many of the private equities evaluated an opportunity for investment into Aster however on account of GCC businesses they could not entered. The separation move will enable the company to invite private equity/strategic partner into the company.

Transaction Structure & Taxes

As communicated by the management, they evaluated couple of structures for separation however, considering the incoming investors interest & optimal duties, the separation through stake sale was selected.

Alpha GCC Holdings Limited which will be owned 65% by Fajr Capital and 35% by Mooepan Family (existing promoters of Aster) will purchase 100% equity interest of Aster DM Healthcare FZC from Mauritius subsidiary owned by Aster. Large part of the consideration payable by promoters (Circa INR 2875 crore) for acquiring the 35% stake in GCC business is likely to be funded through distribution of consideration by Aster to shareholders for selling the GCC business. Of course, promoters will need to arrange bridge financing till the money receives back to them (through dividend).

Aster will receive INR 8215 as equity consideration for the deal. The actual sale transaction will be between Mauritius entity & GCC entity, benefits of double taxation avoidance agreement will come into the picture. Thereafter, the Mauritius entity like to upstream the net consideration in the form of dividends & redeemable preference shares to Aster which will help in optimisation of duties in the hands of Aster.

As communicated, Aster will distribute most of the consideration as dividend to shareholders. This transaction will be taxable in the hands of shareholders basis their tax bracket. In all, the major tax consequences will be likely to be only at end leg of the deal which is final distribution of consideration to Aster shareholders. For promoters, their entire holding in Aster (41.41% out of 41.88%) is through Mauritius based entities. For them, this deal likely to have limited direct tax burden. In March 2023, the promoters increase their stake in Aster from 37.88% to 41.88% through Mauritius entity.

INR in Crore

| Particulars | Amount |

| Gross equity consideration | 8215 |

| Transaction Cost (USD$20m million*) | 164 |

| Net Consideration (before taxes) | 8051 |

| Promoters interest (41.88%) | 3372 |

| Infusion required for purchasing 35% stake in GCC business | 2875 |

*: As communicated by the managementIt looks, most of the consideration received by the promoters will go in funding the 35% stake in GCC business. Reminder will be for tax & foregoing the 6.81% stake in GCC business. In all, the deal is well executed for optimal transaction cost.

Financials & India Business

GCC contributes significant part of overall Aster’s business. For FY 23, GCC contributed 75% of the Aster’s revenue. Dr. Moopen started the business from GCC region only.

India Business

Aster’s India business is dominated toward southern part. Its 2nd largest hospital network in South India with presence in Kerala, Andhra Pradesh & Karnataka. Current India capacity is 4855 beds which has grown from 3007 beds in 2018. Aster has also entered Pharmacy & laboratories business as part of its expansion policy.

Growth achieved by the Company in India business:

| Particulars | 2018 | 2023 |

| Revenue | 1178 | 2983 |

| EBITDA Margins | 10% | 18% |

| Presence | 10 hospitals | 19 hospitals |

| ARPOB | 23,700 | 39,000 |

Valuations

| Particulars | Amount |

| Enterprise Value | 10,666* |

| Equity Value | 8215 |

| FY-2023 Revenue | 8950 |

| FY-2023 EBITDA | 1112 |

| EV/Revenue Multiple | 1.2 |

| EV/EBITDA Multiple | 9.6 |

| EV/per bed | 7.41 |

*: Excluding lease liability as per Ind-AS 116.Effective valuation assigned to India business & its comparison to Apollo Hospital Limited.

| Particulars | Aster-India | Apollo |

| Market Capitalisation* | 8385 | 78,500 |

| Net debt | 617 | 1489 |

| Enterprise Value | 9002 | 79,989 |

| Revenue | 2983 | 16,702 |

| EBITDA | 453 | 2138 |

| No. of beds | 4317 | 9155 |

| Occupancy Rate | 68% | 68% |

| ARPOB | 37,900 | 57,931 |

| EV/Revenue Multiple | 3.1 | 4.78 |

| EV/EBITDA Multiple | 19.8 | 37.4 |

| EV/per bed | 2.08 | 8.73 |

*: Market capitalisation has been calculated considering the market capitalisation as on as on deal announcement date less market capitalisation assigned to GCC as part of the proposed deal.Conclusion

No doubt, the transaction will create the simple structure which will help the management of both the businesses and for investors to take investment call. It is also visible that promotors want to hold stake in both the companies and public will continue to hold stake in Indian operations. Indian shareholders including promoters will receive large dividend for sale of GCC business.

The new structure is value accretive to all the respective shareholders.