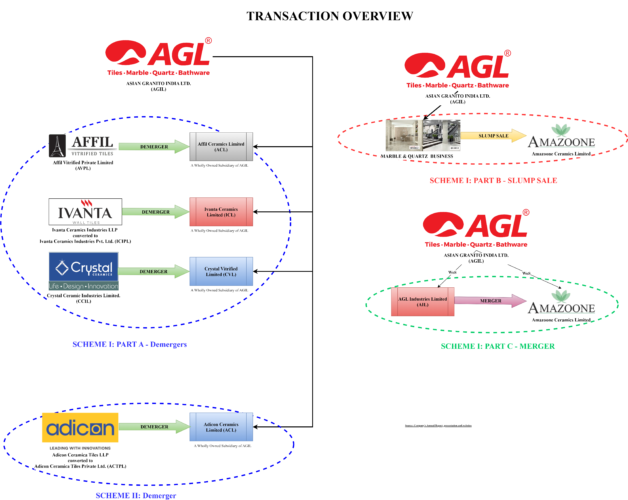

The Board of Directors of Asian Granito India Limited at its Board Meeting approved the Composite Scheme of Arrangement under Sections 230 to 232 and other applicable provisions of the Companies Act, 2013 amongst Asian Granito India Limited and Affil Vitrified Private Limited and Ivanta Ceramics Industries Private Limited and Crystal Ceramic Industries Limited and Affil Ceramics Limited and Ivanta Ceramic Limited and Crystal Vitrified Limited and Amazoone Ceramics Limited and AGL Industries Limited and their respective Shareholders and Creditors (“Scheme 1”).

In addition, the Board of Directors of Asian Granito India at its Board Meeting held on the same day approved the Composite Scheme of Arrangement under Sections 230 to 232 and other applicable provisions of the Companies Act, 2013 amongst Asian Granito India Limited and Adicon Ceramica Tiles Private Limited and Adicon Ceramics Limited and their respective Shareholders and Creditors (“Scheme 2”).

Asian Granito India Limited (AGIL or the Demerged Company 4 or Resulting Company 1) is engaged in manufacturing and trading a wide range of tile products such as ceramic, wall and vitrified tiles, bathware, sanitaryware and marble & quartz products. It currently owns five state-of-the-art manufacturing facilities and one windmill in Gujarat. The equity shares of AGIL are listed on nationwide bourses.

Affil Vitrified Private Limited (Demerged Company 1 or AVPL) is engaged, inter alia, in the business of manufacturing of tiles under the brand name ‘Affil’ and also on job work basis for AGIL, the Resulting Company 1 and trading activities.

Ivanta Ceramics Industries LLP (Demerged Company 2 or ICIL) is engaged, inter alia, in the business of manufacturing of tiles under the brand name ‘Ivanta’ and also on job work basis for AGIL, the Resulting Company 1 and trading activities and will continue the same business activities on conversion and thereafter.

Pursuant to Section 366 of the Companies Act, 2013 read with the rules made thereunder, Ivanta Ceramics Industries LLP is being converted into Ivanta Ceramics Industries Private Limited following the prescribed procedure.

Crystal Ceramic Industries Limited (Demerged Company 3 or CCIL) is engaged, inter alia, in the business of manufacturing of glaze vitrified tiles under the brand name ‘Crystal’ and also on job work basis for AGIL, the Resulting Company 1 and trading activities. The Resulting Company 1 holds 70% paid-up capital of Demerged Company 3.

Affil Ceramics Limited (Resulting Company 2 or ACL) is incorporated to facilitate the transaction is a wholly owned subsidiary of AGIL, the Resulting Company 1.

Ivanta Ceramic Limited (Resulting Company 3 or ICL) is incorporated to facilitate the transaction is a wholly owned subsidiary of AGIL, the Resulting Company 1.

Crystal Vitrified Limited (Resulting Company 4 or CVL) is incorporated to facilitate the transaction is a wholly owned subsidiary of AGIL, the Resulting Company 1.

Amazoone Ceramics Limited (Resulting Company 5 or Transferee Company or AMCL) is engaged in the business of manufacturing of Quartz Surfaces and Marble Surfaces and is a wholly owned subsidiary of AGIL, the Resulting Company 1.

AGL Industries Limited (Transferor Company or AGLIL) is engaged in the business of manufacturing of building construction related materials and adhesive solutions and is a wholly owned subsidiary of AGIL, the Resulting Company 1.

Adicon Ceramica Tiles LLP (Demerged Company 4 or ACTPL) is engaged, inter alia, in the business of manufacturing of tiles under the brand name ‘Adicon’ and also on job work basis for AGIL, the Resulting Company 1 and trading activities.

Pursuant to Section 366 of the Companies Act, 2013 read with the rules made thereunder, Adicon Ceramica Tiles LLP is being converted into Adicon Ceramica Tiles Private Limited.

Adicon Ceramics Limited (Resulting Company 6 or ACL) is incorporated to facilitate the transaction is a wholly owned subsidiary of AGIL, the Resulting Company 1.

The Transaction:

The scheme I is further divided into three parts:

Part A:

Following undertakings to be demerged and transferred in the following manner:

- Affil Tiles Manufacturing Undertaking of Affil Vitrified Private Limited to be demerged into Affil Ceramics Limited.

- Ivanta Tiles Manufacturing Undertaking of Ivanta Ceramics Industries Private Limited (pursuant to Rule 3(2) of the Companies Rules, 2014 read with Section 366 of the Companies Act, 2013, Ivanta Ceramics Industries LLP is being converted into Ivanta Ceramics Industries Private Limited following the procedure prescribed in the rules) to be demerged into Ivanta Ceramic Limited and

- Crystal Tiles Manufacturing Undertaking of Crystal Ceramic Industries Limited to be demerged into Crystal Vitrified Limited

Effectively, pursuant to part A; Asian Granito group will place the privately held tile manufacturing undertakings (currently doing job work for AGL) into different wholly owned subsidiaries of AGL.

Part B:

Following undertaking to be sold by way of slump sale and transferred in the following manner:

- Marbles & Quartz Division of Asian Granito India Limited into Amazoone Ceramics Limited

Effectively, the Marbles & Quartz Division of AGL will be transferred to a wholly owned subsidiary of AGL.

Part C:

Following company to be merged and transferred in the following manner:

- AGL Industries Limited to be merged into Amazoone Ceramics Limited

Effectively, AGL will merge two of its wholly-owned subsidiaries.

The appointed date for the scheme I is 16th October 2023.

Scheme II provides for:

Adicon Tiles Manufacturing Undertaking of Adicon Ceramica Tiles Private Limited (pursuant to Rule 3(2) of the Companies Rules, 2014 read with Section 366 of the CompaniesAct, 2013, Adicon Ceramica Tiles LLP is being converted into Adicon Ceramica Tiles Private Limited following the procedure prescribed in the rules) to be demerged into Adicon Ceramics Limited.

Same as Part A of Scheme I, privately held tile manufacturing undertaking will get demerged into a separate wholly-owned subsidiary of AGL.

The appointed date for scheme II is also 16th October 2023.

Some of the rationale for consolidation:

- Better control on utilization of production capacity due to integration of the manufacturing process;

- Inorganic expansion of production lines and opportunity for further organic expansion due to increased fungibility of the existing funds;

- Economies of scale due to synergistic effect of the combination of the businesses related to similar business line of manufacturing of tiles;

- Enhancing operational efficiencies, ensuring synergies through pooling of the financial, managerial, and technical resources, personnel capabilities, skills, expertise and technologies by bundling the businesses pertaining to different industries.

Financial details of the undertakings getting transferred:

Part B of Scheme 1:

| Particulars | Slump Sale |

| Total Networth | 117.89 |

| Total Revenue | 190.71 |

Financials of the private entities & AGIL under consideration:

All the private entities which will become part of AGIL are currently not making any profits (meagre profits). Most of them have carry-forward losses. Further, it is not clear whether the loan availed by these companies will form part of the transferred undertaking.

Considering the swap ratio report & business valuation report (attached as an annexure to swap ratio report which is being used to determine swap ratio), the valuation given to the respective company is similar valuation considered for undertaking getting transferred. Further, significant revenue of the respective company is from the undertaking getting transferred. Thus, essentially though it is termed as demerger, it is akin to the merger of entire operations.

Capital Structure:

Currently, the private entities getting consolidated with AGIL, are held by AGIL promoters along with public shareholders.

Swap Ratio for the transaction:

| Affil Tiles Manufacturing Undertaking | 73 equity shares of Asian Granito India Limited for every 40 shares held in Affil Vitrified Private Limited |

| Ivanta Tiles Manufacturing Undertaking | 479 equity shares of Asian Granito India Limited for every 12 shares held in Ivanta Ceramics Industries Private Limited |

| Crystal Tiles Manufacturing Undertaking | 695 equity shares of Asian Granito India Limited for every 426 shares held in Crystal Ceramic Industries Limited |

| Slump Sale of Marble & Quartz Undertaking | The consideration of Rs. 102 Crores in one or more tranches, with or without interest |

| Amalgamation of AGLIL with AMCL | (283 preference shares of Amazoone Ceramics Limited for every 444 shares held in Asian Granito India Limited |

| Adicon Tiles Manufacturing Undertaking | 1060 equity shares of Asian Granito India Limited for every 11 shares held in Adicon Ceramica Tiles Private Limited |

| Particulars | AGL-Pre | Scheme I: Part A | Scheme II |

| No. of Paid-up Shares | 14,70,45,316 | 23,19,11,160 | 29,64,75,295 |

| Face Value | 10 | 10 | 10 |

| Promoter Stake | 33.52% | 38.83% | 44.32% |

| Existing Public Shareholders stake | 66.47% | 42.15% | 32.97% |

| New Public Shareholders stake | - | 19.02% | 22.71% |

Please note that the consideration for slump sale will be in cash & pursuant to the merger between two wholly owned subsidiaries, there will not be any change in share capital of AGIL. Pursuant to the mega restructuring, the paid-up share capital of the AGIL will become more than double. The promoters will able to increase their stake from 33.52% to 44.32% while the existing public shareholding will get diluted from 66.47% to 32.97%.

Other nitty-gritties relating to the scheme:

Reason for separate entities:

As envisaged in the scheme, since the suppliers (AVPL, ICIPL, CCIPL, ACTPL) has separate brands names and related Intellectual Property such as brands, trademarks, registrations, etc. attached to these names, it is considered appropriate to demerge this businesses in respective wholly owned subsidiaries of AGIL.

Appointed Date:

The Appointed date for both schemes are 16th October 2023. There could be commercial reason for having appointed date as 16th October 2023. Further, two of the demerged companies (ICIPL & ACTPL) are in the process of getting converted from LLP to Company. Thus, Appointed Date could be selected accordingly.

Why two separate schemes:

Schemes I & II are identical however, ACTPL demerger will be executed through a different scheme. There could be commercial and/or regulatory reasons for executing similar transactions through different scheme. This will avoid dependency of one scheme on other and so can be given effect separately.

Conversion of LLP into Company:

Due to regulatory & tax challenges, demerger from LLP into Company is not doable. Thus, to give effect, the LLPs were being converted into a company before appointed date for demerger.

Tax Aspect:

For the demergers, there won’t be any direct tax in the hands of demerged entity/resulting company or shareholders. As per section 2(41A) of the Income Tax Act, 1961 a holding company (holding 100% share capital of the company in which undertaking getting transferred pursuant to demerger) is also resulting company and may discharge the consideration for demerger. Thus, though undertaking is getting transferred in wholly owned subsidiary, AGIL can issue shares for the demerger.

For Slump Sale, AGIL will pay taxes accordance with section 50B read with rule 11UAE. However, as the difference between networth and consideration will be miniscule.

As far as ICIPL & ACTPL are concerned, the conversion of LLP to company will likely to be tax neutral on account of Section 47(xiii) of the Income tax Act, 1961 and as the transaction is demerger, both ICIPL & ACTPL will continue to exist even after the transaction.

Accounting Aspect:

All the entities involved shall account for the Schemes in their respective books/ financial statements upon receipt of all relevant/ requisite approvals for the Scheme, in compliance with the applicable Accounting Standard 14 ("AS - 14") or Indian Accounting Standard 103 ("Ind-AS 103").

| Demerger |

|

| Slump Sale |

|

Conclusion

The aim of the mega re-structuring is to consolidate private entities mainly doing job work for listed AGIL which will enable AGIL to avoid related party transactions and to form bigger entity. However, it is difficult to understand how the proposed schemes can create value for any stakeholders or benefit public shareholders when capital size is doubling post transaction. Most likely it will significantly dilute ROCE and EPS for AGIL.

It is important to note that existing public shareholders stake is getting diluted from 66.47% to 32.97% while promoters will increase substantially. The scheme will also provide exit opportunity for the non-promotors shareholders of private entities whose undertaking getting demerged.

From the transaction perspective, one really need to understand why the transactions are designed as demergers, selection of appointed date & execution of two different things amongst other. Only time will tell whether this jumbo size of the capital creates value for shareholders even in the long run.