After successful demerger followed by separate listing of its Container Freight Stations/Inland Container Depots Business and Equipment Rental, Logistics Parks and other Real Estate assets, Allcargo Logistics Limited announced yet another restructuring which shall pave the way for the separation of its core international supply chain business followed by simplification of its group structure.

Allcargo Logistics Limited (“ALL” or “Demerged Company” or “Transferee Company 2”) is directly, & indirectly through subsidiaries, engaged in the International Supply Chain Business as well as Express Logistics and Contract Logistics businesses. The equity shares of ALL are listed on nationwide bourses.

Allcargo Supply Chain Private Limited (“ASCPL” or “Transferor Company 1”) is a wholly owned subsidiary of ALL engaged in the business of contract logistics and warehousing.

Allcargo Gati Limited (“AGL” or Transferee Company 1 or Transferor Company 3) is a subsidiary of ALL inter alia engaged in the business of in the business of domestic express and supply chain logistics through its subsidiary Gati Express & Supply Chain Private Limited.

To have a registered office in the same state as that of other companies involved in the transaction, AGL is in the process of transferring its registered office from the state of Telangana to Maharashtra which shall be done before filing of the scheme with Hon’ble NCLT (National Company Law Tribunal). Thus, the composite scheme shall be required to be filed only in one state. The equity shares of AGL are listed on nationwide bourses. As on date, ALL holds 50.16% share capital of AGL.

Gati Express & Supply Chain Private Limited (GESCPL or Transferor Company 2) is engaged in the express distribution and supply chain of goods business. A 30% equity stake of GESCPL is held by ALL while the remaining 70% is being held by AGL. In 2022, ALL provided exit to other JV partner, Kintetsu World Express Group from GESCPL by purchasing the 30% stake for INR 407 crore.

Allcargo ECU Limited (“AEL” or “Resulting Company”) is being incorporated to facilitate the proposed demerge transaction. AEL is a wholly owned subsidiary of ALL.

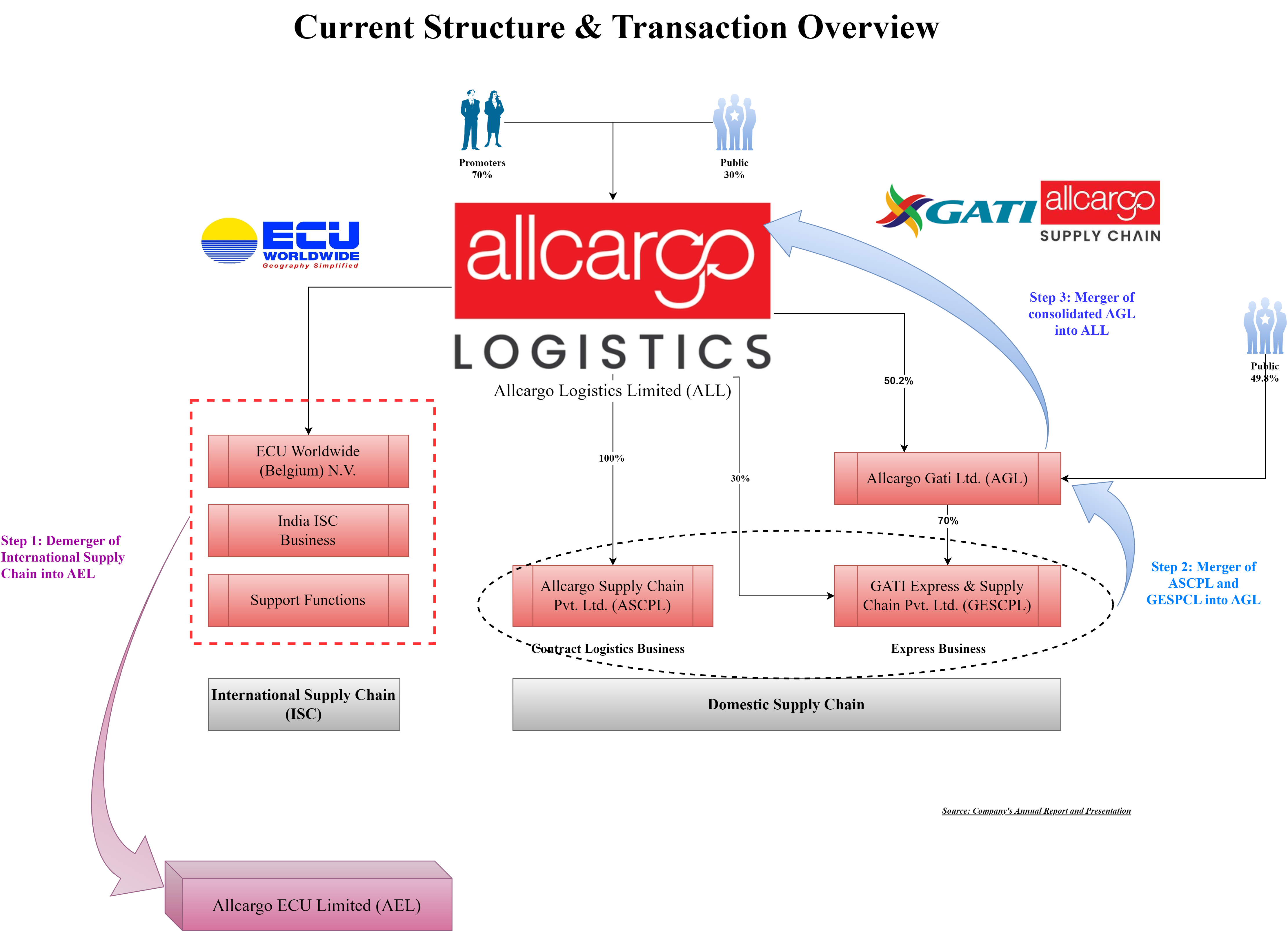

The Current Structure of the Group:

Some of the key pre steps taken by ALL and its subsidiaries:

- In 2019, to expand the business into express logistics, ALL acquired a controlling stake in AGL.

- In 2021, ALL announced demerger of its real estate business (warehousing) & CFS-ICD business into two separate companies and list the equity shares of the respective companies.

- AGL’s express logistic business is being carried through GESCPL which was an earlier 70:30 joint venture between AGL & Kintetsu World Express Group. Keeping in mind the future transaction & other commercial objectives, ALL (instead of AGL) acquired a 30% stake from Kintetsu World Express for a consideration of INR 407 crore.

- In March 2023, ALL acquired the remaining 38.87% stake in ASCPL from its joint venture partner CCI Logistics for an enterprise value of INR 145 crore making it a wholly owned subsidiary. ASCPL was formed in 2016 pursuant to the clubbing of contract logistic business of ALL & CCI Integrated Logistics.

- In December 2023, the board of directors of AGL approved a fundraise of INR 500 crore through various permissible mode including issue of equity shares. The funds are intended for growth capital, expansion, capex, working capital, etc.

- In January 2024, ALL announced bonus issue of 3:1 (three equity shares for every 1 equity share) which tantamount to significant increase in its paid-up capital.

The proposed transaction:

The Board of Directors of ALL & other companies approved a Composited Scheme of Arrangement (Scheme) which provides for demerger of international supply chain business carried by ALL followed by simplification of its key subsidiaries. The proposed composited scheme inter-alia provides for:

Step 1: Demerger of demerged undertaking from ALL to AEL.

Step 2: Amalgamation of Transferor Company 1 & 2 with Transferee Company 1.

Step 3: Amalgamation of Transferor Company 3 with Transferee Company 2.

The demerged undertaking includes international supply chain business, which ALL do in India as well as the business that ALL do across the world under the group level subsidiary, Allcargo’s Belgium subsidiary, which is ECU Worldwide N.V. So, the international supply chain business, the India as well as the international part will get demerged into Allcargo ECU Limited.

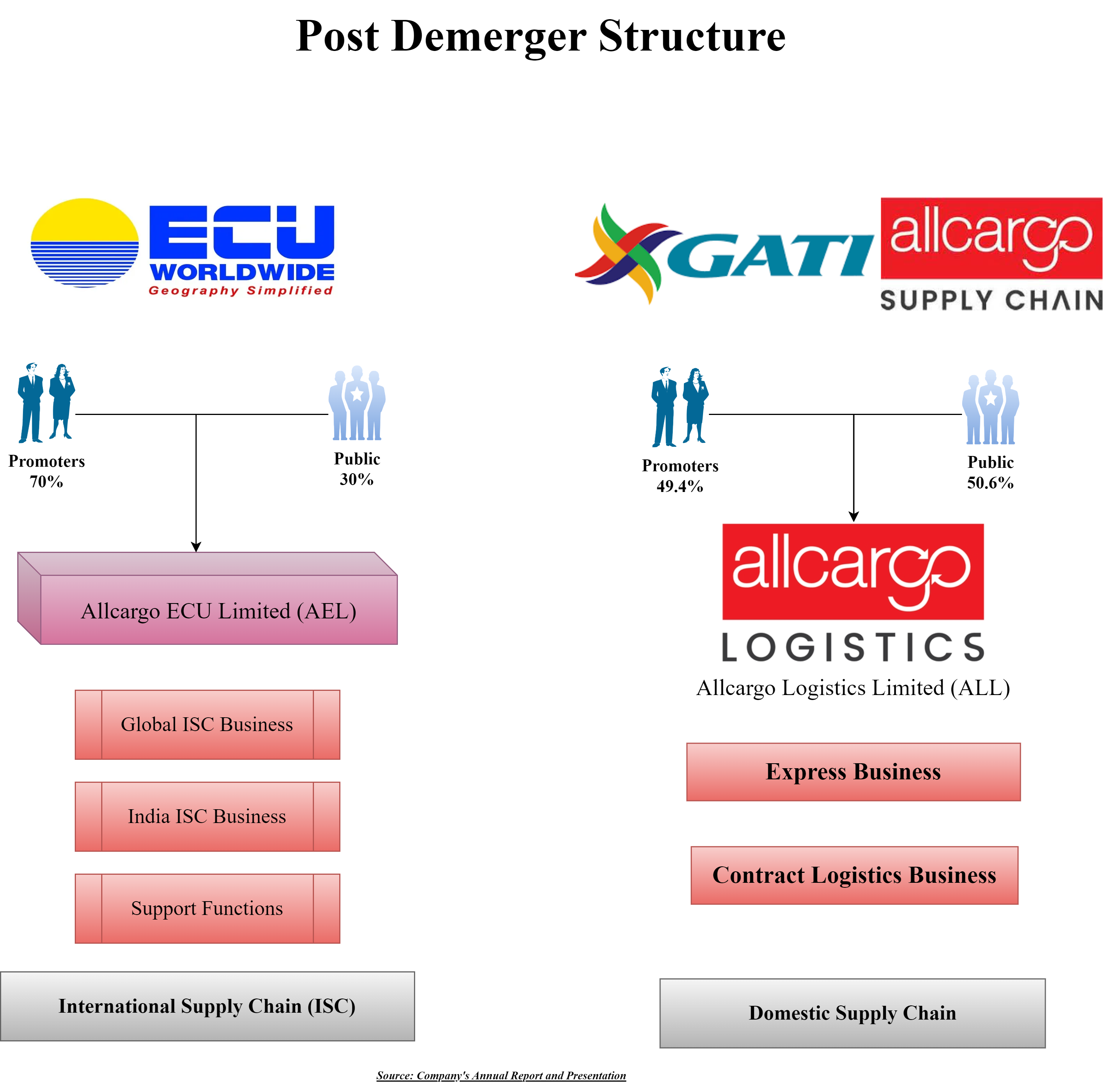

The Scheme shall be given effect in above-mentioned order. Clearly, each part of the proposed transaction has been structured in such a way that existing shareholders of ALL shall continue to retain shareholding in the international supply chain business in the same % as they are holding currently while there will be dilution post AGL merger.

Excluding the demerged business, ALL holds two other businesses through subsidiaries, Express supply chain & contract logistics business. Express supply chain business has been held by GESCPL which is 70:30 equity sharing with AGL & ALL. Apart from a 70% equity interest in GESCPL, AGL don’t have other significant assets (its fuel station business is being held for sale).

Contract logistics business is carried through wholly owned subsidiary ASCPL. In step 2, as transferor companies 1 & 2 will get merged with AGL, ALL stake will get increased in AGL which shall be cancelled pursuant to AGL merger with ALL.

Some of the rationale for the scheme:

- The transaction would enable creation of an independent company focusing on the International Supply Chain Business.

- The businesses of Transferee Company 1, Transferor Company 1 and Transferor Company 2 are complementary in nature, with similar strategies, target markets, growth opportunities, industry dynamics, competition, risks, and challenges.

- The Scheme shall provide for simplification of the corporate structure and reducing the number of legal entities. The International Supply Chain Business will be undertaken by the Resulting Company, which will be directly owned by the shareholders.

- The transaction shall lead to focused and efficient management control, independent growth plans, financial independence, streamlining operations, and optimising costs.

The composite transaction will have two different Appointed Dates. For Steps 1 & 2, the Appointed date will be 1st October 2023 and for Step 3 i.e. Amalgamation of AGL with ALL, the Appointed Date will be the Effective Date.

The probable reason for keeping AGL merger appointed date as effective date could be to draw clear-cut separation between transactions and probable fundraise by AGL in near future.

Consideration & Swap Ratio

The proposed scheme involves multiple steps and thus, the equity shares will be issued at various stages of the scheme. Further, recently ALL also issued bonus shares in the ratio of 3:1 (Three equity shares for every 1 equity share). Pursuant to the same, the paid-up capital of ALL has increased substantially.

Demerger of International Supply Chain:

As the swap ratio is 1:1, the shareholding pattern of AEL will be mirror image as that of ALL. The existing shares held by ALL in AEL will be cancelled. There will not be any impact on the shareholding pattern of ALL.

Consolidation of ASCPL & GESCPL:

Currently, ASCPL is a wholly owned subsidiary of ALL while ALL holds 30% equity stake in GESCPL. Pursuant to their merger with AGL, AGL will issue additional shares to ALL.

Further, on consolidation of AGL with ALL being the final leg of the proposed transaction, ALL will issue its own equity shares to the public shareholders of AGL. ALL’ holding in AGL will get cancelled.

Interestingly, the steps have been designed in such a way so as to have minimum dilution for existing shareholders of ALL when ultimately AGL will get consolidated with ALL.

Existing Capital of Subsidiary Companies:

| Particulars | ASCPL | AGL | GESCPL |

| No. of paid-up shares | 22,91,57,113* | 13,02,37,337 | 5,00,000 |

| Face Value | 10 | 2 | 10 |

*Excluding 1,97,28,682 OCRPS (Optionally Convertible Preference Shares)| Particulars | ALL-Pre | ALL-Post | AEL-Post |

| No. of paid-up shares of INR 2 each | 98,27,82,096 | 139,00,00,000* | 98,27,82,096 |

| Promoters Stake | 70% | 49.4% | 70% |

*: Tentative number & excludes the effect of proposed fundraise through equity issueClearly, the number of equity shares for ALL’s contract & Express logistics business which has done turnover of circa INR 1800 crore in FY 2023 will be significantly high and one needs to evaluate whether it commensurate with the size of the operations ALL will be having post-demerger.

| Particulars | Swap Ratio |

| For Demerger of International Supply Chain Business | 1 equity share of AEL for every 1 equity share of ALL. |

| On merger of Transferor Company 1 with Transferee Company 1 | 2 equity shares of AGL for every 1 equity share of ASCPL. 1 Redeemable Preference Share of AGL of for every 1 OCRPS of ASCPL (option of conversion on OCRPS has been rescinded by the holder of OCRPS) |

| On merger of Transferor Company 2 with Transferee Company 1 | 3475 equity shares of AGL for every 10 equity shares of GESCPL |

| On merger of Transferor Company 3 with Transferee Company 2 | 63 equity shares of ALL for every 10 equity shares of AGL. |

Financials:

Progress & margins of various businesses of ALL for FY 2023 & FY 2021 years:

| Particulars | International Supply Chain | Express (AGL) | Contract (ASCPL) |

| Revenue | 16,333 | 1469 | 341 |

| EBITDA | 1059 | 72 | 121 |

| Capital Employed | 2433 | 846 | 165 |

| FY 2021 | |||

| Revenue | 8449 | 1012 | 255 |

| EBITDA | 456 | 38 | 104 |

Both the International Supply Chain & Contract Logistics business of ALL is having decent operating margins & better return on capital employed. AGL, being acquired in 2020, is still a turnaround story looking for an outcome. Hopefully, with consolidation of contract logistics business, AGL’s number improves. There is also unallocated capital employed of circa INR 500 crore. There is no clarity on how this will be bifurcated.

Comparison between Contract Logistics & Express business carried by ASCPL & AGL respectively for FY 2023:

| Particulars | ASCPL | AGL |

| Revenue | 341 | 1469 |

| EBITDA | 121 | 72 |

| EBIT | 42 | 14 |

| PAT | 14 | -5 |

Valuation

Assigned valuations to various entities involved:

| Particulars | Tentative Valuation (INR in Crore) |

| AGL | 2025 |

| GESCPL | 2650 |

| ASCPL | 720 |

| ALL-Post demerger | 2378 |

Conclusion

All Cargo’s yet another mega restructuring aim is to separate its core international supply chain business into a new entity while directly housing the contract & express business into it. As informed by the management, the transaction is the last leg of their effort to create multiple listed entities for each of the businesses with streamlined structure.

No doubt, the transaction is complex as it involves multiple entities and an appointed date, it has been structured in such a way that there will be minimum dilution for all cargo’s shareholders however, there may be additional transaction cost in terms of stamp duty. The group started the idea of this proposed transaction much early and taken a few pre-steps in accordance with the final desired structure. Despite many efforts, AGL is still waiting to turn around its business. May the final consolidation with contract logistic business will be able to bring shiny days for AGL/express business.