Private equity groups Bain Capital, Carlyle Group and Cerberus Capital Management are set to make binding bids in the next few weeks to buy out Gautam Adani’s six-year-old shadow bank, Adani Capital, as the billionaire businessman looks to exit non-core businesses and conserve cash for his principal operations, said multiple people involved.

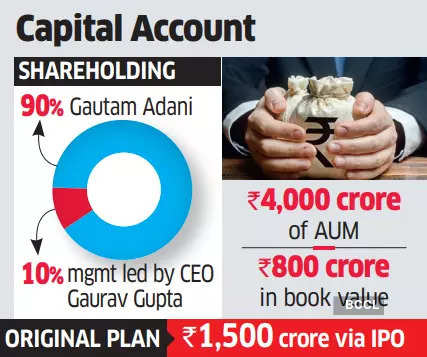

Adani Capital’s management — led by former Lehman Brothers and Macquarie investment banker Gaurav Gupta, who joined the conglomerate in 2016 — owns around 10% of the company. The promoters own nearly 90% of the firm, which is up for grabs.

The funds are looking at a 100% buyout even if the incumbent management team continues to run the business.

The company has Rs 4,000 crore of assets under management (AUM) and Rs 800 crore in book value. Adani Group is believed to be expecting 2-2.5 times the book value, which translates to a Rs 2,000-crore valuation.

There will also be a Rs 1,000-Rs 1,500 crore primary infusion in the company by the new investor as growth capital, said the people cited above.

Depending on the final valuation, the promoters are expected to take a final call on whether they will retain a small stake for future value upsides. Most bidders, however, are keen on full ownership of the business.

The company was planning an initial public offering early in 2024, Bloomberg reported last July, quoting managing director and chief executive Gupta, to raise Rs 1,500 crore ($188 million), offering about 10% stake at a target valuation of around $2 billion. This was before it came under the short-seller’s attack late in January this year.

Being associated with Adani Group has resulted in limitations in fund flow for the shadow bank, whose raw material is money, as most banks and lending groups are nearing the group exposure limits, added the sources mentioned above.

Adani is now working with Avendus for the sale process.

Bain and Carlyle have both made big bets in the financial services sector in India, ranging from investments in banks and NBFCs to insurance and card companies such as Axis Bank, L&T Finance, IIFL Wealth, HDFC, Yes Bank, SBI Cards and SBI Life Insurance.

Cerberus is a special situations specialist, with $60 billion of assets in various pools. It was in the fray to acquire the Rs 48,000-crore bad loans portfolio of Yes Bank. It also recently led the $1.7-billion financing of the SP Group promoters, who pledged part of their Tata Sons’ holding to raise money.

What’s on Offer

The financial services arm offers both retail and wholesale lending across six verticals. The farm sector is the largest vertical in terms of assets under management.

It also gives business loans to small and medium businesses for buying commercial vehicles and homes, loans against property and does supply chain financing across a wide footprint of 160-plus branches in nine states — Gujarat, Maharashtra, Rajasthan, Karnataka, Andhra Pradesh, Telangana, Madhya Pradesh, Uttar Pradesh and Tamil Nadu. No state contributes more than 36% to the portfolio, resulting in low concentration risks, according to Crisil rating.

Mails sent to the Adani Group spokesperson and Gupta on Saturday did not elicit a comment till Sunday press time. Carlyle and Bain declined to comment. Cerberus Capital remained unavailable for comment.

The company witnessed a healthy three-year compounded annual growth of ~61% pre-pandemic. Growth during the first quarter of fiscal 2022 was impacted by the second wave of Covid-19, but improved in the subsequent quarters.

“Anyone looking at a readymade platform and a management team would be best suited for this,” said a person in the know. “The business lacks scale compared to many of its larger peers, and has been trying to create a niche in segments that were either vacated by others or had growth opportunities. But it constantly needs funds to grow and that is a challenge at this moment for the promoter, who would rather focus on his core infrastructure operations for now. Hence the divestment.”

“If you are listed, then your ability to raise incremental capital is higher,” Gupta was quoted as saying in a Bloomberg article from June 29 last year. “We are not a fintech company, but a credit company that is leveraging technology to acquire or underwrite customers more effectively.” The lender uses a direct-to-customer distribution model and 90% of the business is self-generated, Gupta had added.

Several other funds, including Arpwood and CVC Capital, have also been approached, but the sources cited said they were unlikely to pursue the NBFC’s acquisition.

Crisil, in its May 2022 analysis, noted that during the first wave of the pandemic, the company had provided a moratorium to its customers. Collections declined during the initial months but improved thereafter. Intermittent lockdowns and localised restrictions amid the second wave again impacted collections.

While this has improved subsequently, any change in the payment discipline of borrowers or subsequent waves may affect delinquency levels.

Adani Capital and Adani Housing witnessed an inch-up in overall delinquencies in retail asset classes during the first half of fiscal 2022 owing to the second wave-induced lockdowns; they have, however, improved. The 90+ days past due stood at 1.3% as on March 31, 2022, compared with 2.4% as on September 30, 2021, (1.3% as on March 31, 2021).

Source: Mint