India’s Intas Pharmaceuticals and Dr Reddy’s Laboratories are in talks to acquire Athenex Inc in a $200-250 million (₹1,580-1,980 crore) deal, as the US-based biotechnology firm looks to sell a controlling stake. The two Indian pharma companies are competing with a handful of mid-market healthcare-focused private equity funds in the US, people with knowledge of the matter told ET.

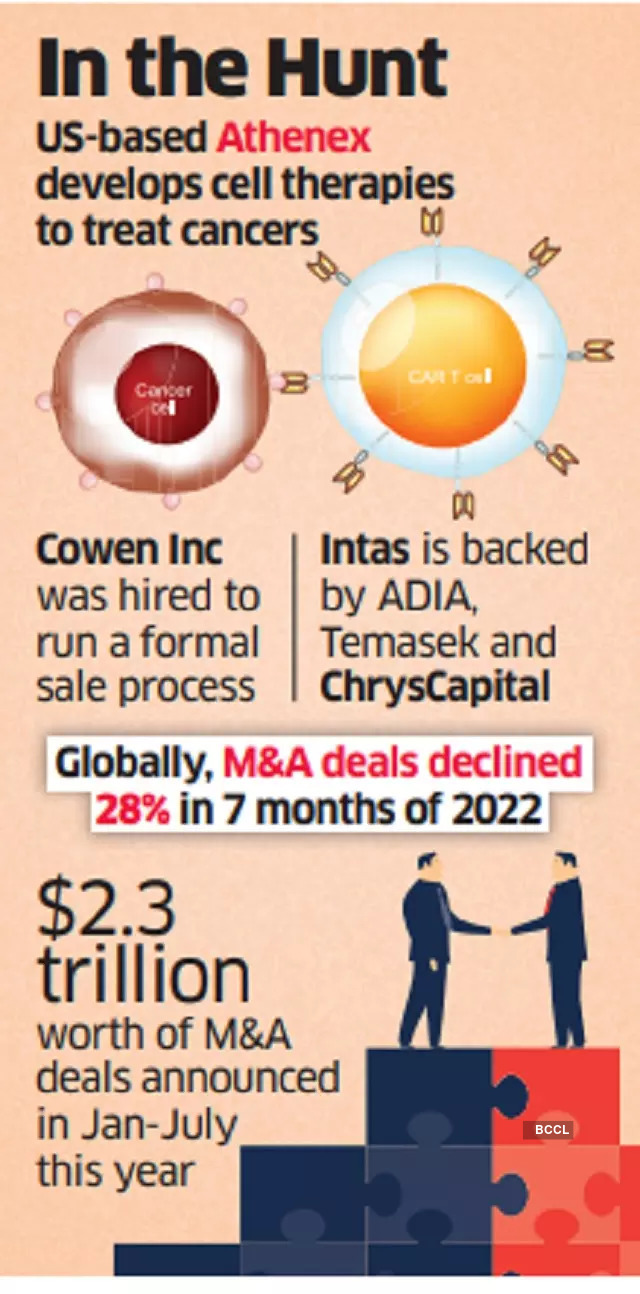

Athenex, which is into the development of cell therapies to treat cancers, had hired investment advisory firm Cowen Inc to run a formal process to find a buyer.

“A formal process has started and the first round of offers have come in,” said one of the people. “Intas and Dr Reddy’s are the two Indian firms in the race at present. A transaction could be concluded during the current quarter.”

A mail sent to Athenex on Tuesday remained unanswered at the time of going to press Thursday. Intas and Dr Reddy’s also did not respond to emails seeking comment.

Athenex has raised more than $250 million in private capital since it was founded in 2002. Its drug-delivery system enables existing chemotherapy drugs that are given intravenously to be administered orally. Athenex products in development include an oral version of paclitaxel, a treatment for breast, lung, ovarian and pancreatic cancer. The company also develops supportive-care products for cancer patients, addressing conditions such as chemotherapy-induced nausea. Athenex has its North American headquarters in Buffalo, New York, and Asian headquarters in Hong Kong.

In one of the largest outbound deals in the pharma space, Intas had acquired Actavis UK & Actavis Ireland from Teva Pharmaceutical Industries for 600 million pounds in 2016.

Intas is backed by the Abu Dhabi Investment Authority (ADIA), a sovereign wealth fund owned by the Emirate of Abu Dhabi. ADIA had recently invested $260 million to buy a 3% stake at a valuation of $8.5 billion. Temasek Holdings and ChrysCapital also hold minority stakes in the Indian drug manufacturer.

Dr Reddy’s also keeps expanding global footprints with multiple buyouts. In June, it acquired a portfolio of branded and generic injectable products from US-based Eton Pharmaceuticals for an upfront payment of about $5 million in cash, plus contingent payments of up to $45 million. In February, Dr Reddy’s acquired Germany-based

Health GmbH, a licensed pharmaceutical wholesaler focusing on medical cannabis in Germany.

Major buyouts of Dr Reddy’s include Betapharm ($570 million deal in 2006), OctoPlus ($36 million in 2012) and Cidmus ($61 million in April 2022).

The Indian pharmaceuticals industry has seen deals worth $922 million in the second quarter of 2022 against $1 billion during the same period in 2021, according to IVCA-EY data.