In an attempt to clean up its books before the announced merger with its subsidiary bank, HDFC Ltd is in the final stages of selling four large distressed accounts, including that of Subhash Chandra-promoted Siti Networks, to Assets Care and Reconstruction Enterprise (ACRE), two people aware of the discussions told ET.

ACRE, a buyer of soured loans, has given a binding bid of Rs 270 crore to acquire mortgage-financier HDFC’s Rs 577-crore portfolio of the four corporate accounts, the people cited above said. Its offer equates to a recovery of 47% for India’s biggest home financier.

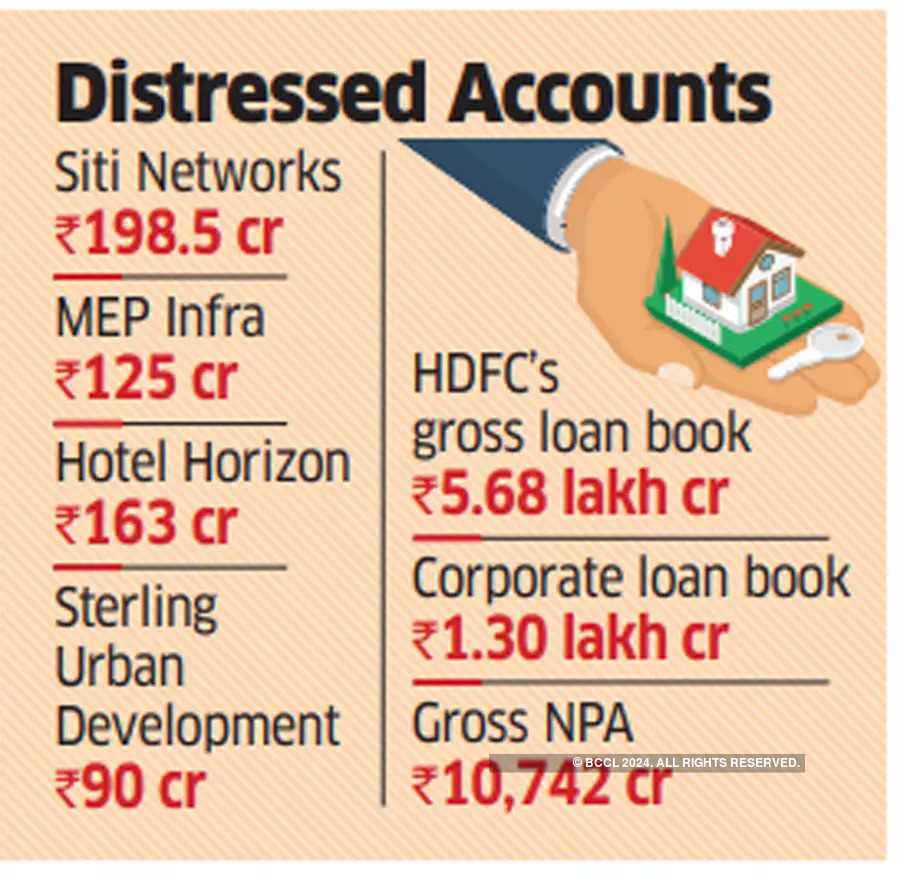

BSE-listed Siti Networks is the biggest of the four accounts in this portfolio, accounting for Rs 198.5 crore. The other three accounts are those of MEP Infrastructure Developers, with a principal loan of Rs 125 crore, Hotel Horizon at Rs 163 crore, and Sterling Urban Development at Rs 90 crore. These four accounts are already fully provided for in HDFC’s books, said a third person aware of the matter.

Swiss Challenge Auction Process

Backed by Ares SSG Capital, special situation fund ACRE has offered to pay Rs 270 crore upfront for the four accounts. The offer has triggered a Swiss Challenge auction wherein ACRE will have the first right to match any counteroffer HDFC receives for the distressed loan portfolio.

Prospective bidders have until June 24 evening to submit expressions of interest, a notice issued by HDFC said. It stated that any counteroffer will have to be at a mark-up of 10% over the base price of Rs 270 crore. Thus, the counteroffer has to be Rs 297 crore or above.

HDFC and ACRE did not respond to ET’s queries.

Siti Networks, a digital cable television service provider earlier known as Wire and Wireless (India) Ltd, and MEP Infrastructure are the two attractive accounts, according to one of the persons cited above. MEP is into the construction of roads and collection of tolls.

HDFC has a gross loan book of Rs 5.68 lakh crore, of which Rs 1.30 lakh crore is a corporate loan book. Its gross non-performing loans stood at Rs 10,742 crore. After provisioning, the net non-performing loan book stood at Rs 5,884 crore, according to HDFC’s annual report. Its gross NPA stood at 1.91%.

On the other hand, ACRE has emerged as one of the largest ARCs, with assets under management (AUM) of Rs 9,400 crore.

HDFC Bank, the country’s most valued lender with which HDFC will now merge, had also sold Rs 2,188 crore of its distressed loan portfolio in three tranches to ARCs in the first nine months of FY22, ET reported on January 6. Phoenix ARC had acquired two pools and Edelweiss ARC had purchased one.

HDFC and HDFC Bank announced the merger of the two entities on April 4. The merged entity will have combined advances of more than Rs18 lakh crore and a net worth of more than Rs 3 lakh crore on a pro forma basis, said a report by CareEdge on April 7.

As per the swap ratio, each shareholder of HDFC will receive 42 shares of HDFC Bank for every 25 shares of HDFC. As part of the two-stage merger plan, HDFC Investments Ltd and HDFC Holdings will merge into HDFC; in the second stage, HDFC will merge into HDFC Bank.